Since it’s the holiday season of consumerism, and since I often get this question sent to me: I’ll answer it here and now for all time.

What is the difference between Stocklabs Basic and Pro?

The Basic plan includes:

Full access to technical and fundamental ranking systems, seasonality, valuation data systems

Full access to my portfolios, picks, and community chat inside the Pelican Room

Full access to mean reversion algorithms

Full access to news wire

Pro plan includes:

All of the above, obviously.

Full access to volume tools, designed for day trading and swing trading.

Full access to high speed alpha tools, which are screens used for day trading.

Real time Intelligence algorithms, backtesting algos using real time tech scores to glean into the future.

Essentially, if you want the full power of the Stocklabs platform — go pro. There are numerous upgrade capabilities for an additional $40 per month. If a miser and cheap with money, at $59 per month you get access to community, Fly, and all of the basic things inside the platform — but your screening abilities will be limited because the screener is designed around some volume trading tools.

I’d love for most people to want to join for the software — because it’s great and I placed a lot of effort in creating it. But I know you son of a bitches mostly join for my ideas — since you’re all lazy and not good enough to trade on your own.

Here are my portfolio concepts.

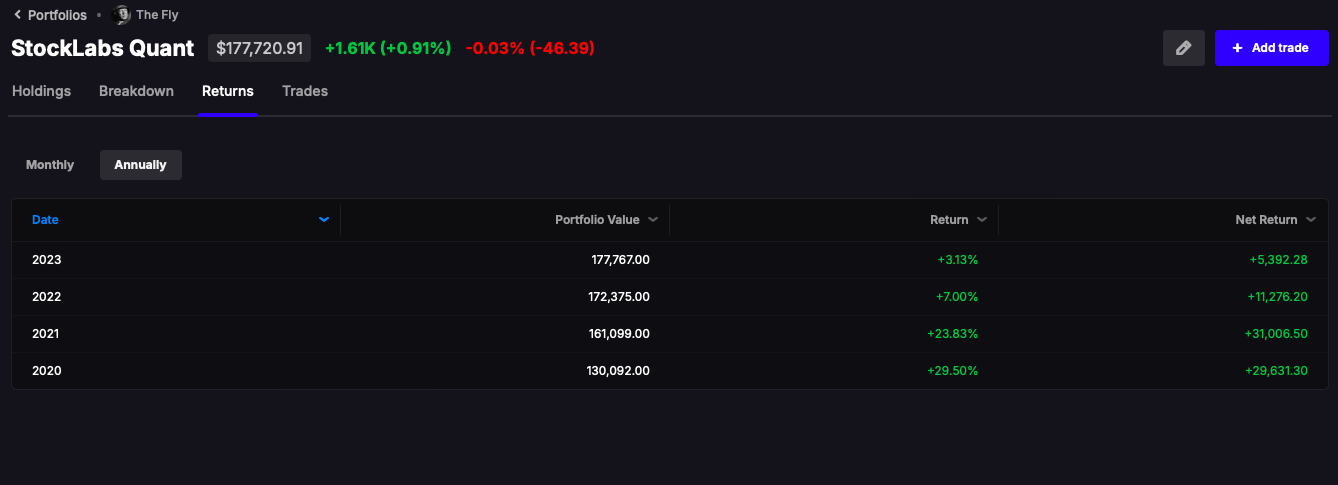

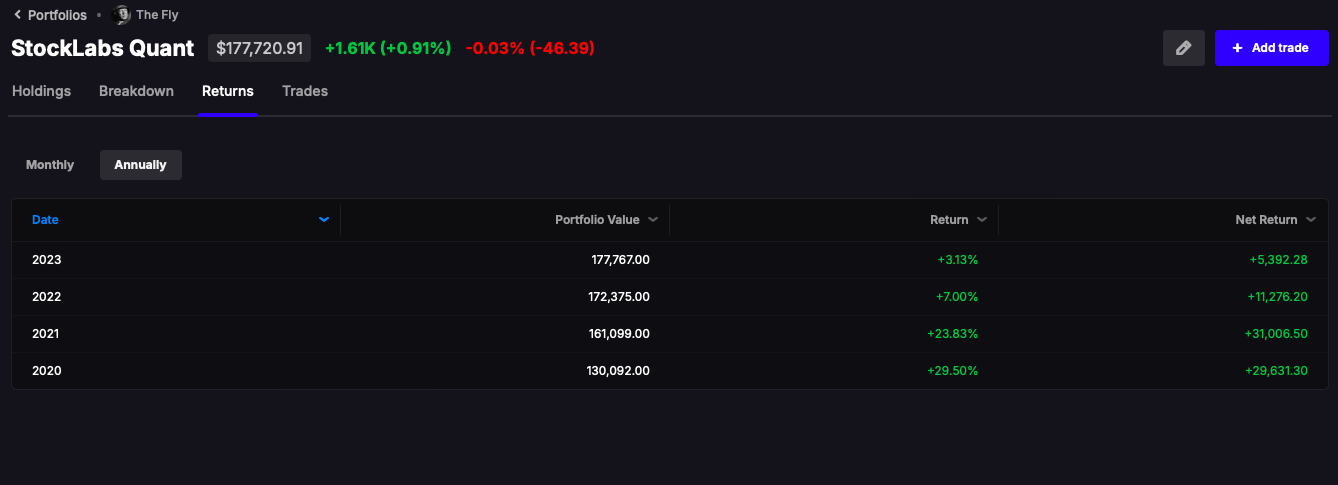

The Quant: allocated into 20 equal weighted stocks once per month, which uses the algorithms to switch between value and growth in order to achieve maximum risk aversion results. This is a concept I adjust over time, with the stated goal of dying and having it invest my money post mortem.

