Back in 2014, I underwent my worst drawdown of my life. It was a pivotal moment for me. I didn’t know it at the time, naturally, since I was dealing with the realization that I had made ruinous choices with my money. Heading into 2014, I had a chest full of pride and sack filled with courage. By April of 2014, I had nothing but BALs (BIG ASS LOSSES). Here’s a blog I had written then, lamenting over my situation.

The majority of my holdings are in 4 stocks: WDAY, FEYE, SPLK and YELP. I bought them because they were growing their revenues (LOL) and were winners, led by fantastic management teams. All of that means absolutely nothing today, as this basket of hell, death and aids netted me losses in excess of 10% (that’s right, 10%…for the day). I am beyond words. This is more than what I signed up for and ponder to myself the very meaning of life.

As a general rule, I sell after 10% losses. This time around, I rode these stocks straight down the toilet bowl and now swim with them in the raw sewage, with the rats and alligators.

I sold out of some small positions today, CLIR, FLXN and ANGI. But the money raised from those sales do nothing for me, as I am completely decimated amidst a crowd of geeks laughing at me for being so stupid.

With today’s sales, I could average down in these stocks again; but the life has been drawn out of me and I am giving up. I won’t sell. However, I intend to drift away on a small piece of wood, into the sunset, without any paddles or provisions. It was just meant to be, a fantastic blow up, broadcasted live in a public forum for all to scrutinize. Please do not let my newly found tone of pathetic contrition stop you from poking fun at my state of affairs, as I would not grant you safe quarter if the scenario were reversed.

The reality is the market eats its young and spits out the old men from windows. It’s never personal and just because you suck now and lost a bunch of money, that doesn’t mean you can’t regroup and rise again from the ashes. Greed is a wonderful emotion, but it cuts both ways. You get to make all of that money during the good times, but suffer, abhorrently, during the bad.

Bottom line: Assess the damage and stay in the game. For me, the market crashed today, and funnily enough, it’s barely down 1% for the year. Fuck me running sideways with a pineapple.

Looking back on that post reminds me of the perils of hubris and how success can, in fact, defeat you.

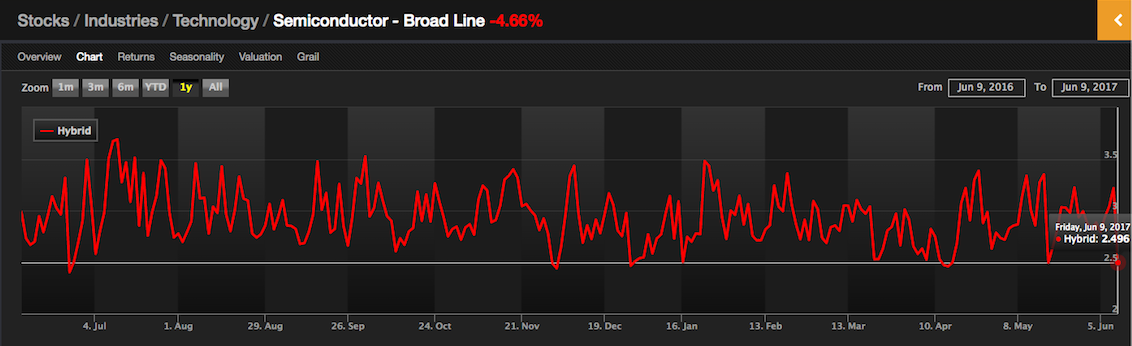

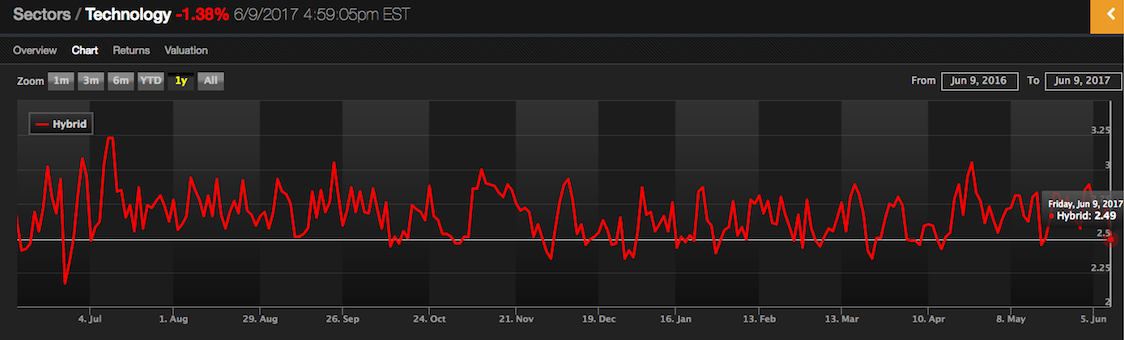

On Friday tech stocks, led by Semiconductor – Broadline, crushed traders. The decline was steeped in retribution — cast upon fast trading monkeys by old money bastards. I know for a fact, ‘they’ don’t want you to success. The market is a casino and the house prefers to win.

