The markets have been erratic over the past week and it’s no surprise given the news flow. I’ve had my head on a constant swivel this past week, playing defense and attempting to not get blindsided. Presidents Day has provided me with an extra day to take a deep breadth, soak in all the relevant information and update the forecast.

Working off of my last forecast (click here) I will provide an update and then briefly discuss the risks and rewards playing out in our financial markets.

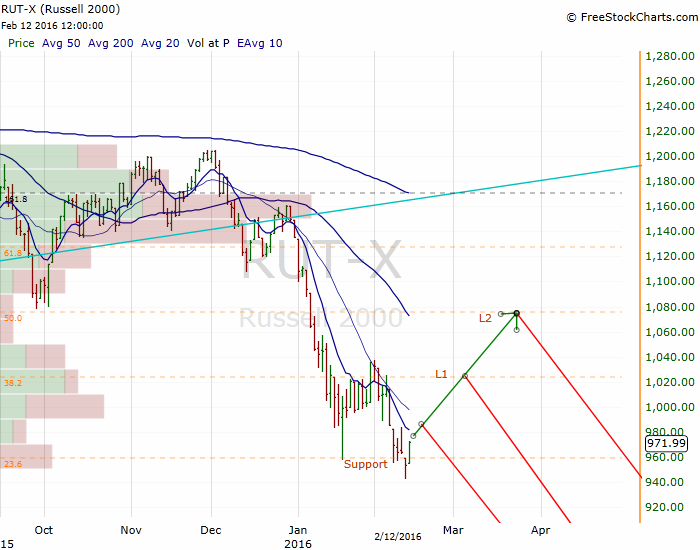

As you know, I am currently keying off of the Russell 2000 Index and still believe we will hit the 2007 highs of around $850 by this summer (at the latest). Last week we briefly broke through support at around $960 before reversing rather quickly. Refer to the chart below:

Now that there’s numerous market participants caught short (including myself), there is increased risk of the market bouncing higher before reversing and continuing the primary downtrend. I will cover my short exposure above $984 and let my long hedges run while the market bounces. I expect equities to reverse near $1024 on the Russell (and possibly even as high as $1077 – but I give that less probability). Refer to ‘L1’ and ‘L2’ in the chart above.

The long term chart is below:

