It’s finally here. Perhaps the most important financial week since probably 2011, when central banks around the world made coordinated efforts to “ease strains in financial markets“. I remember that week clearly; unfortunately I was heavily short equities as markets looked like they were about to roll-over hard. Instead, during a post Thanksgiving food coma, I had to rush to cover my put options and settled with heavy losses.

Lessons learned: don’t underestimate Central Bank power to save markets and don’t underestimate market participants reactions to Central Bank intervention.

From where I stand, it seems like the markets are currently trying to test the Fed’s resolve. Are they really “data dependent” or, are they S&P 500 dependent? If the market sells off into Tuesday (Dec. 15 – the day FOMC members meet), will they decide to pull the trigger? If they do, what’s their narrative going forward? And finally, how will markets react?

I’ll give you 3 scenarios, and then try to frame some trades around this big binary event. Keep in mind, no one really knows how this will play out.

Scenario 1; No Hike (< 20% probability):

If the Fed fails to raise rates, equities will sell off in a tantrum! US Dollar top will be in. Bonds will rally as yields go lower (perhaps negative if recession approaches).

Scenario 2; Dovish Hike (35% probability):

If the Fed raises rates then employs a dovish narrative for their guidance moving forward, equities should be appeased and I would expect a move higher to end the year. The US Dollar top could be in, but it’ll depend more on economic data. Rates will adjust slightly and their reaction will provide a key tell moving forward.

Scenario 3; Hawkish Hike (45% probability):

A Fed rate hike along with a narrative to get the Fed Funds Rate to a 2% target would be extremely hawkish. Expect volatility; participants will be pleased that Fed communication finally matches their actions however, the expectation of multiple rate hikes in 2016 will not bode well. I’d expect an initial positive reaction, followed by a sell off during Yellen’s speech – this is the most likely scenario. The US Dollar will have further positive momentum going forward, i.e., “more of the same”. Bonds will adjust, perhaps rapidly depending on how hawkish the narrative is.

Alright, so having some likely scenarios helps to provide a dose of clarity, but probable outcomes don’t typically equate to great trade setups.

Low probability events produce large returns on capital.

So Here’s the Trade:

Take 50% of a speculative amount of capital, enough to hedge the positions you’re carrying into Wednesday (Dec. 16.) and:

Go Long Gold (GLD) and

Go Long Bonds (TLT)

IF the US Dollar is down on Wednesday, post Yellen’s speech, deploy the remaining 50% by doubling down on GLD and TLT.

Let me explain. If the US Dollar is down on the news it means either Scenario 1 or 2 is playing out… and the world’s reserve currency has likely topped (in my opinion). This is a low probability call that the Fed is tired of being the only Central Bank not easing, and that they’re going to begin shifting the narrative from talking the dollar up, to talking it down. It’ll be like slowly turning an aircraft carrier around (it may take time), but I can easily imagine a world where the Fed is trying it’s best to devalue the dollar and create some inflation at any cost – especially if we’re in for more growth deceleration in 2016.

This will likely mean negative US interest rates. Janet Yellen has even discussed this possibility in November!

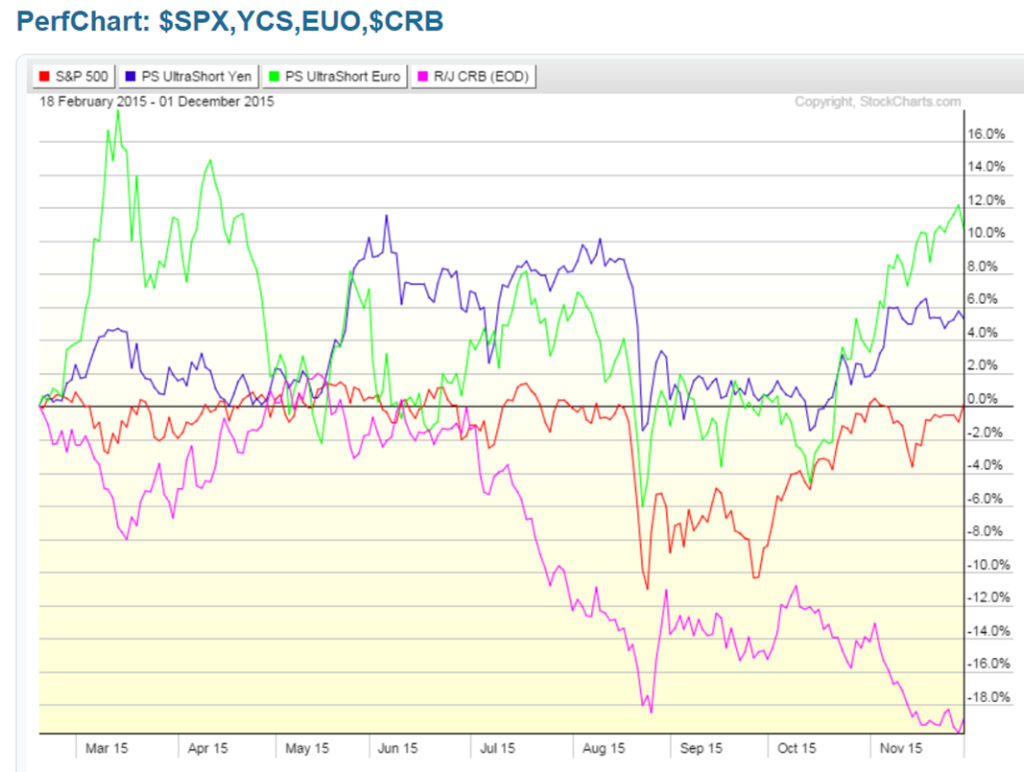

Alternatively, if the low probability trade doesn’t work out, and it’s “more of the same”, my trade from Yell Laughing at Commodities should work.

Regarding equities, I’ve provided a structured trade idea in the article The Perfect Pair. This paired trade should provide the opportunity to pivot with the market once equities settle on a direction.

At the very least I’ve laid out some considerations which should help get the your own ideas flowing ahead of this event.

Comments »