I’ve read comments by people jumping into the decline, hoping for a bounce. Here is what the Exodus oscillator is saying.

Based on what I’m seeing above, the sector looks somewhat oversold. But that’s under normal conditions. Those oscillators are useless in a six sigma event.

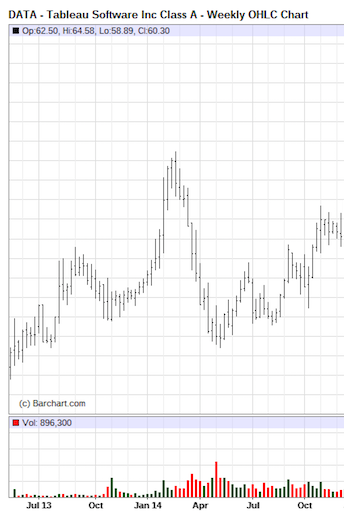

For those who forgot, let me show you the severity of the drawdown during the tech wreck of 2014.

I recall doing a post, highlighting the losses of early 2014 — which displayed a sundry of popular tech stocks down by 30-60% inside of a few short months. The point here is to expect the unexpected during times of duress. Is this the beginning of an extended pullback in tech?

Maybe.

From a market cap standpoint, tech now represents more than 25% of all stocks, or $10 trillion. I cannot recall the weighting being so high — so you should expect a reversion to the mean in the not-too-distant future.

Here I documented corrections from 1998-2000.

A case study of SCMR during the dot com crash.

If you enjoy the content at iBankCoin, please follow us on Twitter

Reality is that “tech” truly does make up25% of the market value now, as opposed to then. Bits bytes and pieces are embedded, and are part of, practically everything and every facet of life as we know it now.

It will not and indeud… cannot disappear or even retreat. A retrenchment now and then, for sure, but good tech companies have nowhere to go but up.

Do you realize the absurdity of your logic after posting it? Tech has nowhere to go but up?

Have you ever studied trends, boom and bust cycles? The hubris in this market is astounding.

Truthfully speaking, no I do not.

Perhaps it is a difference of semantics though.

When you use the term “tech” are you referencing FANG type companies? Or “tech” as a generic term describing all things in electronics, bio medical, micro devices etc etc?

I know this is relevant to the earlier post, but it has to be said. Frog criticized Trump & defended Obama by saying Trump accused him of being a Muslim and that he hadn’t proved he was born in the USA.

Frog, under Islamic law a person born to a Muslim father IS a Muslim – and you are not allowed to leave Islam. Obamas biological father was a Muslim, and then his mother remarried and had a second husband who was ALSO a Muslim!

As to the birth certificate – I am not an expert on such matters, but I read how some people had challenged the authenticity of the certificate – and I was ASTONISHED that NO ONE ever mentions that just as some started asking questions about the “certificate”, the NEXT DAY Obama announced news that they had got Bin Laden (which by the way was not released in a timely fashion, and Bin Ladens death was earlier than that, though I’m not sure (and WHO is?) when it was exactly.

Wake up and smell the coffee Frog

this is a finance post. Come on

Finance post? How’d that get in?

How about when the pentagon lost 1.5 trillion dollars some how, new hit the tape on 9/10. The next day, we forgot about that trillion son

Lastly, since this is a financial blog, tech is in the 4th stage of tech boom. Think 1990’s as the last one.

Tech has one way to go .. it’s up.

AI is the next Internet , “Gates and DARPA” agree.

Regards

Chuck Bennett

I don’t think tech is anywhere near a bubble. I will be adding on any additional weakness. You can look at crypto currency ETH for a real bubble. Up 30x since Jan 1st. I think the FANG stocks could go 10x higher before any bubble talk would be warranted. This is not the dot coms from the 90s.

Please back up your fundamental analysis with valuations. Pray tell me how NVDA and other tech stocks, trading at 60x earnings, is not a bubble.

Moreover, please explain to me how FB, Amazon, Netflix and Google can support market values 10x present valuations, based on revenues and sales expectations.

I’ll wait.

If a person can believe fake news about a president’s birthplace, they sure can believe fake news about how “This time is different for tech stocks” just as easily. in fact, it’s totally consistent.

Frog is douche

Was HUSSEIN Obama’s father a Muslim Froggy? Yes or no?

Frog is right. Obama most likely was born in the US.