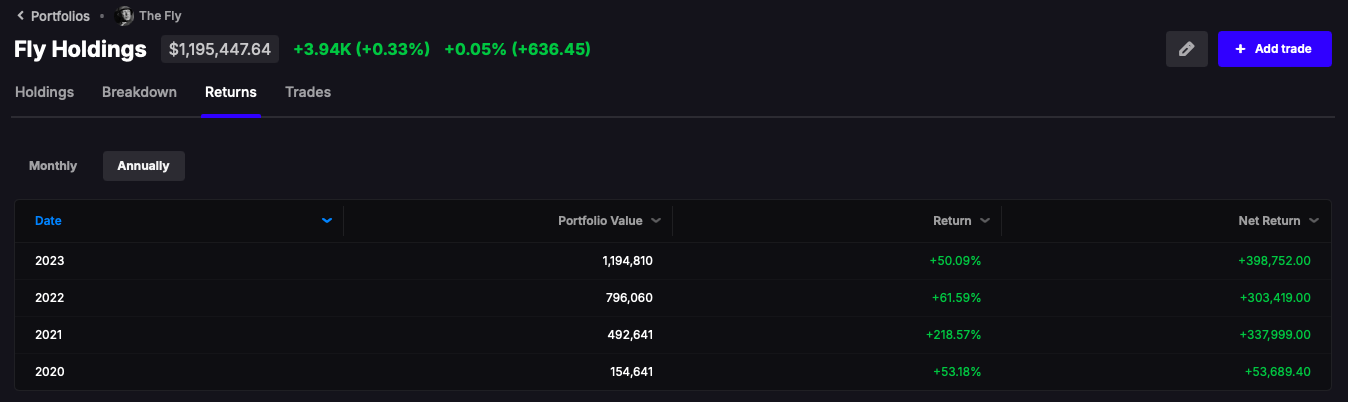

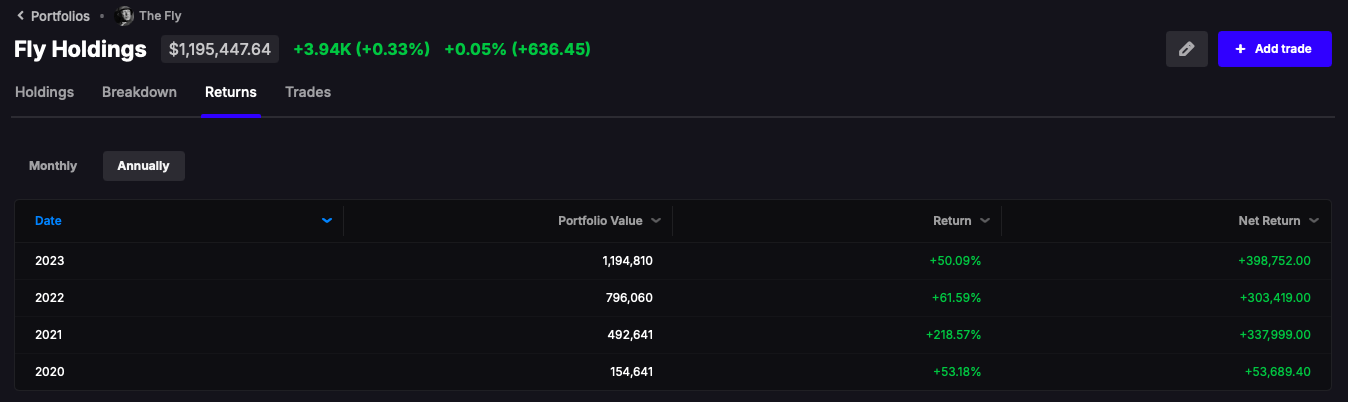

Fly Holdings: My day trading and tactical account. This was seeded in late 2020 at $100k and because I’m s good, it’s much higher now. Nothing new under the sun. I’ve been bowling on my competition (there isn’t any) since 2007.

