“….Commodities guru Jim Rogers isn’t buying gold yet.

He told Business Insider there were four key things driving the sell-off….”

Comments »

“….Commodities guru Jim Rogers isn’t buying gold yet.

He told Business Insider there were four key things driving the sell-off….”

Comments »“The International Monetary Fund has urged advanced economies to use “all prudent measures” to boost sluggish demand, including monetary policy, even as it trimmed 2013 growth forecasts for the global economy to 3.25 percent.

In its latest World Economic Report, chief economist Olivier Blanchard asked policymakers not to relax their efforts, but to ensure financial policies support the implementation of monetary policy.

“There is no silver bullet to address all the concerns about demand and debt. Rather, fiscal adjustment needs to progress gradually, building on measures that limit damage to demand in the short-term,” he said.

The IMF shaved its projections for global economic growth for both this year and next due to sharp government spending cuts in the U.S and the latest struggles of recession-stricken Europe.

They also cut their 2013 forecast for global growth to 3.25 percent, down from its projection in January of 3.5 percent. It also trimmed its 2014 forecast to 4.0 percent from 4.1 percent….”

Comments »“Chancellor Angela Merkel said that austerity in the euro area will claim victims as European leaders struggle to resolve the debt crisis, though the pain will be worth it to regain sustainable economic growth.

The German leader dismissed the notion that increasing debt is necessary to generate growth. She lauded European leaders for cutting budget deficits in half during the years of crisis, citing her championing of the bloc’s fiscal pact.

“We know that there will have to be victims from this in many countries,” Merkel told a forestry conference today in Berlin. “But I believe that in the long term we’ll have to have a growth strategy without always having to pile on debt.”

The German-led strategy of scaling back deficits as a response to the three-year-old debt crisis has come under criticism from other parts of the world because of recession and record unemployment in the 17-nation euro bloc…..”

Comments »“April 15, 2013

If feedback from the real world is suppressed, then decisions will necessarily be bad.

You’ve probably heard this stock market truism: what everyone knows has no value. This has several components:

1. If you’re basing your trading decisions on the same contexts and conclusions as everyone else, it’s difficult to develop much of an edge.

2. Unless it’s completely manipulated, the market generally doesn’t reward “what everyone knows,” i.e. the consensus, for long.

3. “What everyone knows” often includes trends and targets. For example, everyone now knows gold is in a bear market and the next technical target is $1,250 – $1,300. As a result, everyone’s on one side of the boat: those recommending buying gold at $1,480 are few and far between.

Legendary traders like Jesse Livermore viewed the market as a mechanism for taking as much money from the consensus as possible: taking as few traders as possible along on bullish runs higher and punishing as many traders as possible on bearish declines.

This raises two questions:

1. What does everyone not know that might have value?

2. Is there some contrarian value in what everyone knows?

We all know the Federal Reserve is manipulating the stock market. It does so in two ways:

1. Financial repression: lowering the yield on “safe” assets such as Treasury bonds to negative rates (adjusted for inflation, you’re paying the government to park your capital in its bonds), which drives capital into so-called risk assets that offer a yield, for example dividend-paying stocks and rental housing.

2. POMO and bulk purchases of futures contracts on the S&P 500 before the market opens. Studies have found that the majority of gains in the stock market occur on POMO (one of the Fed’s quantitative easing programs) days and on days when large lots of E-Mini futures contracts are purchased, pushing the markets higher at the open.

Everyone knows markets in the U.S. and Japan are levitating higher as money is created and pushed (via currency devaluation and financial repression) into stocks.

What nobody knows is the eventual consequence of all this manipulation. Right now the consensus is “don’t fight the Fed,” meaning stay invested in stocks because they’re going higher.

In less-manipulated markets, we would expect the consensus to eventually be punished, simply because the market rarely rewards the majority for long. But in central-planning manipulated markets, the feedback that is the foundation of open markets has been suppressed.

Feedback is another way of saying information from the real world is allowed to enter a transparent exchange. We know the exchange is no longer transparent, what with dark pools and high-frequency trading machines. We also know signals from the real economy are not the dominant market-moving forces.

