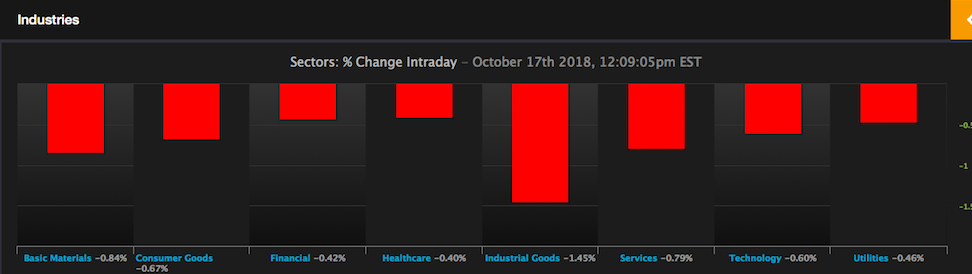

Markets are improving from the early morning sell-off, partly buoyed by strong gains in MS, USB, GS and other banks. Oil is notably on the downside, down by 2.7% WTI and 1.9% Brent. The contraction of the WTI-Brent spread is of course bearish for US refiners who mostly acquired crude in WTI and then retail in Brent. Refiners are moderately lower, off by 1.1% for the session.

Taking the other side of the oil trade are airlines, higher by 1.5%, led by strong gains in UAL. It’s worth noting, UAL, AAL, and DAL have stopped fuel hedging and stand to profit most from the drop in jet fuel costs.

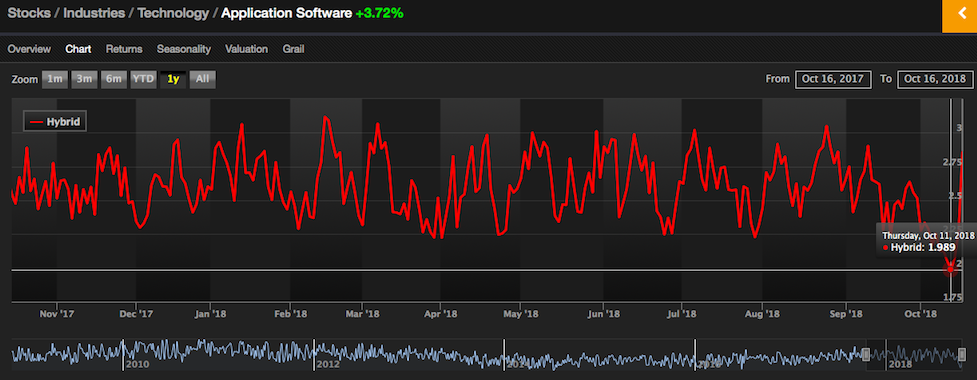

SAAS stocks are off by 0.9%, following yesterday’s +6% surge — but have been firming throughout the morning.

Notable SAAS stocks include: HUBS, WDAY, CRM and recently IPO’d PLAN.

The Cannabis sector has cooled, in spite of Canada’s legalization of marijuana today for recreational use. It’s also worth noting, popular retailers of cannabis in Canada, Aurora Cannabis, has applied for their shares to be listed on the NYSE, under the ticker symbol ACB.

Notable cannabis stocks include: TLRY, NBEV, PYX, and CGC.

What a wonderful world we live in.

Moving on, auto parts stores are enduring ruinous losses today, thanks to a 23% drop in European car sales — likely the direct result of new emissions tests about to start. Some have dubbed this ‘Carmageddon’ (Zerohedge), but this is nothing more than coming off the August sugar high of +30% European car sales, as people bought cars as fast as they could before the new emissions laws went into effect.

Notable auto stocks include: AZO, AAP, RUSHB, and SAH.

Nothing is really trending today, however. Then again, we were higher by 500 yesterday, so consolidation of those gains is to be expected.

On the more aggressive side of the market, traders are diving head first into a nefarious Chinese, ticker YECO — higher by 275% now on 10 million shares traded.

The made an acquisition today, so apparently traders went nuts.

Yulong Eco-Materials Limited (Nasdaq CM: YECO) today announced that it has completed the acquisition of the Millennium Sapphire “MS”. Yulong announced on August 22, 2018 that it had signed a Sale and Purchase Agreement to acquire the Millennium Sapphire for US$50 million. The acquisition was acquired via the issuance of 25 million YECO restricted shares valued at $2.00 per share.

Other notable stocks flying to the upside, with market caps above $1b, include: VICR (+17%, earnings), SMCI (+9%, short squeeze), CZR (+6% on takeover rumors), NFLX (+6%, earnings), LRCX (+2.5%, earnings) and CREE (+4%, earnings). It’s also worth noting, SHLD is higher by 40%, due to bankruptcy filing, naturally.

