Here’s a hint… when the market has a bull’s on parade rally, and that stock you own doesn’t go up – that’s SUPPLY (people are selling).

Conversely, when the market craps the bed and that stock you’ve been meaning to buy doesn’t go down – that’s DEMAND (people are buying).

I’m a strong advocate for buying strength and selling weakness. Let the price action tell you what to do next.

Here’s the trick: you want to start accumulating shares in the companies that don’t go down on red market days. You may not catch the latest momentum stock bouncing, but you also don’t run as much risk in catching more downside. In the same sense, if that momentum stock doesn’t bounce along with the market on a huge up-day, what do you think might happen if the bounce reverses? That’s right, you’ll be stuck holding too much risk, and with no demand in sight you’ll be one of the weak hands chasing the bid/ask lower in a desperate attempt to sell.

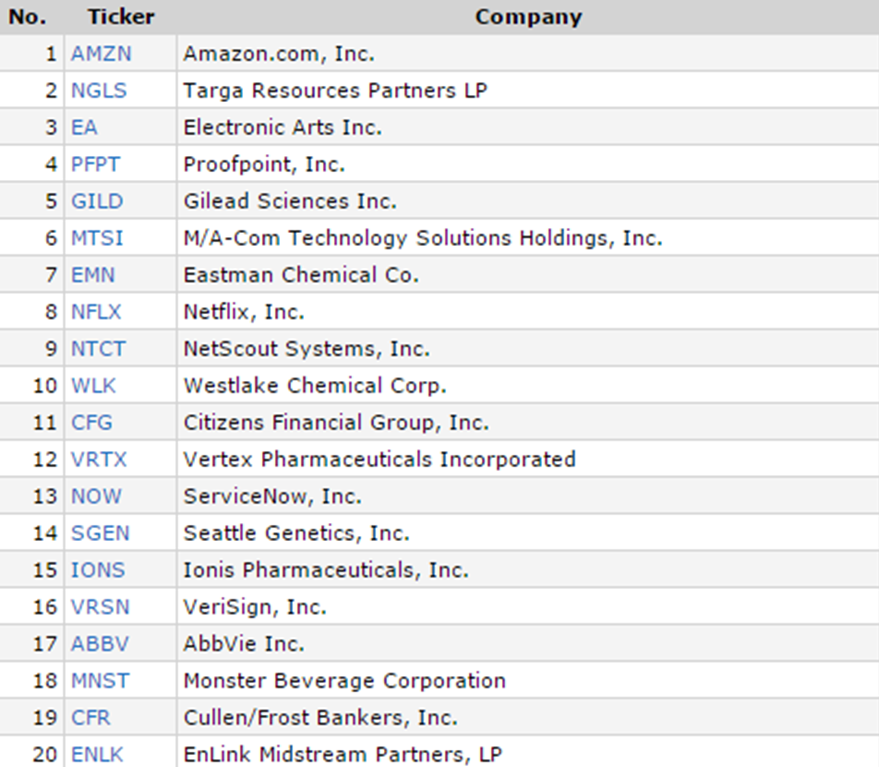

Therefore, given my intermediate term market forecast which you can read here: Market Forecast – More Blood, and given the bounce in equities last week, specifically Friday, I ran a screen for stocks down on Friday:

Nothing fancy here folks, but that is a good list of short candidates.

Now, if you’ve read any of my articles you probably know that I’m a huge Netflix bear (Reminder – Stick to the Plan!!, F-U Money, and Crazy for Netflix??) and for full disclosure I’ve got most of my account leveraged in NFLX puts. So I’m happy it made the cut.

This screen has turned up another gem of a short in my opinion – and that’s Gilead Sciences Inc. (GILD). The biotech sector has shown significant weakness lately, and in my opinion you can use GILD as a play on more weakness. I’m also short Tesla Motors (TSLA) which was green on Friday but has been under performing since we bottomed last week (so it qualifies in my mind).

Here’s the Trade:

If these companies continue to underperform the overall indices, start to build short positions. If (when) the market shows it’s hand and hit’s the wall of supply waiting overhead, you’ll already be positioned for it and have an edge. This strategy works well to compliment long positions you may already have in your portfolio.

Let’s take a look at the supply gap for the three companies I’ve mentioned:

Notice in the charts above where the overall market bounced on Jan. 20th; these companies then continued to trade lower. If/when the market gives up those gains, it’s easy to imagine the ugliness to come for these three names.

Now, when the market does get ugly again, run the same screen – but for companies trading green in a sea of red. I think you can make a living trading with this one simple technique. Remember to always buy strength and sell weakness.

Follow me on Twitter @dyer440 to see how I play it (never perfect, but always honest).

If you enjoy the content at iBankCoin, please follow us on Twitter

Dyer, I can appreciate this strategy for trading a short term position. However, if you like some of these companies (NFLX, AMZN, GILD), if you’ve got the patience, risk profile, and capital, dedicating a small percent of your account and buying lots (1/3-1/4) in these companies for the long term, can be successful in the long run.

My question for you is, with Gilead announcing earnings after the close on Tuesday, are you buying puts? Not calling you out or anything, but interested in knowing how you would implore this strategy with earnings announcements.

This is a short term strategy that is suppose to fit within my intermediate term outlook (which currently is that the market is bouncing but will end up a lot lower by Q2. So it’s simply trying to spot relative weakness and using those companies as shorting vehicles.

Doesn’t always work – NFLX & TSLA are eating my lunch today for example!

Generally I stay away from big positions during earnings, unless I’m already locked and loaded. I’m not in GILD as yet, but if it continues to underperform (including post earnings) I will be. It’s on my watch list so to speak.

what expiry/strike are you holding for NFLX?

i took feb 85’s from your recommendation last month. Quite pricey, as a $30 drop in the stock has happened since then, but still nicely profitable.

Feb19 80’s (+37%)

Feb19 90’s (+53%)

Feb19 104’s (+150%)

Mar18 80’s (+96%)

I’m getting anxious about them to be honest. Probably close the Feb 80’s soon. Or hedge with something else.