Only a few times per year do you get a shot at making F-U Money. I think we have such a setup for 2016 here, and I’ve written about it before (which didn’t pan out), but the upside is such that it could pay to take another look.

IF we have a moment where the market wake’s up to reality I think Netflix (NFLX) could see a 50% pullback.

Doing some research I came across this David Einhorn gem:

NFLX changed its story and pushed its promises into the distant future, with grand hopes for the decade starting in 2020. It transitioned from being a company judged by how much it earns into a company judged by how much it spends. Whether the spending proves successful won’t be known during the investment horizon of most NFLX shareholders.

Here’s the link to Greenlight Capitals Q2 Letter.

Einhorn hasn’t done that well in 2015, but I largely agree with him in regards to NFLX and the market in general, specifically this quote:

In today’s market, the best performing stocks are companies with exciting stories where accountability is in the distant future.

You can easily add Tesla Motors (TSLA) to the list of companies with exciting stories, blowing through tons of money, and lacking any accountability.

However, if you’d like your shot a F-U Money it doesn’t come without risk. That’s how finance works; it’s not the person with the largest work ethic, or the best of intentions, it’s the person willing to risk hard earned capital using insane leverage in a low probability scenario. Even if you get the setup and price direction correct, you won’t make F-U Money unless you have the patience to hold onto the trade, even when you’re up 500% – you’ve got to go for the jugular in order to make F-U Money. It’ll take some brass balls to pull it off…

So Here’s the Trade:

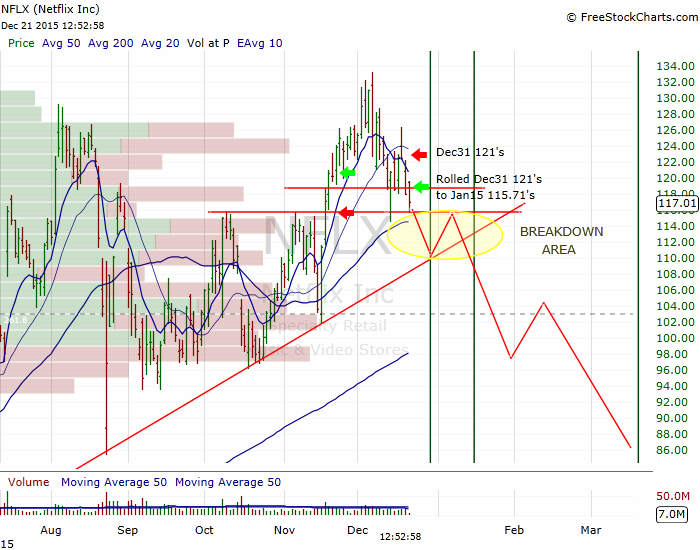

Go SHORT NFLX using way out-of-the-money (OTM) Put Options on a break down through the $110 level, refer to the chart below:

I’m currently in this trade; I’ve recently rolled some Dec. 31 121 puts to Jan. 15 115.71’s. On a break through the horizontal resistance at today’s low $115.7, and the trend line resistance rising up towards that level, I will be fully locked and loaded with OTM puts. Price target is anywhere in the $60’s.

I’ll probably start with February puts using the 70 strike, with the goal of around 2,000% profits.

This sort of thing isn’t for everybody. I will follow-up with the setup for TSLA once the price action becomes clearer.

If you enjoy the content at iBankCoin, please follow us on Twitter

I love the idea…

I 2nd that ^^^

May the force be with you DYER440

Really interesting post that led me to your commodity and Fed-related posts – all of which are excellent. I’ve been trying to make the FU money shorting crude and am at 400% using USO puts and DWTI. I look a lot at the US – Loonie but not a lot at the euro and yen and am itching to test that, so much thanks for the broader view.

As for NFLX – gobbling up $5 billion for content without ever saying how many of their subscribers actually watch the shows they are making (especially those where they assume 100% risk) – it amazes me that people continue to give them a pass on those figures.

Would love to know which banks are involved…

To me the story is this (and I haven’t read the Einhorn letter but I will (thanks for the link)): puttingn on 30 odd shows on by this time next year – all with five to 13 or so episodes each – is there really enough talent to sustain them?

With the glut in programming generally the executive ranks must be getting very thin indeud.

I’m pointing to a longer term issue, I guess, but if the edge they have in data and analytics doesn’t translate into increased subscribers based on the $5 billion in new content… And then how long before Amazon puts the screws to them on cloud access, etc?

Anyway, great stuff from you and kudos to the boss for your hire.