Since everyone seems itching to get long oil exposure – being the degenerate gambler myself – I’m going to share with you my own “trigger signals” for commodities in general. First of all however, a bit of a history lesson:

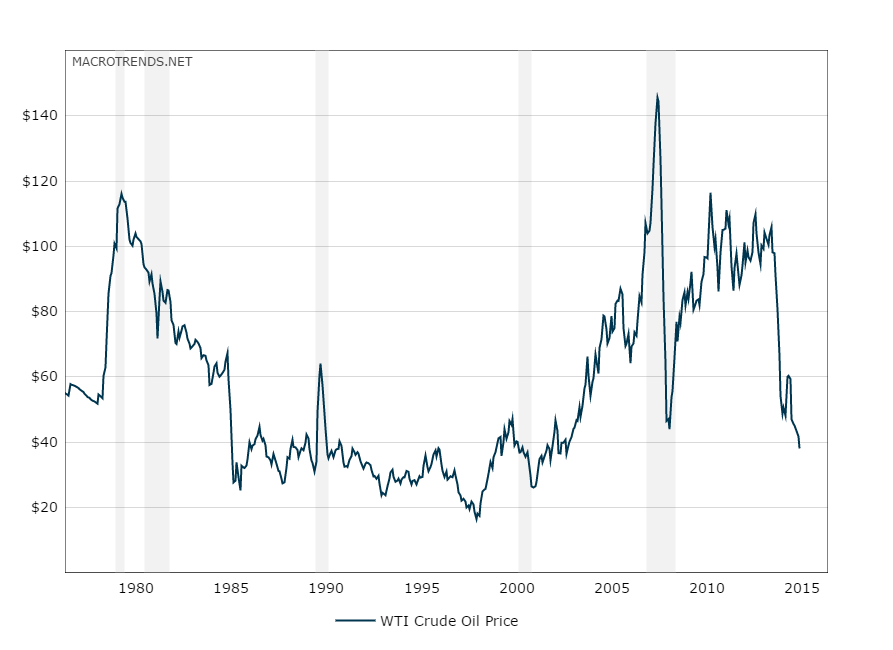

The Oil crash during the Great Recession of 2008-9 was followed-up by a huge rebound as central banks around the world went all-in on various stimulus measures.

This has led some of you to have recency bias. So first of all I would say:

Check your age, and bias at the door of this casino before entering.

Secondly, I believe the current Oil crash to be primarily a result of Saudi Arabia posturing, and the Saudi’s have played this game before. Who remembers the mid 1980’s? I don’t, I was under 5 at the time but I’m from Louisiana and my dad worked off-shore for Schlumberger (he got laid off). Now I live in Houston and the old-timers here still talk about it. They like to say:

Last one leaving Houston, please turn off the lights.

Anyway, it’s part of my life history – sort of a mythology of the time period.

After OPEC took the stance that they were going to capture market share – they didn’t stop pumping until everyone else was in real pain. There’s no reason to expect the Saudi’s to change the playbook this time around.

If you were trying to bottom pick energy exposure back in the mid-80’s you had a tough time of it; there were 3 waves up in price, each followed by another collapse. The rout finally ended when everyone gave up, then crude prices languished for a decade before anyone made real money in the space.

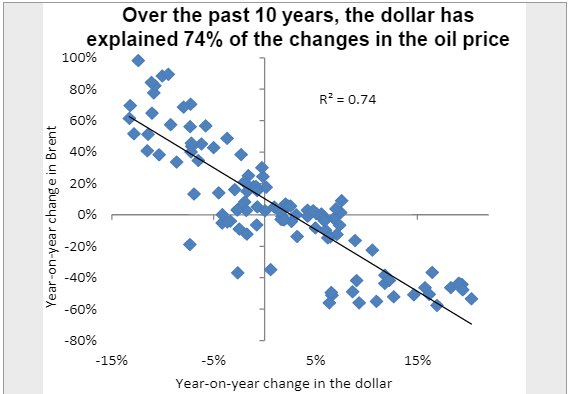

Now, most of you realize that commodities priced in US Dollars are therefore correlated to the US Dollar. Did you know that over the past 10 years, they are 74% correlated on an annual basis? One of my favorite Twitter follows (@TheEuchre) shared this:

My “trigger signals” on the commodity space are therefore currency related. I don’t think you can overlook the currency impact if you are speculating on Oil or Oil related exposure.

I like to view the US Dollar in two ways, in USD/JPY and EUR/USD, as opposed to simply the US Dollar Index by itself. I think there is more detail to be gleaned from it that way, and it provides more confirmation when both pairs signal the same thing.

So Here’s the Trade:

Stay away from Long Oil exposure (and commodities in general) until:

1) The USD/JPY cross falls below 115.50, AND

2) The EUR/USD cross trades above 1.148

Refer to the charts and levels below:

Sure, you might miss out on the first 15% of the move, but you may just save yourself from sleepless nights monitoring futures and more importantly, the huge opportunity costs associated. There are opportunities out there that offer better risk/reward scenarios, so stay out of long energy exposure until the coast is clear.

Better yet, stay short; refer to the following posts for ideas:

If you enjoy the content at iBankCoin, please follow us on Twitter

Top notch post

Holding my last bit of SCO for 137.00 & then possibly 152.00

Dad was a petroleum engineer – we moved to Lafayette in 1983 to take a new job, then the pain hit. I remember hearing about tent cities outside of Houston of people looking for work – copies of the Houston Chronicle sold for $20 for the job postings inside. My dad made things work with part time gigs, but it was rough for about 4 years.

We also lived in Lafayette at the time. My Dad is a mining engineer but the service companies needed all the help they could get during the boom. After the bust and the layoff, he moved us to the West Virginia coal fields for work (we only stayed for a year – my Mom hated it!).

To say I’m worried about my Houston real estate would be an understatement.

Dam DYER440… This post is fire.

Big props to the idea generation never thought to look at fx as actual trading triggers on commods trades until today.

Best of luck man

Dyer – great post.

Dyer – Again, very solid post. Yesterday’s fx pin action aside, the levels noted for the major crosses would appear to be “in the tails” from a statistical standpoint. Even more reason to give the commodity complex (aside from precious metals and maybe palladium) a very wide berth until further notice. JCG

Enjoying your work.

@TheEuchre heavily long oil at the moment.

(Posted some very interesting research on NG & Oil last week.)

Caution, however, on the USD/CL_F correlation: https://twitter.com/groditi/status/672273864118763520

A lot of moving parts here.

Positioning, Saudi saying one thing (and doing another), etc…

Fascinating times.

Great stuff. Those levels you post for UJ and EU would entail serious currency shenanigans as I don’t think BOJ or ECB would sit idle. They have already committed huge sums to devalue. Should be interesting times. Lots of moving parts.

Thanks for the input. Currencies have been especially volatile these days given the unprecedented actions by CB’s around the world. As some of you have mentioned, the target levels appear far from where these crosses are trading today however, I don’t think they are unreachable – at all…

EUR/USD was at the target level approx. 2 mo’s ago. And USD/JPY has flirted w/ the target level 3 times in 2015. We can all agree that it would be a big reversal, but we’re approaching the most important week in financial markets since probably 2011, and there are a lot of possible outcomes given the first Fed move since Dec. 2008.

Expect more FX volatility.