The true scandal is most likely why his school records are sealed.

Obama applied for and went to college as a foreign student for lower tuition and aid. He commit fraud. That is the most likely scenario Hillary’s campaign team got a nugget of that started the birther movement.

Frog … just give it up. Please.

Hard not to take a little nibble when a major index has a 2% down day for no apparent reason.

Do you sell after a 2% up day for no reason?

Probably, yes. Because I would be in options and $TQQQ and want to take the money and run. I don’t trust this market.

“Nothing important has ever been built without irrational exuberance”

“Anything worth doing is worth overdoing” – Mick Jagger

We are in the process of connecting brains to computers, or brain-computer interface, VR/AR, AI, driverless cars and terminator robots to defend globalism.

In 2007 when fucking Nvidia introduced its CUDA platform that included both software and graphics, it might have been AI’s first commercial start. Three years later in 2010, AI researchers started using GPU’s over CPU for machine learning. Just in the last 2 years, the need for specialized chips and storage for AI has started to take off.

The breakthrough developments in image and speech recognition over the last two years are about to change our relationship with machines and computers forever, as computers learn our language and understand what we see and hear. Extra Micron MU you fuckers, And I still have my PI Impinji.

Regards

Chuck Bennett

When’s the best time to buy a stock that’s going up? Everyday! I think you added to that Yelp five times Fly

market do not bottom on a Friday

>market do not bottom on a Friday

or the first week of June

Time to get your asses in oil, materials, and infrastructure. Read the signs given. Nuf sed!

Yep, the peeps hitting the buttons during the summer doldrems were given the signal.

Infrastructure? Fuckin’ INFRASTRUCTURE?

The Trump “Infrastructure” plan is nothing but asking states

(that have no money), and private business who will rape you

with fees, tolls, and general fuckery to make money for THEMSELVES to step up and invest THEIR money and build.

The p[rogram SHOULD be a trillion of new borrowing by

the Federal Government at these ridiculously low interest

rates (like 2.2% on the ten-year), which would cost the Federal Government only $22 billion a year.

Then allocate this money on a per-capita basis to states,

cities and counties to fix roads, build airports and bridges,

fix the power grid, build water systems, schools, protect lakes

and rivers and whatever.

Keep the fuckin’ LEECH private sector out of it! Look at

how the private sector has fucked up our health care!

The private sector fucked up our healthcare? That’s short sighted.

How is our healthcare doing so well all over the world?

Don’t conflate private health who are making deals with our political establishment that end up fucking us the people.

Regards

Chuck Bennett

What the hell do you mean “How is our healthcare doing so well all over the world?”

We got the fuckin’ worst, most expensive so-called “health care” in the world.

Even Cuba’s system is orders of magnituide better than the USA’s piece of shit system.

Smart Americans go to India, China and

South America to get their big stuff done.

Ha ha. I’ll take my chances right here in the USA

Dude, you’re a complete idiot.

Nobody is going to India or China. Our healthcare is making money money and delivering value globally. The only problem is, we the people get the shit end of the stick because our politicians sold us out. Canadians buy the same drugs for a better price

Go figure that. I’m thinking I’m wasting my time even responding

Regards

Chuck Bennett .

Maybe you have never driven behind a government vehicle in route to a build, or witnessed how long the build takes? I’m guessing the planning took years as well.

bid NQ

Fly, Do you condone pear trades at this point in juncture? Say, perhaps long a delightful fruit BBRY and short semi froth in NVDA?

The charts posted are fine examples of extreme buying climaxes. Perhaps we got that in the FANG stocks Friday morning. Hard to judge at this point because hindsight is always 20/20. One can only speculate at this point.This needs more time to unfold. One day, one data point, does not make a trend. I don’t get why everybody’s freaking out about Friday. Yes, rotations can and do happen–often each year, and we may be seeing the start of another one. We can always go with the flow. Yes, corrections happen. We are due. Risk in always present. What will people do when they see a VIX print of 15? Slit their wrists? The game goes on. Right now the market is still in strong hands. The weak hands get shaken, only to turn their shares over to the strong. The bull is still charging. It will probably take some time and more pain—like multiple interest rate hikes or serious signs of an impending US or global recession–to stop it.

You’ll be able to buy them lower between now and Labor Day than where they were on Friday.

No rush, build cash. It would be foolish to let anything that had a great run from November to become a loss.

Man, those stocks you mentioned were shitty 2nd and 3rd tier tech stocks. they were not the masters of the universe like amzn fb goog. In this communication age, the big will continue to get bigger. Barring a major market meltdown, its unlikely these will not do anything more than just pull back. they have the scale and infrastructure and capital to take become leaders in any innovation that comes out.