Disclaimer: I own shares of Twitter and have lost a decent amount of money on this shitty ticker.

As our Master and Commander Fly pointed out here, along with the rest of the financial world, Yahoo set an April 11th deadline for a bidding war for their shitty company.

Yahoo really is a piece of shit company and Marissa Mayer has done a terrible job. I would compare her to that speech Frank Underwood gave in season 3. She was there to help herself, not help the company. But this isn’t about her or Yahoo..it’s about Twitter, the other shitty company.

There is no denying how Twitter has changed the game in all facets. From the way we receive breaking news, to the way we digest just how f’n dumb the mass population is. However, Twitter doesn’t know how to listen to their market. If the company would curate information and tweets to the most relevant stuff to what you want, that’d be sweet I think..

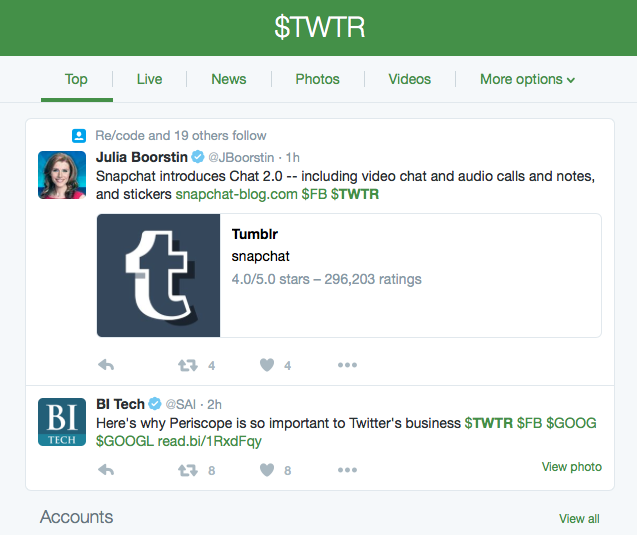

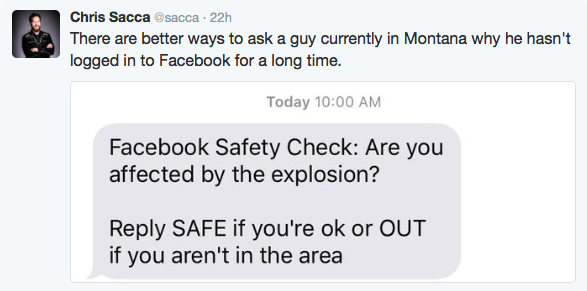

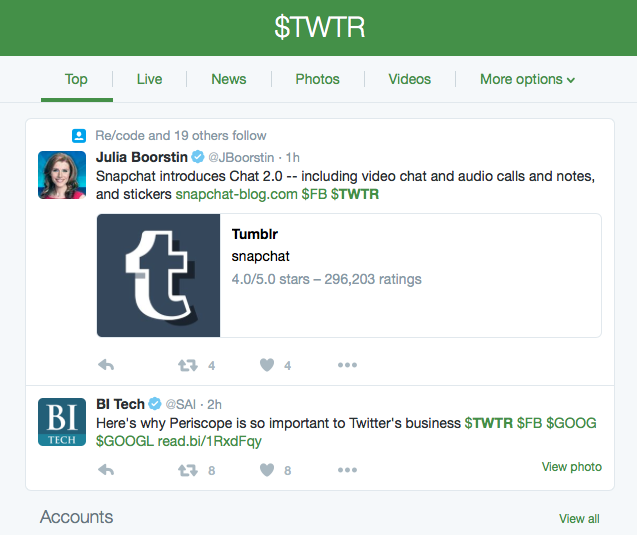

I remember during the NBA finals you could click on their custom hashtag and it would take you to the top tweets page with the current time and score of the game in the banner. Now that was was relevant shit! What if Twitter did that for just about everything! Click on a cashtag and it gives you the current stock price..current poll numbers for the election..just about anything that can be quantified.

Look at this banner, it’s plain and ugly.

Jack Dorsey is too focused on making the product pretty. Who gives a shit about hearts! I think Twitter is deviating from what it does best, bringing timely information to your faces.

To their other problem..user growth..something about people don’t understand how to use it..maybe this is the millennial in me but how is this hard to use..c’mon. Sure Twitter can do a better job going through and finding the power users to follow and create more lists for relevant topics..but really it isn’t all the difficult of a product to use.

With all the rumors popping up every few months or so that some tech giant is interested in buying Twitter…I just wish they would do it already. Not so much to save my shares..there is no saving them now..but because Twitter could be this great product and the management is out of their god damn minds. C’mon Google, pull the trigger and do us all a favor.

Anyway, if this migration off of Twitter continues you can find me on Snapchat: amorekin, and there is also a FinTwit Slack channel used by some pretty prominent people in the Financial Twittersphere

Now go forth and spread the word!

PS: Twitter’s stock didn’t suck with Dick Costolo…just saying.

Comments »