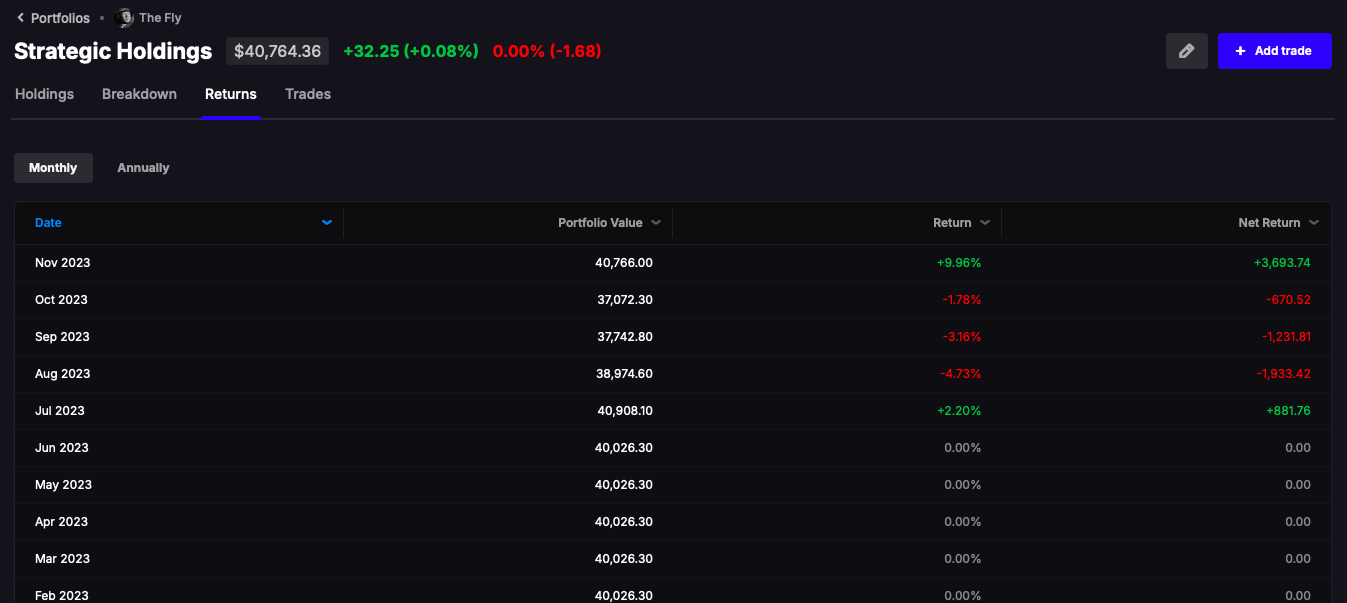

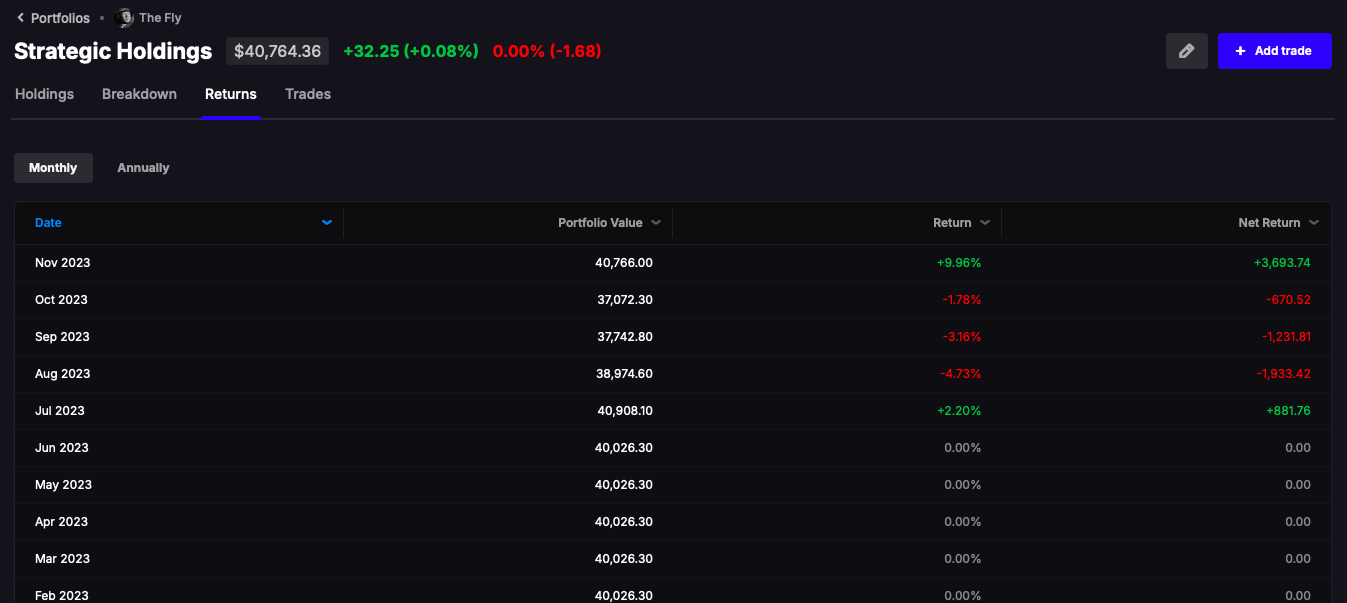

Strategic Holdings: This small account used to have a different focus — but a few months ago I changed it to house my strategic ideas, which are longer term investments designed for people who work jobs and can’t trade 75 times per day. Since managing it under this new goal, the account is about flat.

Tesla Focus: Stated goal here is to pretend I work at Tesla and invest in the stock monthly, as if contributing to a retirement plan. This is a high conviction investment for me. I will be expanding this account to include another high conviction investment in 2024. Most of you who are Stocklabs members already knows what stock I am talking about.

REASONS TO JOIN: You are certain to become a better trader, investor and person. You gain 24/7 access to me and my unhinged rants and a community of like minded individuals. We are down to maybe just 2 or 3 LIBSHITS, as I’ve killed the rest of them. And, the best part, all proceeds go to me — which is a noble thing to do. If malleable to my stratagems, I will will you to win and succeed in this rat race. The people who quit Stocklabs got wiped out CLEAN because they joined to NOT LISTEN TO ME and went off on retarded market excursions. Also, some people got transgendered surgery and a few others were relegated to the kitchen by their Brahmin husbands.

Good day (we are not running a fucking Black Friday deal. This is not Walmart Sir. We are high finance).

Comments »