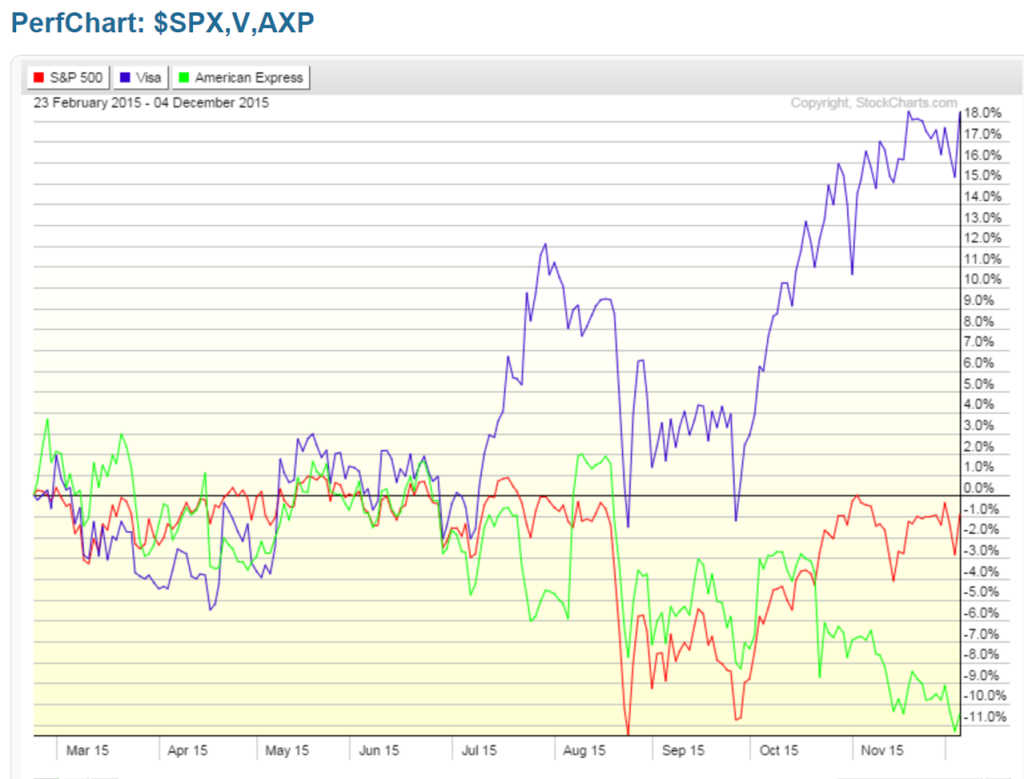

American Express Co. (AXP) and Visa Inc. (V) are two companies that do very similar things, yet they are on two very different trajectories. I’ll keep it simple here, and provide you with a potential setup for the intermediate term.

I write about it a lot – because it really is all that matters – after Fed Day (Dec. 16), equities are either going to break out, or break down. There will be some whipsaws at first but by mid January I think the market will have settled on a direction. We have been consolidating all year, and equities are either poised for a move higher, or building a top for a subsequent move lower. No one knows which way it’s going to break, but we will soon find out. Small investors like me (and I’m assuming you, the reader, as well) have three options on how to deal with this binary setup:

- Keep your portfolio mostly intact, cross your fingers and see how your current positioning and bias plays out.

- Go to mostly cash and jump in once the narrative becomes clear and prices confirm which way is correct.

- Develop a structured setup for the event, one where you’ll be mostly hedged (albeit with potential alpha), but one in which you can quickly pivot in order to catch the direction.

Obviously, I’m going to describe a structured setup using American Express and Visa.

So Here’s the Trade:

Go Long Visa (V) and Short American Express (AXP)

Use the same amount of capital for each leg of this paired trade. Both sides display plenty of upside (or downside re AXP). Over the intermediate term, V should continue to outperform AXP regardless of what the Fed does and how the market reacts, so this paired trade would work without the big binary event on the horizon, see below:

While Visa continues the long term trend upwards toward $100, American Express has put in a solid looking head and shoulders topping pattern:

What makes this a fascinating setup for me is that if you incorporate stop loss levels into each leg of the trade, you will in effect automatically pivot with the market. For example, on the long V leg, use a stop of $74.50; don’t stay in the trade below that level. For the short AXP leg, use a stop of $73.50; don’t stay in the trade above that level.

If/when the overall market breaks out, you may be stopped out of the AXP short position but you can continue to ride the trend in Visa up with the market (most likely outperforming it).

Conversely, if/when the overall market breaks down, you may be stopped out of the V long position, but you will probably outperform the market on the downside in the AXP short.

Additionally, there is a small chance that both sides of this trade continue to work (avoiding stop levels), regardless of the overall market direction.

If you enjoy the content at iBankCoin, please follow us on Twitter

Love this idea, well though out. Tips Hat

Thank you sir.