The hardest part of the trading game is sticking to a strategy. Short term-ism is pervasive is our culture and more so in finance. Therefore, I’ve provided a quick reminder of what is working below:

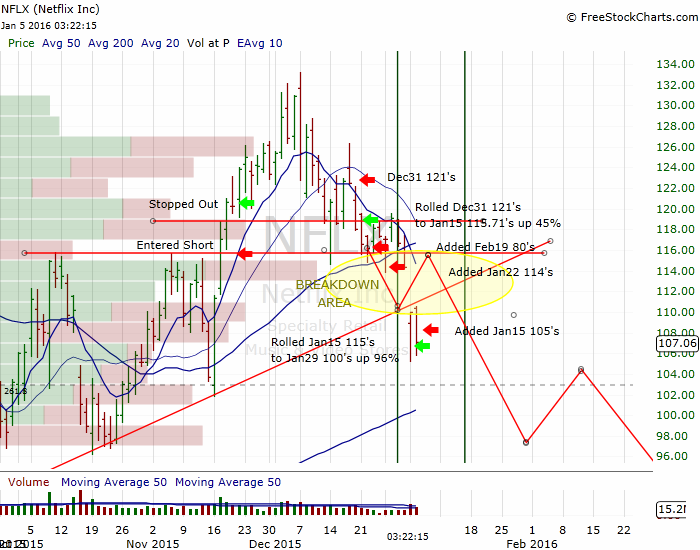

First and most importantly, Netflix – the chart below has my original forecast along with the various maneuvering I’ve done:

NFLX target = anywhere in the $60’s. Refer to the previous posts here and here.

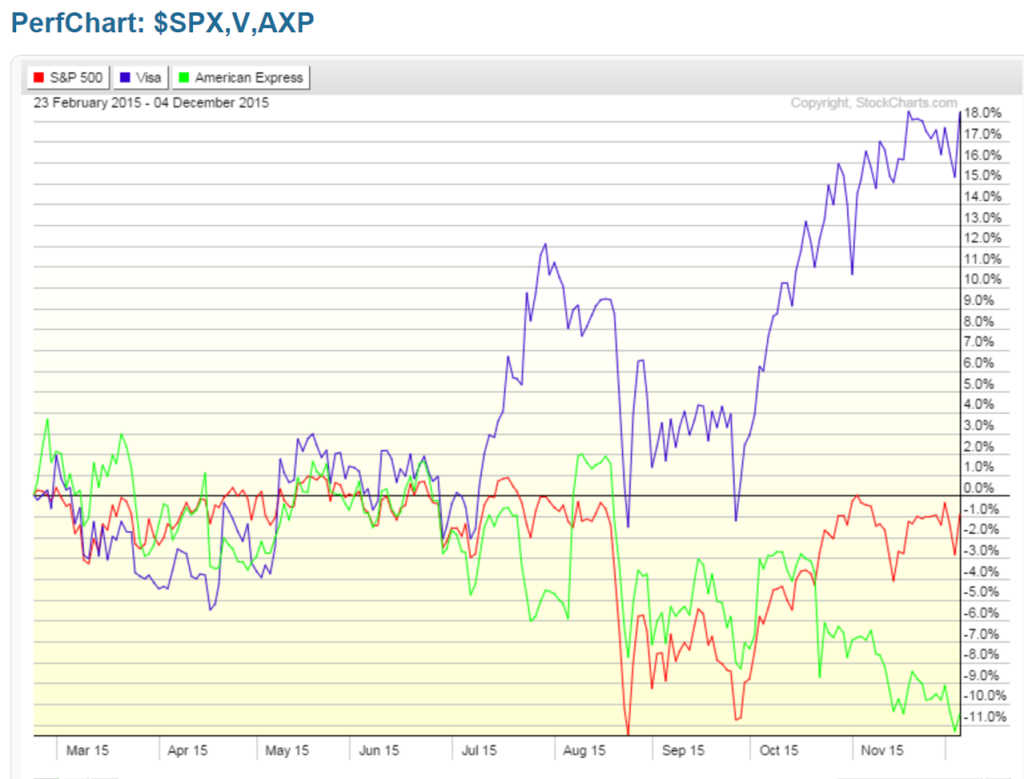

Next up is the Visa vs. American Express pair. Refer to the original post here.

This pair has worked out well and we haven’t been stopped out of either leg of it, which I hope continues. Either way however, this is a great trade setup in order to pivot with the market either up or down. I really like the short on AXP here:

Regarding commodities – which I have beaten to death – literally (shorting) and figuratively, I believe value investors are putting money to work in these sectors to begin 2016 (especially oil & gas). This should have the effect of holding them up relative to the underlying commodities. I therefore favor shorting the commodities over the equities right now.

However, keep in mind the currency trigger levels I pointed out here. If/when those break it’ll be time to get long commodities again – as inflation perhaps finally wakes from it’s slumber.

Currencies are volatile these days (huge understatement). I’m beginning to believe that Crude Oil is the dog wagging the proverbial US Dollar tail – and not the other way around. The FX flows due to the crude trade are simply massive. For example, since Q3 2014 the Saudi Arabian Monetary Agency’s reserves in foreign securities have declined by $71 billion! Reference

These could be are the capital flows causing the US Dollar to rally.

Good luck out there. I’ll have another trade setup later this week, but for now “Stick to the Plan”.

Comments »