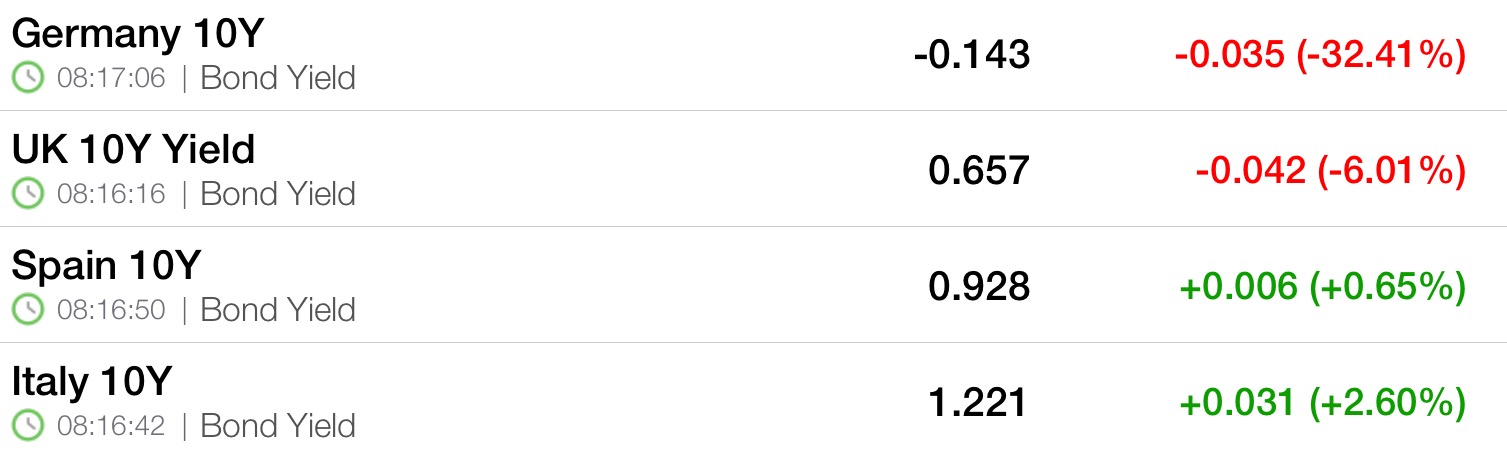

This and the debacle at Deutsche Bank are the number 1 stories, because of the complexities. Bunds are soaring today, sending yields below -0.14%. This is a huge issue, especially since just 1 week ago people were celebrating a positive bund yield. That has changed and with these sinking yields are the pangs of miserable deflation.

But the greater vein to this narrative is how the so called piece of shit countries of Europe, Italy and Spain, are reacting to a flight to safety. People are selling their bonds. As German yields sink, theirs rise. As a union, this makes zero sense, unless of course people are starting to really worry about Deutsche Bank and what it could mean for the EU. Remember, without Germany, both Italian and Spanish yields would be anywhere from 5-10x higher from current levels.

Italian 10yr

This might turn out to be nothing, or the biggest story since 2011. It’s certainly worth paying attention to.

If you enjoy the content at iBankCoin, please follow us on Twitter

Flush the douche bank down the toilet and get this party stated.

Usd to the moon euro to dust.

We all know this isn’t a union.. It would be a true union if the had Euro Bonds (not eurobonds). Even though most of Europe is on the same currency, you have countries that have their own sovereign bonds. I don’t know what the fall out of this is, and quite frankly, I just thought about this paradigm, but it seems to me there’s a flight to safety. DB’s struggles yesterday were what I believe dragged the market down.