What we know, but cannot say out loud lest the charade lose power, is that the Fed is manipulating the stock market higher because it has lost the ability to manipulate the real economy. Our political and financial Elites would prefer to extend their neofeudal dominance by expanding the traditional foundations of debt-based “prosperity”: increasing household income so households can spend more and service more debt.

With household incomes for the bottom 90% in structural decline, they’ve failed, for reasons they either can’t understand or dare not discuss.

Their only control is the lever pushing stocks higher. Publicly, Fed chairman Bernanke has justified goosing the stock market and housing higher as the only available way to trigger the wealth effect, an inner state of consumerist bliss in which the owner of assets sees his assets gain in value. Feeling wealthier, he goes out and buys a bunch of junk he doesn’t need with debt, boosting demand and bank profits.

As for the fact his real income is declining–sorry, Bucko, we can only boost your assets and herd you into risky bets and more debt. The 90% of you with no meaningful exposure to the stock market–well, don’t you feel things are picking up when you see those “Dow hits new high” headlines? Of course you do; that’s the propaganda value of goosing markets higher.

When the causal connection between risk and consequence has been severed, we call it moral hazard. When banks get to keep their gambling profits and taxpayers cover the banks’ losses, this is moral hazard writ large.

In effect, the Fed is extending moral hazard to the entire stock and housing markets. What the Fed is implicitly promising is this: “Go ahead and sink your wealth and income into risky stocks and housing, because we have your back–we’ll never let stocks or housing go down again.”

Do we know if this campaign of extending moral hazard into every market is sustainable over the long term? No. It is an unprecedented experiment, just like the Krugman Cargo Cult Fantasy being played out by the authorities in Japan……”

Comments »“Previously, we have pointed out why Japan’s attempt at reincarnating its economy, geared solely at generating a stock market-based “wealth effect”, and far less focused on boosting the country’s trade surplus or current account, is doomed to failure, namely due the drastically lower equity participation by the general population and financial institutions in the country’s stock market. Sure, foreign investors will come and go renting each rally for a period of time, but unless the local population participates in the “reflation attempt” (which has already sent the price ofluxury goods, energy and food through the rood), or in other words change the behavioral patterns of two generations of Japanese in under two years, the inflationary shock will simply leads to a loss of faith in the government and ultimately Abe’s second untimely demise. Not surprisingly, 4 months after Japan set off on the most ludicrous economic experiment in history, and one week after the BOJ announced its plans to double its balance sheet, Abe’s approval rating has already begun sliding with a poll by Asahi just reporting that popular support of Abe’s cabinet is already down to 60%, down from 71% a month ago.

The reflationary reality has finally started to get official recognition with the very Goldman Sachs (who like in Europe and the US is behind this epic experiment in hidden taxation of consumers) asking how popular inflation would be in Japan, and answers:

Comments »How popular will inflation be in Japan?….”

“The super cycle in commodities has come to an end, according to researchers at Citi, who downgraded several mining stocks on Monday as metals prices have continued to decline since the start of the year….”

Comments »“Japan will be reminded of its pledge not to drive down the yen when Group of 20 finance chiefs meet this week for the first time since the world’s third- largest economy intensified its campaign to defeat deflation.

As G-20 finance ministers and central bankers prepare to convene this week in Washington, theU.S. Treasury is saying it will press Japan to refrain from competitive devaluation and European governments are urging it not to become too reliant on fiscal and monetary stimulus.

The yen has fallen against all 16 of its most-traded peers since April 4 when the Bank of Japan (8301) surprised investors by doubling monthly bond purchases and setting a two-year horizon for achieving its goal of 2 percent inflation. The salvo leaves foreign policy makers coupling praise for the effort to boost stagnant economic growth with concern it may come at the expense of their exporters if the yen keeps sliding.

“Yen moves have been too rapid for the U.S. to applaud Japan’s battle to end deflation,” said Yasuhide Yajima, chief economist at NLI Research Institute Ltd. in Tokyo, an affiliate of Nippon Life Insurance Co., Japan’s biggest life insurer. “Japan will have to show fiscal plans and means to strengthen growth to make it clear it’s not depending only on weakening the yen to revive the economy.”

