I don’t know if I have the mental complexion of an addict or if I am just spotting an opportunity and placing my bets.

Yesterday I dipped my toe back into the murky, shark infested pool of option trading. These trades were transacted in what is better known as my “degenerate account”, therefore they will not be reflected in my portfolio.

Nevertheless, since this blog acts as my trading ‘diary’ of sorts, I figured that I needed to discuss my rationale to try and understand why I would go back to the well, and what this means going forward. As I touched upon yesterday, I feel like my trading improves dramatically when the market starts to behave in a more chaotic manner, moving from one extreme to another in a short amount of time.

I mentioned yesterday on Twitter that Monday’s range of prices on SPY was equivalent to the entirety of the move up from January 23 – February 19. This one day range highlights how incredibly frustrating it can be to try and profit from the market. All the work that was done over the course of what essentially equates to a month is erased in 7.5 hours.

People always echo the sentiment that you need to “let your winners run”. Ok, that’s great. Then your “running winners” are reduced to a break even (or worse) over the course of 24 hours. That can be incredibly demoralizing. Additionally, this also highlights why taking partial profits is rarely a bad decision. You get to lock in some gains, but you also are able to reduce exposure in the event that all of the previous month’s work is evaporated in the course of a single session.

Back to the topic at hand: my self-described ‘addiction’ to trading options. My best options trades have taken place in the midst of market turmoil. These types of markets make more sense to me…I realize that is a little counter-intuitive.

When the market goes up every single day, I am always leery of a February 25th lurking right around the corner. It may be easy for some to board the POMO gravy train and ride it to 5+% months, but my simian brain just cannot compute the behavior of market participants in that environment.

I prefer when things get stretched to extremes. Here I can perceive an exhaustion of buying and selling. The window for maximum potential in trading opportunity does not stay open very long.

Thus when I see volatility spike 25% in a day, I feel like that may be a bit overdone, so I made it a point to go short (volatility). I could have purchased XIV, but I am a low-life, no good degenerate; therefore the only prescription for what ails me was to load up on VXX weekly puts.

I have traded VXX to the long side before, with very predictable results (I was destroyed). I have traded VXX puts before, with reasonable success. Basically my trade is for volatility to “come in” by the end of the week, through the purchase of Weekly 24’s.

Additionally, I noticed abnormally high call volume in both the ATM and the first OTM strike in KORS and LIFE. I like the pattern both stocks have etched out on this pullback, so I purchased March 60 calls in both names in the 1.50’s. Those are certainly more “well reasoned” trades than the short VXX trade, which is more along the lines of what could be considered a “riverboat gamble”.

As for the market as a whole, with these trades I am positioned for a relief rally back to the recent highs. I will be very interested to see what transpires should that take place. There is no doubt that the waters are far more ‘turbulent’ than they were only 2 weeks ago.

Maybe the market just needed a hint of uncertainty to it…lord knows the “powers that be” won’t stand for the primary barometer of economic health to falter here…or anywhere.

“What is that you say dear sir, the stock exchange has declined for more than two days in a row? Do not bother yourself with suchness, for we have a simple solution: open the spigot on the “free money” hose a bit more, and that should do the trick in no time flat. Great, look at that, the stock exchange is back to new highs again!! ”

Now I am starting to sound like Scott.

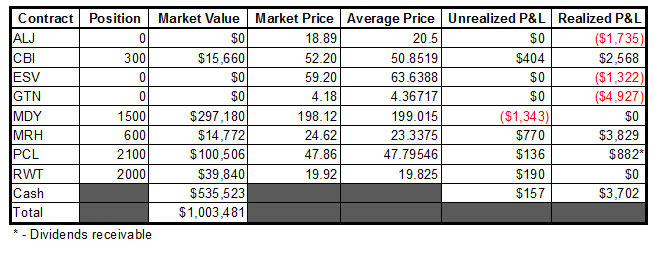

As for this here portfolio, some notes:

- I was stopped out of the remainder of my ALJ position yesterday at 18.50 (from 20.50), locking in a most cordial loss.

- CBI is scheduled to report earnings today (2/27), but I have sold out of the vast majority of my position already, so I am all set for whatever fun stuff is set to take place.

- Right now, MDY is scheduled to be liquidated at the close on Thursday with the proceeds being rolled over into IWM. This is subject to change between now and then, but this appears to be the likely scenario.

- Low beta stocks MRH, PCL, and RWT are trading in a rather subdued fashion, so I am going to keep them around for the time being. I have drawn my lines in the sand with these names, and will let them ride until further notice.

Back in the black for the year and 53% cash…how long that lasts is anyone’s guess.

-EM

5 Responses to “Portfolio 02/26/13: BACK ON “THE PIPE””

Sooz

your simian brain is much smarter than mine, EM

sspiff

I have ‘used’ options heavily for over a decade. At first I was a typical OTB guy feeling the sweet adrenaline rush when the big 50 contract $SPX calls hit and the crash when it went the other way. It takes a long time and a lot of discipline to use options without overdoing risk. Risk management is much harder and proper position sizing takes a lot more math. Now it takes a lot of time to develop a position with options, but my risk management is better for the use of options. If you want to protect gains try a stock replacement strategy or a collar on existing positions. Of course, never trust a junkie!

Sooz

it’s fun to take a spin on ‘The River Boat’ every once in awhile(no Caribbean)edit: as long as you..

Have a great day..

Raul3

That Mike Kors is calling my name EM

Grinder

“I could have purchased XIV, but I am a low-life, no good degenerate”

Thanks for making me chuckle this morning. We all need a little degeneracy, as well as they humility to admit it from time to time, to push the levers when the appropriate setup finally presents itself. Best of luck to you for the remaining week.