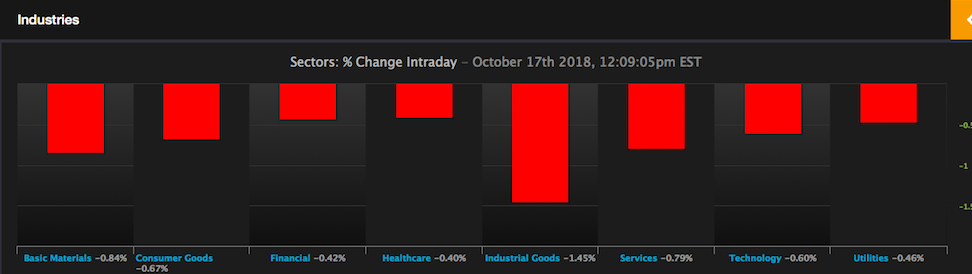

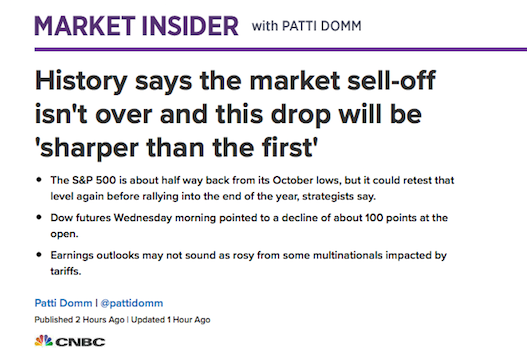

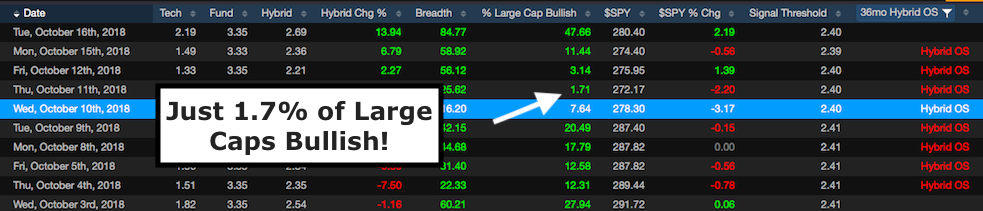

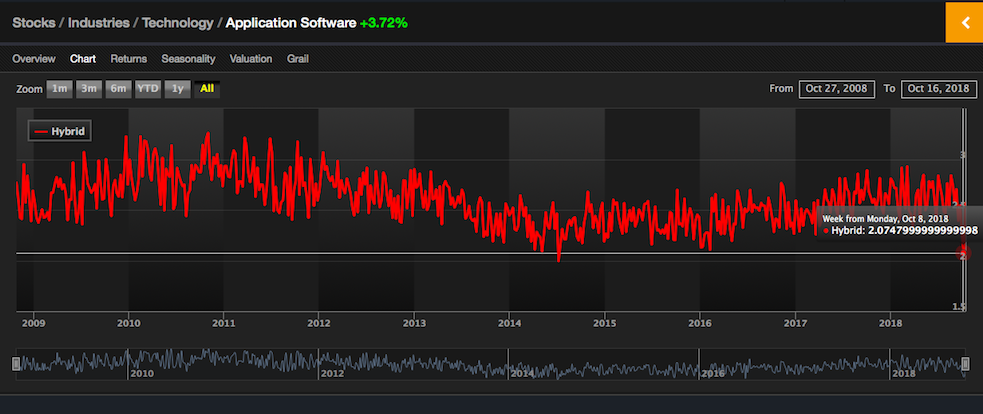

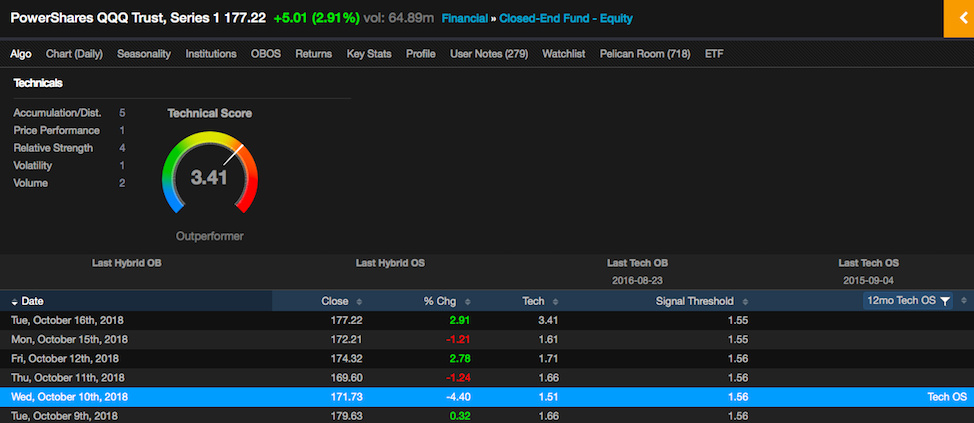

Finally, and it should be noted, breadth is just 30%. The market might be recovering now, but most will view today as an overall poor day for stocks, especially in tech. Now representing a new record 26% of overall market capitalization, tech has undergone a deleterious decline over the past month — particularly in semis and software. Those two industries comprise of approximately $3.2 trillion in market cap, central to the bull case in tech and the overall market. Stocks like LRCX, CRM, ADBE, MU, amongst others, are viewed as lynchpins to the general mood of the market and would need to firm up first in order lure battered traders back into the mix. In spite of the pleasant 13% return in the Nasdaq this year, the technicals of the market have been greatly damaged in recent weeks and, as is always the case with these sort of squalls, traders will need to see some gradual improvement before fully committing on the long side.

Comments »