The yen rose against all but one of 16 major counterparts today after a report showed Chinese growth unexpectedly slowed in the first quarter, fueling demand for haven assets. The Japanese currency added 0.2 percent to 98.22 per dollar as of 12 p.m. in Tokyo after earlier touching 97.63, the strongest since April 8…..”

Comments »Okay not bear market territory exactly, but it feels like it given recent price action.

“Brent crude fell to its lowest level in nine months and West Texas Intermediate dropped below $90 a barrel, as economic growth unexpectedly eased in China, the world’s second-largest crude consumer.

Brent declined as much as 2.2 percent to its weakest since July 13. China’s gross domestic product in the first quarter rose 7.7 percent from a year earlier, according to the National Bureau of Statistics. That compares with the 8 percent median forecast in a Bloomberg survey and 7.9 percent in the prior quarter. The World Bank cut its forecast for the nation’s economic growth. Nicolas Maduro was elected president of Venezuela, OPEC’s third-biggest oil producer.

“This simply confirms the picture of a slowing economy” inChina, said Guy Wolf, Global Head of Market Analytics at Marex Spectron Group in London, who predicts Brent may fall as low as $85 this quarter. “Globally, the picture is not healthy.”

Brent for May settlement, which expires today, fell as much as $2.28, or 2.2 percent, to $100.83 a barrel on the London- based ICE Futures Europe exchange, and traded at $101.04 at 9:42 a.m. local time. The more-active June future dropped $1.97 to $101.07 a barrel. The front-month European benchmark grade was at a premium of $11.88 to WTI futures.

WTI for May delivery decreased as much as $2.83, or 3.1 percent, to $88.46 in electronic trading on the New York Mercantile Exchange, the lowest since Dec. 24. It was at $89.13 a barrel at 9:46 a.m. London time. The volume of all futures traded was 237 percent above the 100-day average.

“Asset price correlations across a wide spectrum of industries and asset classes are meaningfully lower than the last few months. ConvergEx’s Nick Colas note that this is something completely unexpected: we’ve approached a “Normal” capital market over the last 30 days.

S&P 500 sector correlations are below 80% relative to the index, foreign stocks are 77-87% correlated to U.S. stocks, and even domestic high yield corporate bonds are 56% dancing to their own tune.

However, before we run off celebrating the return to a stock-picker’s market, it is worth noting one statistical point worth your time: when industry sector correlations have dropped below 80% from 2010 to the present…”

Comments »“The stock market is not crashing yet, but there are lots of other market crashes happening in the financial world right now. Just like we saw back in 2008, it is taking stocks a little bit of extra time to catch up with economic reality. But almost everywhere else you look, there are signs that a financial avalanche has begun. Bitcoins are crashing, gold and silver are plunging, the price of oil and the overall demand for energy continue to decline, markets all over Europe are collapsing and consumer confidence in the United States just had the biggest miss relative to expectations that has ever been recorded. In many ways, all of this is extremely reminiscent of 2008. Other than the Bitcoin collapse, almost everything else that is happening now also happened back then. So does that mean that a horrible stock market crash is coming as well? Without a doubt, one is coming at some point. The only question is whether it will be sooner or later. Meanwhile, there are a whole lot of other economic crashes that deserve out attention at the moment.

The following are 11 economic crashes that are happening RIGHT NOW…”

Comments »“Critics of sustained easy monetary policy in the United States often cite the potential for a surge in inflation down the road.

The real problem right now though, according to BofA Merrill Lynch economist Ethan Harris, is actually the opposite – disinflation (positive, but falling inflation rates).

“For central banks,” many of which have a 2 percent inflation target, says Harris, “this increases the pressure to maintain super-easy monetary policy.”

Most of the central banks across the developed world still aren’t generating enough inflation to hit their targets, even though many have pinned interest rates at or close to zero. The United States, Canada, the euro area, Sweden, Switzerland, Japan, and Norway all find themselves facing this issue (the U.K. and Australia are notable exceptions).

This struggle, says Harris, is behind the “shift to QE — a less predictable and more controversial policy tool.”

(In 2013, a flurry of speeches by Federal Reserve governors expressed concern over the continued trajectory of quantitative easing and what it means for financial stability.)

