The hardest part of the trading game is sticking to a strategy. Short term-ism is pervasive is our culture and more so in finance. Therefore, I’ve provided a quick reminder of what is working below:

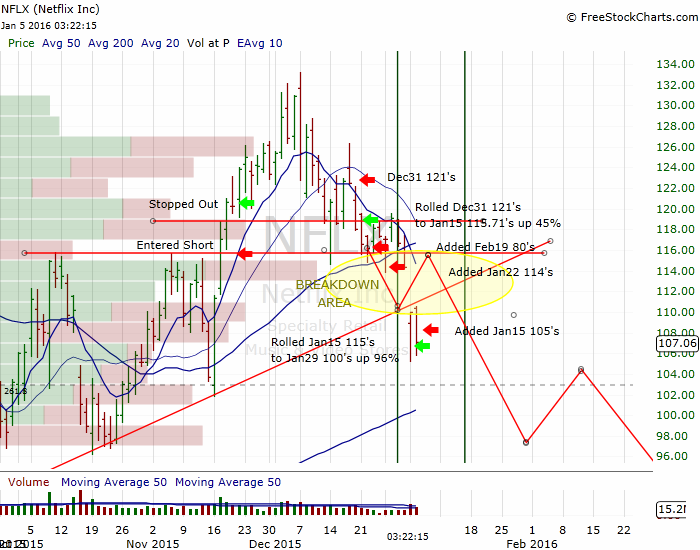

First and most importantly, Netflix – the chart below has my original forecast along with the various maneuvering I’ve done:

NFLX target = anywhere in the $60’s. Refer to the previous posts here and here.

Next up is the Visa vs. American Express pair. Refer to the original post here.

This pair has worked out well and we haven’t been stopped out of either leg of it, which I hope continues. Either way however, this is a great trade setup in order to pivot with the market either up or down. I really like the short on AXP here:

Regarding commodities – which I have beaten to death – literally (shorting) and figuratively, I believe value investors are putting money to work in these sectors to begin 2016 (especially oil & gas). This should have the effect of holding them up relative to the underlying commodities. I therefore favor shorting the commodities over the equities right now.

However, keep in mind the currency trigger levels I pointed out here. If/when those break it’ll be time to get long commodities again – as inflation perhaps finally wakes from it’s slumber.

Currencies are volatile these days (huge understatement). I’m beginning to believe that Crude Oil is the dog wagging the proverbial US Dollar tail – and not the other way around. The FX flows due to the crude trade are simply massive. For example, since Q3 2014 the Saudi Arabian Monetary Agency’s reserves in foreign securities have declined by $71 billion! Reference

These could be are the capital flows causing the US Dollar to rally.

Good luck out there. I’ll have another trade setup later this week, but for now “Stick to the Plan”.

If you enjoy the content at iBankCoin, please follow us on Twitter

Kudos Dyer. Top page blog. Respect !

Thanks. I’m not really sure how that happened but I know Le Fly is a sucker for a feature image that is meta-poetic, lol.

Great stuff. thank you dyer440.

Solid stuff dude

Very good analysis man. One thing I wanted to dig a little further into though; no trolling, more education and insight.

Could you explain a little deeper as to why you believe it’s crude moving dollar, and not the other way around? With the Saudi’s decrease in foreign currency reserves, I see this as the oil market is forcing them to do this so their citizens don’t create a (full) up rise.

I think it all comes back to King Dollar; you can see it in all commodities as well as in Treasuries. Either way, I’m always down for hearing the other side. Much respect on all your trades discussed above!

I don’t have a good answer to be honest. It’s one of those “chicken or egg” questions that intellectually I’m trying to figure out.

I think it’s safe to say that the supply/demand balance does not equate to the type of declines we have seen in the price of crude. And we know that since crude is priced in US Dollars they are uniquely correlated…

But I’ve been wondering lately what the actual effect the drop is crude price has on forex capital flows. There has to be a direct effect, for example: when commodities fall in price, there are less US Dollars being exchanged globally, right? I’m wondering if this some type of perpetual cycle – where the effects continue to contribute to the trend. I don’t know the answer.

It’s interesting however that the Saudi’s accumulated US Dollars in anticipation of this effect… They hedged their crude price exposure (knowing they could bring it down) and now they are cashing in (covering) that hedge. Smart.

Sort of like the Chinese accumulating gold to hedge their US Dollar exposure. These types of maneuvers have got to have an effect currencies?

Well put.

let’s review the iBC bloggers.

fly: has a different plan everyday and sticks to it (schizophrenic paranoid)

OA: sticks to a plan even though it is wrong

RC: day trader: doesn’t have a plan

More like a highly functional sociopath.

NFLX clearly messing w/ my mojo now… I love these companies that use alternative growth metrics in their fundamental story: “subscriber growth is killing it!!”. We’re going to spend more money by being “available in 130 countries”. Come on. Remove the “narrative” and look at cash flow/revenues – would you buy this company?

Hell no.

All that being said however, my stop loss levels are being hit now. Never feels good.