I’ve been handing out free money to iBankCoin readers for the past few weeks and I’d like to summarize my take on the markets and my recommendations up to this point. This is done in an effort to be transparent with my ideas, calling out my own mistakes and tooting my own horn when I’ve made money.

First of all, if you’re short the Fed Trade School Basket you’re doing very well for yourself, I’ve updated my recommendations below:

Stay short the country basket, Brazil (EWZ), China (FXI), Mexico (EWW), Russia (RSX or ERUS), and Australia (EWA), you should be up on all of these except EWZ, be patient these will continue to work well, especially if you are long some of your favorite US equities as well.

Take some profits on Freeport-McMoran (FCX), you should’ve made some nice gains on this one, personally my options were up around 85% when I took profits on Thursday (too early). If you’re still short I recommend taking profits and perhaps leaving a piece on, depending on your trading style.

Currencies are still a good play, although my recommendation was to use Friday’s highs (11/6/15) as a stop loss, you would’ve been stopped out however, I believe these will still work; “Short the Aussie Dollar (FXA), and Short the Canadian Dollar (FXC)”.

Stay short Oil (USO), you’re making a killing here! No reason to to cover, especially after we had war escalating events over the weekend (Paris attacks) and crude oil was still down today – very bearish. Perhaps move your stops down depending on your trading style.

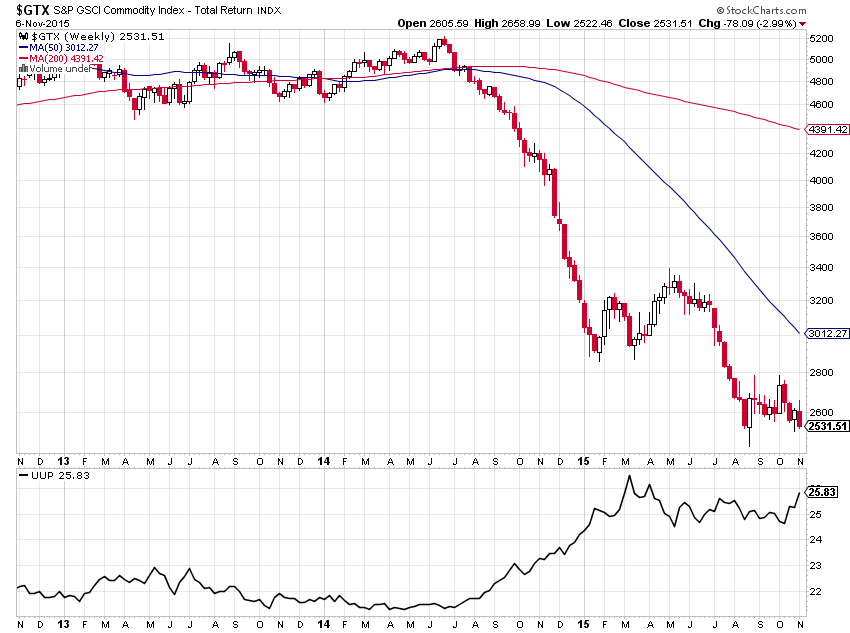

From last week’s post, Commodity Not-So Super Cycle you should be short ConocoPhillips (COP). Depending on your entry you should be doing okay in this one.

Stay short COP, use Wednesday’s (11/11/15) high around $54.75 as a stop.

Finally, my call on coal (perhaps) bottoming in King Coal’s Big Bounce? is still a wait and see event driven idea.

Keep an Eye on ACI, for the signal to buy BTU, when it’s apparent that Arch Coal (ACI) is in fact going bankrupt, depending on the reaction in Peabody Energy’s (BTU) shares, go long BTU for a potential bottom in coal.

I think overall the markets should bounce early in the week and most likely give up those gains by the close on Friday. The easy trade is to stay short commodity exposure (as described above) and stay long US equities until they break down again. I personally doubt we’ll see any fireworks until the end of the year.

I’m working on a few ideas for this week, they’ll be associated with transportation (rail) stocks and perhaps THE momentum trade of 2016.

Feel free to comment below, let me know if I’m adding any value here or if you’d rather me go back into my own little trading cave.

Comments »