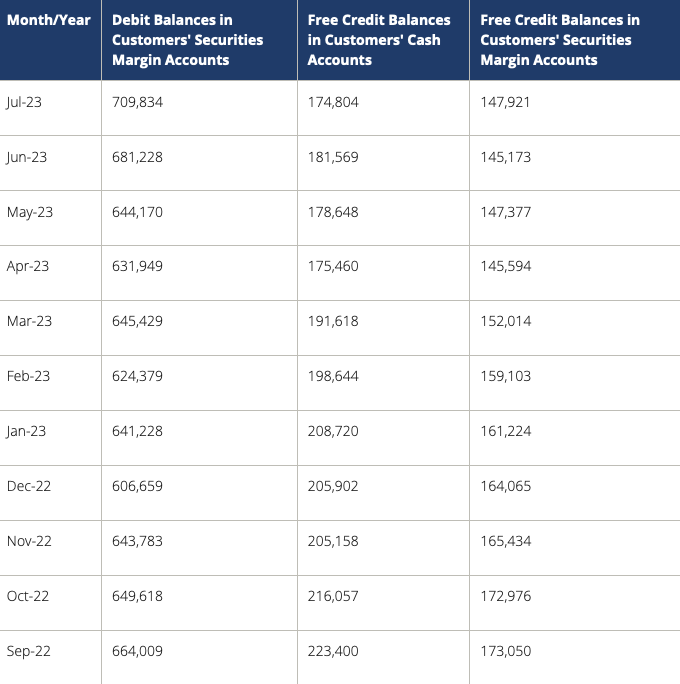

Let’s make a few things abundantly clear. The bank run that occurred in early 2023 was never solved. As a point in fact, it has only gotten worse. The assets on the balance sheets of banks (treasuries) are worth even less now than before. We are talking about 50-60 cents on the dollar from original basis. Also, rates are barreling up nearly every single day — making the necessity to SELL even greater.

Why sell, you ask?

Because people would prefer to open an account directly with the US treasury and get bills at 5.5%, rather than a money market at Schwab for 4.5%. Do you understand what is happening?

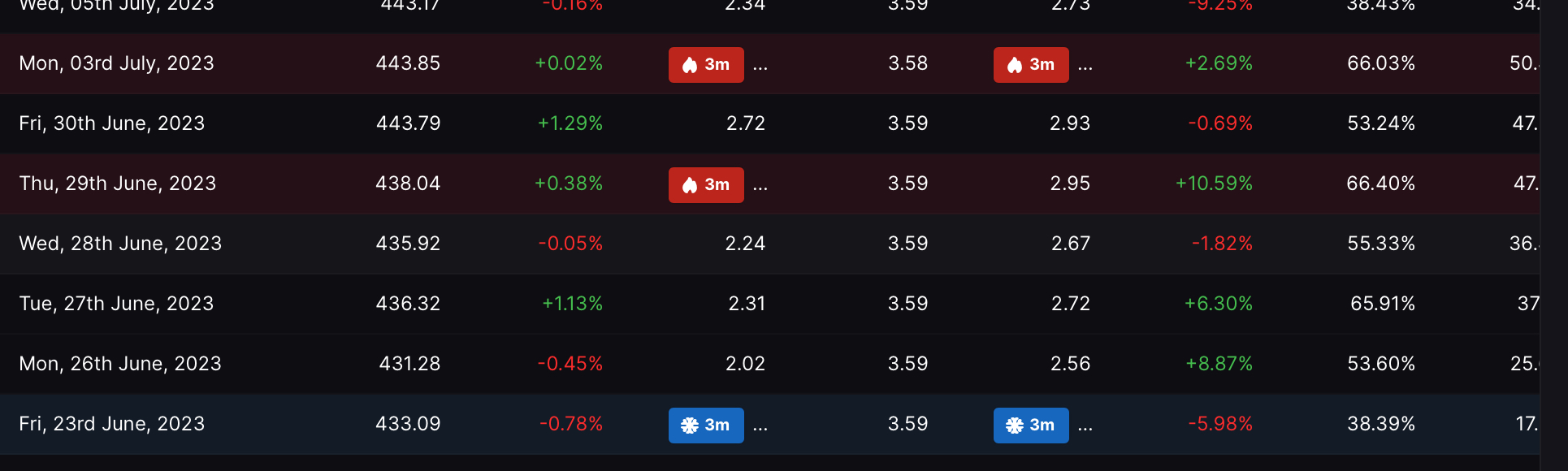

Today we are seeing a renewal of bank scares after S&P downgraded some banks last night. Shares of $RF $ZION $VLY and $SCHW are getting the business on the finance side today. In retail, $DKS missed and $M is always a disaster — and as such we are bearing witness to the total and complete annihilation of the sector, with names like $JWN, $W, $KSS and $VFC pitching in just to be good sports.

