NYSE

New Highs 18

COMPANY SYMBOL HIGH VOLUME

------- ------ ---- ------

BlackRock NY Municipal Tr BNY 16.54 951

Church & Dwight CHD 52.49 51,772

Everest Re RE 101.45 14,485

Fedl Ag Mtge Corp Cl B AGM 25.60 3,800

First Republic Bk Pfd A FRCpA 26.53 1,847

Hercules Tech Nts 2019 HTGZ 25.25 1,500

Invesco VK PAValMun VPV 15.19 4,407

NV Engy NVE 17.38 1,230,755

National Grid NGG 54.52 20,377

Nuveen NJ Premium Income NNJ 15.98 8,753

PionrMuniAdv Tr MAV 15.55 6,161

Post Properties PPS 49.56 38,522

Prudentl Sh Dur Hi Yd Fd ISD 20.14 6,230

Putnam Muni Opportunities PMO 12.90 3,440

TX Pacific Land Tr TPL 61.51 3,741

Textainer Group Hldg TGH 36.20 13,797

TransDigm Group TDG 132.69 71,868

Vitamin Shoppe VSI 50.64 292,604

New Lows 43

COMPANY SYMBOL LOW VOLUME

------- ------ ---- ------

ASA Gold & Prec Metals ASA 22.36 14,460

Alumina ADS AWC 4.02 88,554

Barrick Gold ABX 36.69 1,268,887

Best Buy BBY 20.09 402,773

CARBO Ceramics CRR 80.43 10,004

Checkpoint Sys CKP 8.40 23,611

Christopher & Banks CBK 1.65 23,755

Coeur D'Alene CDE 18.33 226,229

Dolan DM 6.49 18,878

Ducommun DCO 9.83 14,300

Edgen Group Cl A EDG 8.16 3,230

EldoradoGold EGO 12.26 620,678

Enerplus ERF 17.10 216,977

GFI Group GFIG 2.98 24,579

Genco Shipping Trading GNK 4.03 72,318

Goldcorp GG 34.75 786,967

Hecla Mining HL 3.82 623,740

Hill Intl HIL 3.10 11,941

IamGold IAG 10.76 300,177

Ivanhoe Mines IVN 9.90 441,737

Jaguar Mining JAG 2.17 58,580

Kinross Gold KGC 8.01 919,791

Memc Elec Materials WFR 3.26 313,333

Mechel OAO MTL 7.26 195,980

Moneygram Intl Inc MGI 15.23 1,925

Newmont Mining NEM 44.50 1,047,627

No Amer Engy Ptnrs NOA 3.54 8,080

Nuveen Glbl Val Opp Fd JGV 15.04 8,028

Pacific Coast Oil Trust ROYT 19.55 45,900

Panasonic Cp PC 7.11 40,625

Petrobras Argentina ADS PZE 10.41 6,863

Phillips 66 PSX 28.75 1,311,914

Pitney Bowes PBI 15.11 1,231,938

RadioShack RSH 4.91 195,431

Resolute Energy wt REN/WS 0.87 5,200

Seabridge Gold SA 14.59 72,868

Sony Corp ADS SNE 15.04 117,113

STMicroelec STM 5.33 266,341

Telecom Argentina TEO 13.11 28,449

Thompson Creek Metals TC 4.30 1,780,251

Vale Cap II 6.75% CJS 56.70 5,780

Vanguard Health Systems VHS 8.45 11,210

Xerium Tech XRM 4.14 3,750

NASDAQ

New Highs 21

COMPANY SYMBOL HIGH VOLUME

------- ------ ---- ------

