You may notice I’ve slightly backed off the mouth foaming rhetoric about my bullishness in Tesla Motors. While still my absolute favorite long-term investment, it’s now trading above intermediate term value.

Does that mean I will sell?

No. Nah son, that’s a petty move.

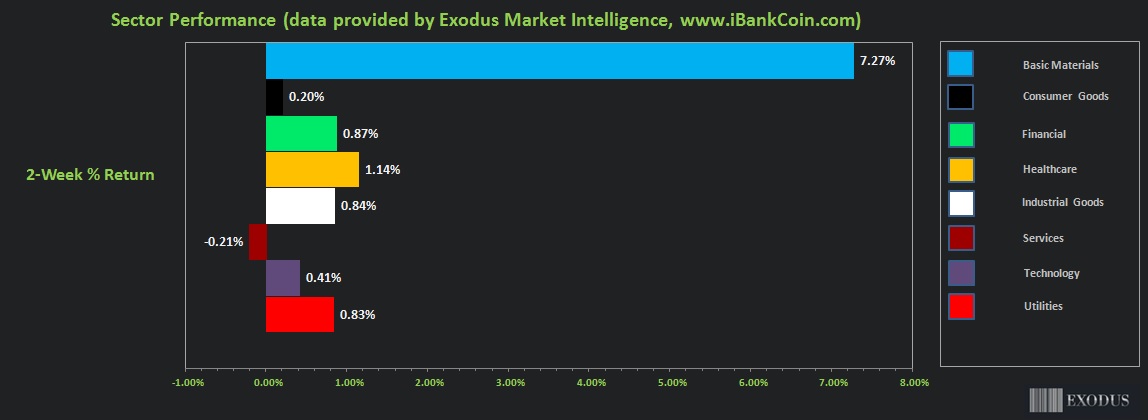

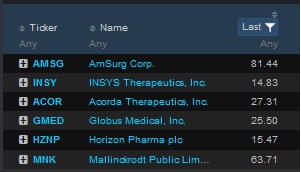

But you need to understand a few basic tenents of technical analysis. One is balance, also known as range. Stocks spend the majority of their time in balance. Identifying and plotting the territory is key to assessing whether your idea is ‘working’ and also when and where to take action.

If I were a more fickle Tesla investor, thank goodness I am not, then I would consider capturing some of the recent gains from sub-200 as we approach range high, see below:

The same method of trading can be applied to any instrument. Buy range low, sell range high. Eventually you’ll need risk parameters in place to get you out of the way when the break happens. When the break happens, it will be explosive due to one ‘side’ of the tape being wrong.

For now, and despite political transition, an end to California’s drought, an acquisition of a solar company, and massive updates to the Autopilot feature, there has not been a shift in the perceived value of $TSLA equity.

Understand range trading, and you will be well on your way to better stock market decision making.

Tech Analysis 101

#STUDY

Comments »