So, what’s behind the disinflation?

According to Harris, there are three major fundamental drivers of falling inflation rate….”

Comments »[youtube://http://www.youtube.com/watch?v=jYuTaxJC2Qs 450 300]

Comments »“Retail sales in the U.S. unexpectedly fell in March by the most in nine months as employment slowed, showing households ended the first quarter on softer footing.

The 0.4 percent decrease, the biggest since June, followed a 1 percent gain in February, Commerce Department figures showed today in Washington. The median forecast of 85 economists surveyed by Bloomberg called for an unchanged reading in March. Department stores and electronics dealers were among the weakest showings.

The figures may prompt economists, who are projecting consumer spending climbed in the first quarter at the fastest pace in two years, to reduce growth estimates. A pickup in hiring and bigger increases in wages will be needed to ensure any slowdown proves temporary as federal budget cuts restrain the world’s largest economy.

“Consumers are still on somewhat shaky ground,” Scott Anderson, chief economist at Bank of the West in San Francisco, said before the report. “We need more evidence that the spurt of activity seen early in the year is sustainable.”

Wholesale prices fell more than forecast in March as the cost of energy slumped by the most in three years, data from the Labor Department also showed today. The 0.6 percent drop in theproducer price index was the biggest since May and followed a 0.7 percent gain in the prior month….”

Comments »“(Reuters) – At least three Wall Street analysts this week have written reports about the possibility of the biggest banks breaking themselves up to boost profitability, signaling that investors may be more willing to embrace an idea that is still toxic to some lawmakers in Washington.

New regulations in areas like capital requirements are imposing higher costs on the biggestinvestment banks, raising doubts about their future profitability. These questions make the biggest global investment banks “un-investable,” wrote analyst Kian Abouhossein, who himself works atJPMorgan, one of the biggest global investment banks.

Breaking up large “universal banks,” could unlock value for shareholders, Wells Fargo analystMatthew Burnell wrote in a report on Wednesday. These “financial supermarkets” typically house investment banking, consumer banking and wealth management operations under one roof.

If these banks broke up into smaller companies, the value of the parts would likely be greater than the current whole, Burnell wrote. He estimated that universal banks currently trade at 25 to 30 percent below publicly traded financial firms that focus on just one business.

CLSA analyst Mike Mayo, a long-time critic of big banks, wrote on Tuesday: “Almost every investor that we speak with indicates that a breakup would be bullish for the stocks.” …”

Comments »“BRUSSELS—Europe is embarking on a new attempt to pull its banks out of the molasses of its debt crisis, hoping an aggressive cleanup of toxic assets will get banks to lend again and kick-start its flailing economies.

The push is being led by several key officials in Brussels and Frankfurt, who want to see a new round of much-tougher stress tests before the European Central Bank becomes the euro zone’s main banking policeman next year, according to four European officials familiar the talks.

They are backed by the continent’s richer countries, including Germany, the Netherlands and Finland, which don’t want to pick up the bill for weak lenders in their poorer neighbors.

The proponents of strict stress tests will launch their campaign at a meeting of European Union finance ministers in Dublin on Friday. That debate follows a first discussion of the exercise among senior national finance-ministry officials last week.

Efforts to rid banks of bad assets and then boost their capital buffers face formidable challenges: Previous stress tests have been watered down as national governments lacked the willingness and financial capacity to deal with the results. Even now, officials caution that key players—including the ECB and the European Commission, the EU’s executive—haven’t made up their minds on how intrusive they want the new stress tests to be.

But a group of key crisis managers believes cleaning up weak banks is the only way to get Europe’s economy to grow again, after superlow interest rates and large-scale liquidity injections from the ECB have failed to produce the desired results. These officials see continued doubts over the health of many lenders as the main reason banks are reluctant to lend to companies, especially in the continent’s weaker countries…..”

Comments »“NEW YORK (Reuters) – The Securities and Exchange Commission told five big Wall Street banks last year to improve disclosures about structured notes that are mostly sold to retail investors, and criticized use of the term “principal protected” in marketing materials.