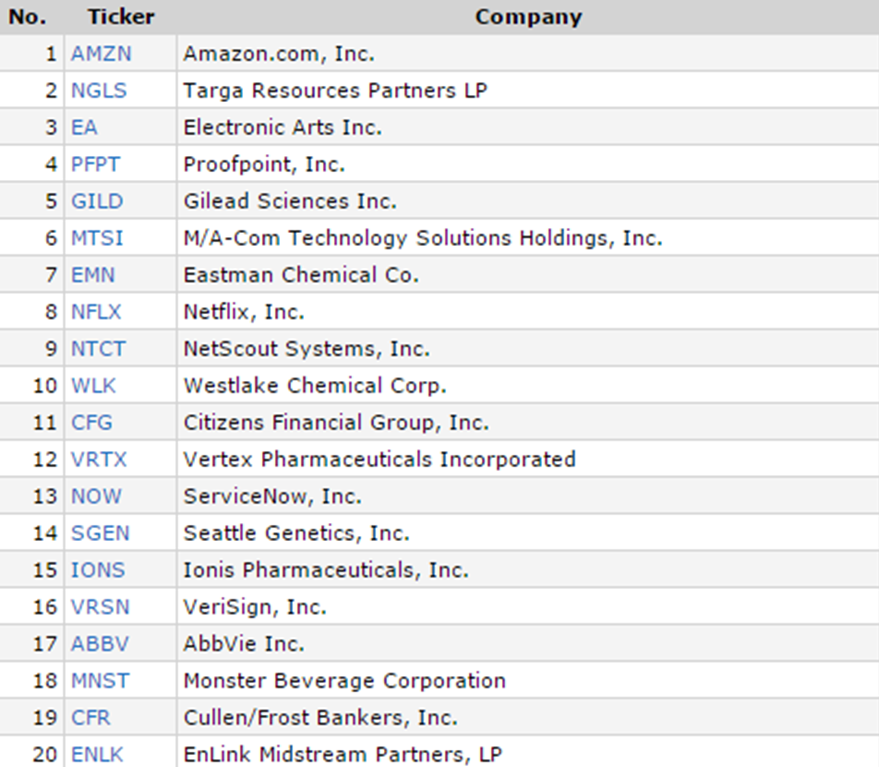

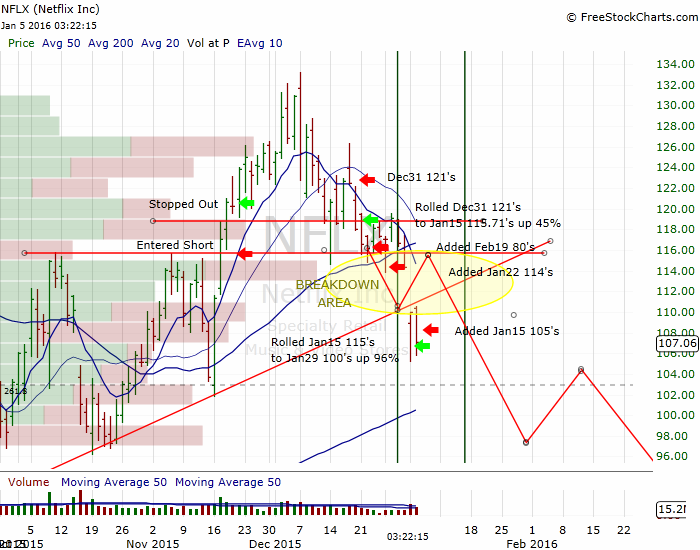

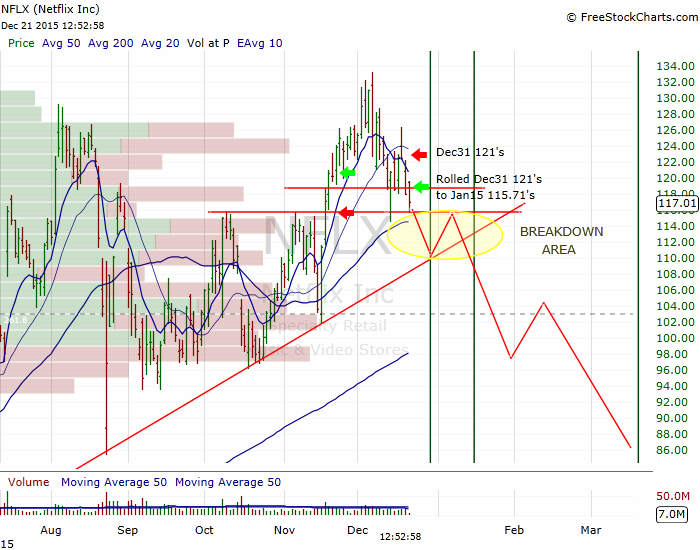

Once it’s clear that one of the above scenarios is playing out, I will jump all over the short ideas I’ve discussed already – and I’ve added a few new names below. When the time is right I will discuss which ones I’m focusing on in a follow-up post:

- NFLX

- TSLA

- EA

- BAC

- MON

Regarding the rest of the financial landscape, I think it’s important to understand what the central banks are trying to accomplish. Neil Howe possibly put it best and I’ll paraphrase:

Central banks are trying to pry the extra cash out of peoples pockets with negative interest rates.

They’re trying to get you to spend your money! They desperately need inflation. Removing cash currency under the guise of illegal activity is simply another maneuver to gain control over the economic levers. If we can’t horde cash, then the negative interest rate policy (NIRP) will have more of an effect. I’m sure the iBankCoin readership realizes this.

I’m trying to figure out how to 1) safeguard myself from this development and 2) position myself to prosper from it. Gold seems obvious at this juncture, but I don’t feel comfortable chasing it.

I’m leaning toward simply shorting the Japanese Yen and/or the Nikkei. I think there’s a chance the USD/JPY currency cross and the Nikkei correlation breaks down – is it possible for them both to go down? Last week’s carry trade unwind has me sitting on the sidelines. I also think shorting the Euro (EUR/USD) could be a compelling idea, now that it’s had a pullback. However, I don’t have a lot of conviction yet.

The question remains: is what we are seeing in Japan (and Europe) going to be what plays out here in the US if/when the economy rolls over??

I’d love to hear what you think and I encourage you to post a comment below.

And follow me on Twitter @dyer440

Comments »