Ada-es ADES 28.99 22,090

Amer Cap Agency Pfd A AGNCP 25.60 470

Arena Pharmaceuticals ARNA 3.49 12,079,411

Aware AWRE 7.50 50,824

BofI Hldg BOFI 18.94 2,950

CaesarStone SdotYam CSTE 13.88 73,950

Carmike Cinemas CKEC 15.41 86,724

Carrols Restaurant Group TAST 5.28 60,879

China Growth Eqty Inv Wt CGEIW 0.60 2,100

Churchill Downs CHDN 61.47 13,676

CommVault Systems CVLT 55.49 273,055

Homeownrs Choice HCII 15.48 6,737

Kingold Jewelry KGJI 2.84 550,998

MidWestOne Fincl Group MOFG 22.20 5,525

MutualFirst Fincl MFSF 11.42 8,691

NASB Fincl NASB 18.46 600

PDI PDII 8.87 700

PhotoMedex PHMD 17.25 10,255

Reading Intl A RDI 5.42 1,024

Span-America Medical Sys SPAN 18.00 3,019

Vertex Pharm VRTX 61.73 2,999,816

New Lows 42

COMPANY SYMBOL LOW VOLUME

------- ------ ---- ------

APCO Oil and Gas APAGF 28.88 100

Amyris AMRS 2.30 39,961

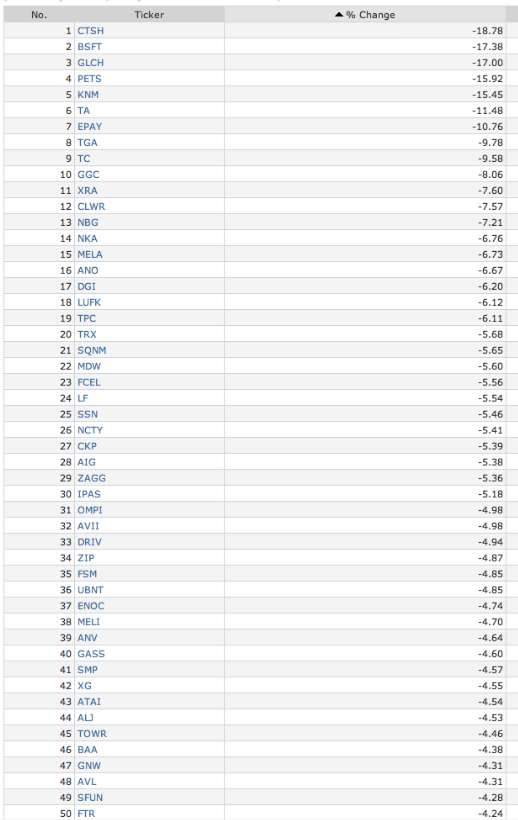

Atmel ATML 7.23 602,821

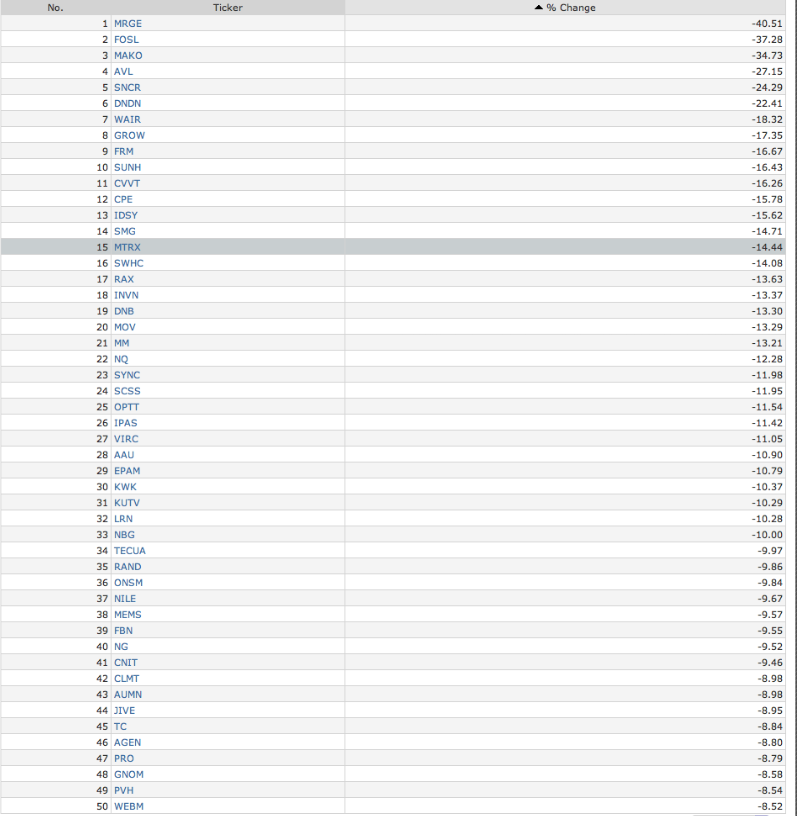

Blue Nile NILE 27.69 26,445

Carbonite CARB 7.03 9,067

China Valves Technology CVVT 1.76 53,170

Compressco Partners GSJK 12.17 1,100

Cypress Semi CY 13.50 411,591

Daktronics DAKT 7.70 740

RR Donnelley RRD 11.01 266,369

Electronic Arts EA 14.25 2,502,265

Ezcorp (Cl A) EZPW 25.18 8,910

Fiesta Restaurant Group FRGI 10.95 21,343

Flir Systems FLIR 21.32 42,449

GT Advanced Technologies GTAT 6.18 88,635

Home Inns & Hotels Mngmt HMIN 22.00 85,068

iRobot IRBT 21.51 36,220

iSh MSCI Emg Mkts Value EVAL 48.40 100

James River Coal Co JRCC 3.87 117,262

Knightsbridge Tankers VLCCF 11.66 10,116

Lincoln Educational Svcs LINC 6.30 9,452

ManTech Intl (Cl A) MANT 24.43 75,845

Merge Healthcare MRGE 2.73 548,984

Oclaro Inc OCLR 2.51 33,503

Peerless Manufacturing Co PMFG 11.94 4,908

Pan American Silver PAAS 16.81 196,371

Planar Systems PLNR 1.69 24,608

Polycom PLCM 12.01 94,154

PwrShs Gbl Gld & Prec Mtl PSAU 33.90 100

Quality Systems QSII 32.38 141,762

QuinStreet QNST 7.91 10,108

Research in Motion RIMM 11.67 2,280,314

Rimage RIMG 8.58 500

STEC STEC 7.90 35,163

ShoreTel SHOR 4.20 26,348

Sify Techs (ADS) SIFY 2.58 19,179

Synchronoss Techs SNCR 20.74 601,890

Tecumseh Products A TECUA 3.22 29,387

Telestone Techs TSTC 2.76 1,406

Tellabs TLAB 3.63 110,085

Global Investors GROW 5.66 10,050

Wet Seal (Cl A) WTSLA 2.94 182,726

Comments »