Penises shall be chopped off by way of machinery today. It’s no longer a foregone conclusion, but a real time reality. Brace yourself for the blade and remember the days when your manhood meant something, for you will no longer have it.

Comments »

Penises shall be chopped off by way of machinery today. It’s no longer a foregone conclusion, but a real time reality. Brace yourself for the blade and remember the days when your manhood meant something, for you will no longer have it.

Comments »

Believe it or not, silver.

ETFs

Members of The PPT can click on image to access full screen results.

Comments »

We are no longer in recovery, gents. It’s boom time.

Listen to the FBHS conference call and pray for a dip.

Comments »This is so god damned funny, I had to post it with still shots of Sara’s on air strap on dildo.

Is it just me or is this the most moribund market since Hannibal cornered the grain trade just outside of Rome?

I was down 1% earlier, but have recaptured all of the lost coin and sit with a gain of 0.15%. I suppose one could argue that regaining lost ground is “exciting,” exhilarating even. I beg to differ.

It is my God given right to magnanimous stock market gains. When it happens, I am neither surprised or invigorated. It’s normal fare at Le Casa del Fly.

By the way, I am riding my black steed into two earnings battles, FBHS tonight and WETF tomorrow morning. I only expect the best. Anything less than that would be a mild disappointment.

My goal in this life is to make 5% per month. I am not greedy and have never been known to partake in the act of gluttony. Five percent is my demand and I shall have it each and every month for as long as I roam the earth.

NOTE: By the time this post was finished, my gains more than tripled to 0.5%

I realize a great many of you chart-chomping imbeciles scour the market for a certain look. One of the preferred looks is a breakout, following a long consolidation. While you rifle through thousands of charts, by hand, Senor Tropicana presses a button and gets results.

Courtesy of the Godly folks over at The PPT, I present to you today’s “Fly’s Lab” picks, which was designed by yours truly to identify stocks in a long sideways pattern–fixing to break out north.

NTLS

ABMD

ACTG

AMRC

CY

FST

SZYM

STRA

Comments »

There is nothing unique or unsettling about today’s market. Breadth is still north of 50% and plenty of stocks are up more than 5%. Steel and iron stocks are up, making it very hard for me to take the great big bears, dressed in ballerina costumes, seriously.

HMC reported decent numbers, but today’s numbers meant nothing to me–mere child’s play. I am keeping HMC in my portfolio for at least 6 months, as part of a thesis that states Japan is going “samurai” on deflation.

Here are some dips in stocks with market caps more than $1 billion, over the past week. Whether they are buyable dips or not, I leave entirely to you.

Comments »I am enjoying the global warmed winter. We nearly had a hurricane here last night. The trees in the yard were menacing my house, as wind gusts knocked out the power, disrupting my movie watching excursions. Truth be told, my power returned within a few hours–but it was still an inconvenience.

I do not miss the winter. It’s been several years since the winter showed itself in the tri-state area. The new climes are wonderful for people who loathe shoveling snow, but dreadful for retailers.

I’d avoid any and all retailers because their highest margin products are winter garments. I don’t care what Sam Poser says, DECK is a sell.

On the other hand, this warm weather is a boon for restaurants. Places of gluttony, like PNRA and CMG, should continue to do well. I hate fast food restaurants. But upscale casual dining is a sweet spot that should engender plenty of shareholder satisfaction.

Also, with warmer climes comes the unfortunate side effect of storm activity. As power outages persist, sales of generators will soar. I am having a permanent, natural gas, generator installed, made by GNRC.

FB is selling off hard. My position is so small, I don’t care what happens to the stock. There were some impressive earnings last night, especially from CTXS, QCOM and SWKS. Last quarter was dreadful and was reflected in the number of earnings short falls, as well as negative GDP. Look at the bright side: the markets are near new highs, even though the economy contracted last quarter. Should we grow by 1.5% this quarter, the market should rip higher, based upon some pretty decent quarter over quarter growth.

The only way this market gets derailed is by government interference. Until April 15th, any dips should be viewed as an opportunity to gather some free money for the lean summer months that will follow.