The SEC sent letters to JPMorgan Chase & Co , Bank of America Corp , Citigroup Inc , Goldman Sachs Group Inc and Morgan Stanley on April 12, 2012, with 14 comments about their marketing, pricing and distribution practices for structured notes that the banks issued from April 2009 through March 2012.

SEC staff said that using the term “principal protected” for structured notes should also come with disclosures about risk.

The correspondence between the banks and the SEC were released this week.

Structured notes are unsecured bonds that are paired with derivatives, which guarantee the return of an initial investment, as well as some portion of any profits that come from the derivatives trade. However, the investments are not entirely risk-free: repayment of the bond is based on the credit-worthiness of the note issuer.

For instance, when Lehman Brothers filed for bankruptcy, holders of its “100 percent principal-protected notes” were treated like other unsecured creditors. UBS AG , which sold those notes to its brokerage clients, lost a series of related arbitration cases before the Financial Industry Regulatory Authority.

“Note titles using the term ‘principal protected’ should also include balanced information about limitations to the principal protection feature,” the SEC said, adding that issuers should “clearly describe the product in a balanced manner and avoid titles that stress positive features without also identifying limiting or negative features.”

In responses to the SEC, all five banks said they do not currently use the term “principal protected” and will continue to review titles of structured notes to ensure they reflect risks as well as positive attributes….”

Comments »“As most of us can remember that Iceland was the first country that went down during the last Global Financial Crisis in 2008. During that time Iceland had done something remarkable and that is during the five years prior to the crisis, managed to transform its economy from a fishing industry to a mega hedge fund country. Many of its citizens left their traditional trade which is fishing to become fund managers and salesman. As a result Iceland’s banking assets (physical assets + Loans + Reserves + Investment securities) grown to more than 10x its GDP of $14 billion. With such high leverage, when the financial crisis struck it is unable to defend its economy and hence its house of cards collapsed.

The purpose of this article is a post-event analysis of the performance of the Icelandic economy that refuses a bailout as compared to Greece which went for a bailout with the injection of funds from Troika. To simplify matters, we shall coin the bail-in and bail-out as (BIBO)for short. Of course in the short term it helped stabilized the Greek economy for a while but we want to know to what extent it had transformed the Greek economy in the long run with the accompanying terms and conditions and austerity measures. In this article we shall compare the performance of both the economies of Iceland and Greece with the economic indicators or metrics below from the year 2002 to the present. We believed we have been fed with too much toxics by the mainstream medias which are also own by them that capitalized on the age old investment axiom of good-to-good.

Does Government do what’s right for us?

We have led to believed or should we say brought up with the perception that when someone does well then he/she will be blessed in return. Hence it gave rise to an old age investment axiom of good-to-good and bad-to-bad reaction which can be translate to good action leads to good reaction. So we always believed that whatever our Government does it will be for the better of us. So when they bailed out the banks, we believed that they are doing the right thing and we should leave everything in their good hands and expect good reaction. Right? WRONG ! We shall show you on our analysis below that whatever our Government does is not necessary the right thing to do. We have based our analysis on the following indicators or metrics.

The following is a review of the Icelandic economy which not only refuses a bailout of its banks but instead bankrupting them. They are taking a big risk to take things into their own hands instead of letting the bankers running their country. They are going off the beaten path and from our analysis we reckoned that they have done the right thing. Below we compare the economies of two different countries that have taken different paths – one that receive bailouts (Greece) and the other (Iceland) refuses bailouts. The first metric we are using is the GDP per Capita.

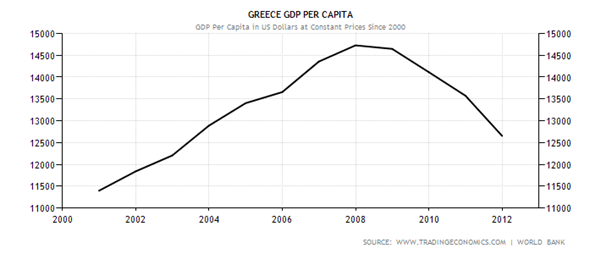

The first metric that we are going to compare is the GDP/Capita ratio. GDP/Capita also shows the standard of living of a particular country and a higher ratio normally denotes a higher standard of living. As you can see from the charts 1a & 1b below Greece seems still to be on the plunging mode and somehow there seems to be no slowing down in sight and hence a floor has yet to be set. Whereas Iceland seem to be going on a firmer footing when its GDP/Capita ratio seems to be stabilizing around 2011 and it seems to be on the uptrend. Iceland’s current (2012) ratio seems to be heading back towards the 2006 level whereas Greece’s is heading backwards to the 2003 level.

