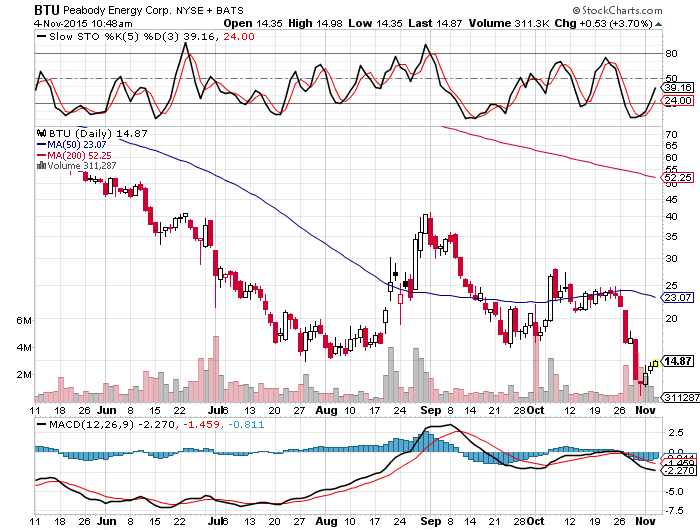

I expected Arch Coal’s Ch. 11 Bankruptcy to signal the bottom in the coal market. I was wrong however and here’s why:

If Arch can continue operating as usual without neither lien holders nor bankruptcy courts requiring them to sell assets, then zero coal comes off the market (at least for a while). Arch is currently flooding the market with cheap coal in order to keep cash flows rolling in.

Take their Leer Mining Complex for example, they are exporting metallurgical coal in the low $40’s per ton; I think they are taking $20-30 losses on each ton of coal sold at these prices. In the process they are driving the rest of the industry down the toilet with them. Nobody can produce deep coal with positive returns at those prices.

Therefore it’s simply a financial engineering game between the lenders, courts, accountants, and cash flowing assets. Eventually, they will have to stop selling coal at those prices. But until someone makes them stop, the coal sector will not find a bottom.

The same thing is happening in the Oil and Gas industry… each company is waiting for the other to drown in debt. Meanwhile, as long as cash is rolling-in – albeit with negative returns on capital – they can attempt to stay afloat – breathing air through one of those skinny flexible straws!

Stay away from these energy producers – they are in a race with each other to the bottom. The prices of the underlying commodities will not bounce until the supply comes off the market. The only savior is bankruptcy courts and lien holders taking a hard line and demanding asset sales.

Comments »