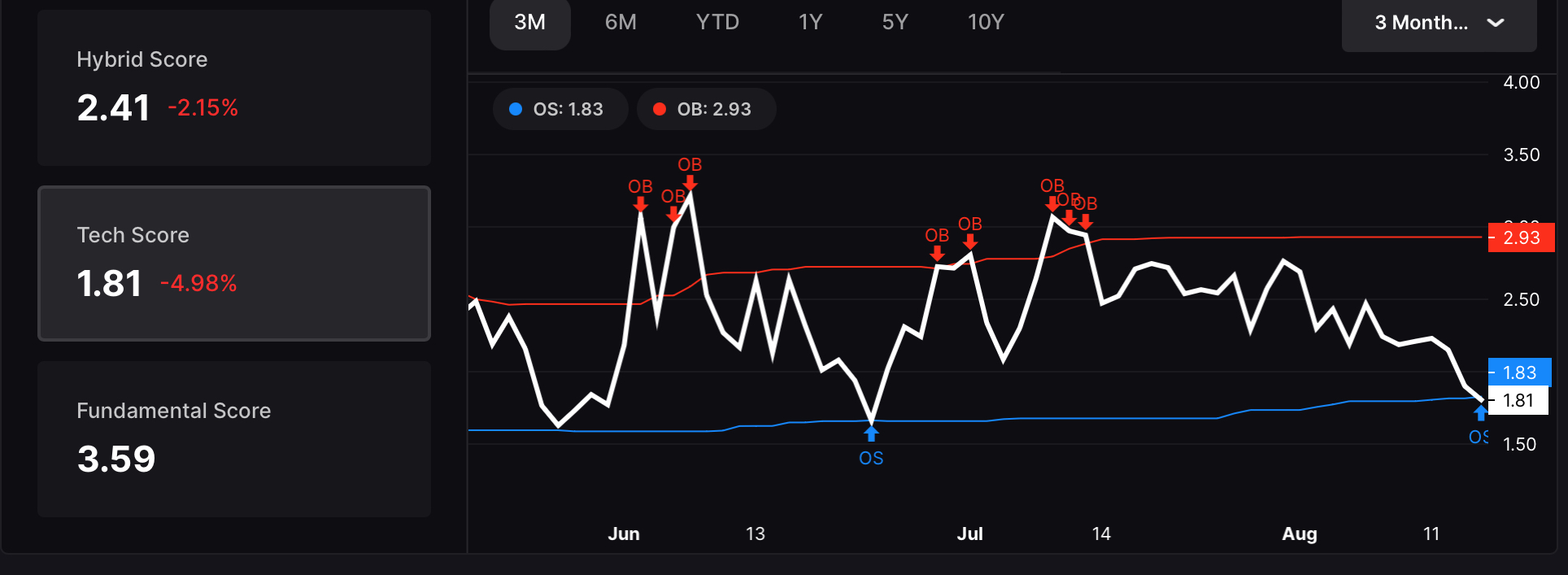

So we have banks and retail crushing lower whilst volatility is almost unchanged. Markets are flat and bulls keep pinning their hopes on shares of $NVDA climbing forever.

HOWEVER, all of my machinations and opinions are somewhat gaunt in the face of a market which refuses to drop — are they not? If things or people were truly in a bad state — wouldn’t markets reflect as much? I think it’s important, especially when the news doesn’t match the action, to take a step back and trade small — to wait and see — rather than jump to conclusions. Next thing you know, bond yields tank 20bps tomorrow on some Fed speech and the NASDAQ flies +200 and everyone cries foul — how it’s all rigged and it’s a scam. The only scam is refusing to accept reality and living inside a fantasyland of your own choosing.

Comments »