Comments »

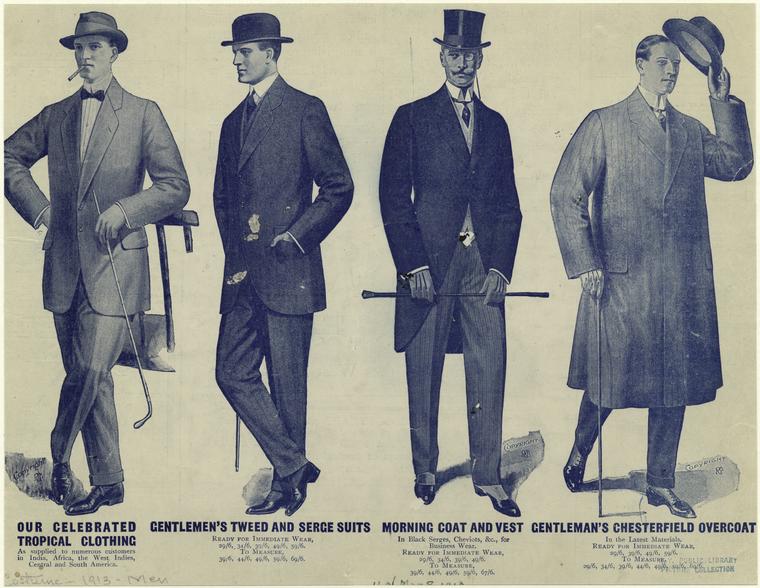

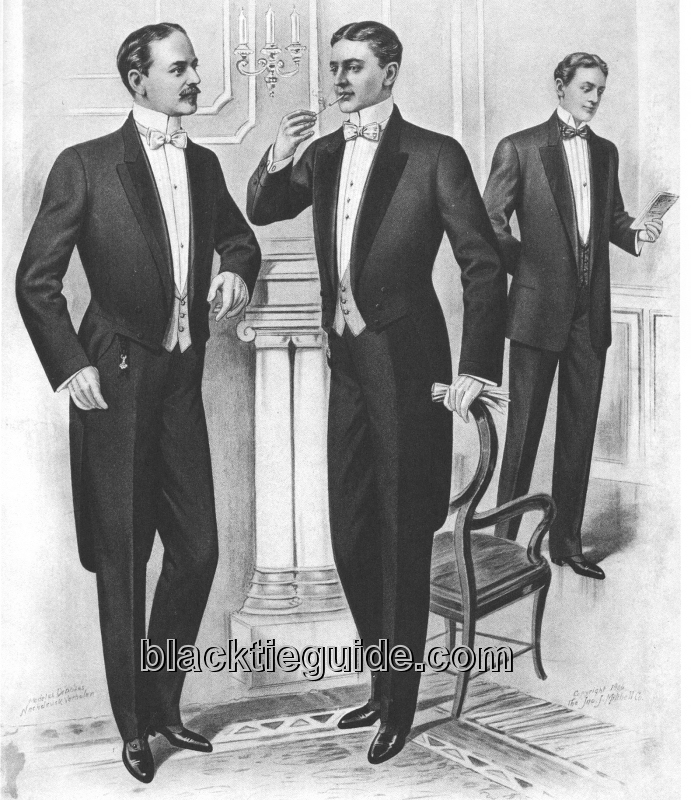

As you know, iBankCoin upholds the strictest dress code on the internets, consisting of tuxedo, white tie, proper dinner jacket, white gloves, top hat and cane. This dress code remains a constant throughout the site, except when reading Rhino’s blog–who asked permission and was granted to wear army fatigues and blackened face when working on the site. Just a reminder, women must adhere to these codes as well.

We are not gender friendly at iBC. Consider this to be sausage fest, without all of the vulgarity and depravity that swirls through your small brains. We are gentlemen here who are interested in banking coin. That is all.

Effective immediately, black ties will be permitted in these halls, but only on dress down Friday. Here are some images to clarify my edict.

PERMITTED

NOT PERMITTED (no scarves allowed)

PERMITTED (only on Rhino’s blog)

PERMITTED (female attire)

NOT PERMITTED (nice try sneaking in a filthy animal, but the disguise has been detected and the canine will be escorted off the premises)

NOT PERMITTED (if you come here looking like that, the police will be called)

PERMITTED (“hello good Sir, did you come with a topped hat?” “Why of course, I gave it to the footman when I arrived.” “Very Well.”)

PERMITTED (“Why hello good Sir, may I offer you a cocked tail? “Ruff, ruff.” Very well Sir”)

Comments »Whenever the market rips and I lose money, the very next day I lose a lot more. Yesterday I noted how the 70 point melt up was exclusive to a select few, considering my pastiche of holdings lost me money. Today, me and my 100% long only portfolio got shipped to the woodshed to be chained like an animal and whipped with junkyard chains.

Five minutes to the bell and I am off by 1.69%, a very stern drawback for Le Fly.

Nevertheless, I’d be lying to you if I claimed to be scared. Nothing scares me, not even all of my stocks going to zero in unison. I have faith that the plan that I put into motion will deliver extreme winship. It’s only a matter of time before these things materialize, small plebs.

Do not panic and never let them see you with pie on your face. Gentlemen never eat pie, only cake.

It’s earnings season, so anything can happen. But if we are to base our assumptions on history, we are going UP till the tax man comes.

Comments »