Chart 1a & 1b (GDP Per Capita)

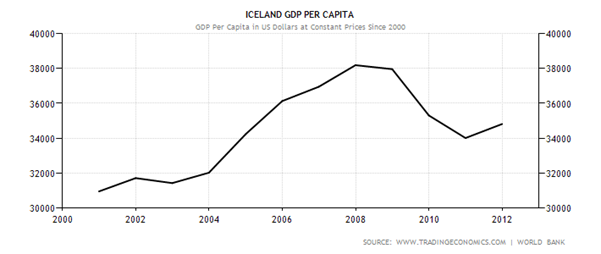

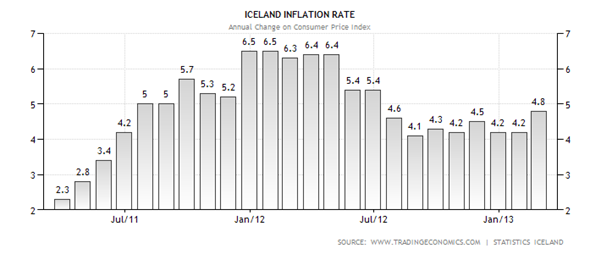

The second metric is the Inflation rate. From Chart 2a below it seems like Greece’s might be facing the risk of a deflationary spiral as happened to Japan in the 1990s. Its inflation rate has fallen from 4.5% in April 2011 to 0.1% in February 2013. Once the economy sets it path on a deflationary mode it is very difficult to reflate it back to the preferred long term inflation rate of 1-2 % above zero. Japan will be a good example when its economy was gripped by the deflationary forces since the 1990s, eventually it ended with 2 lost decades of growth. Only recently newly elected Prime Minister Mr Shinzo Abe is committed to reflate Japan’s economy at any cost. On the other hand Iceland’s inflation rate is now at 4.8% which is hovering around the mean of (4.7%) for the past three years and considered to be manageable and essential for economic growth.

Chart 2a & 2b (Inflation Rate)

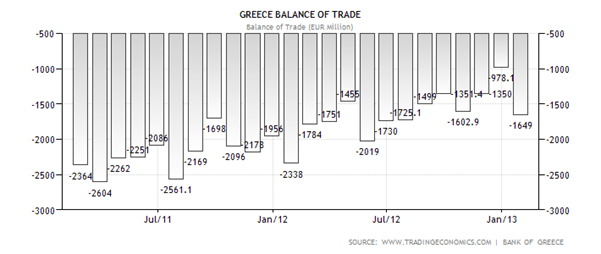

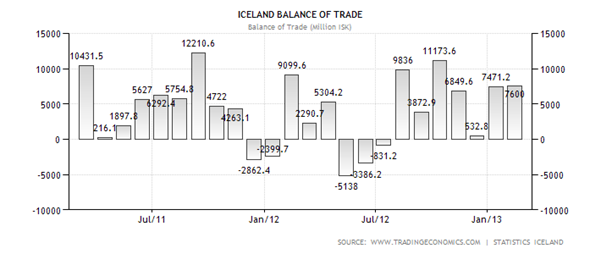

The third metric is the Balance of Trade which is also can be defined as difference between the exports and imports in monetary terms. From Chart 3a it is very obvious that Greece has been running trade deficits for the past 24 months consecutively. Negative trade deficits means there is a net outflow of money from Greece. This means that Greece may need to borrow more in future in order to finance its government expenditure and hence will incur more debts in its coffer. As for Iceland it is a different story where out of the 24 months 19 of them are experiencing positive balance of trade. Positive balance of trade means positive net inflow of funds and hence it enable the Icelandic government either quicken their repayment of debts or embark on new government fiscal expenditures without resorting to more borrowing.

Chart 3a & 3b (Balance of Trade)

Next is the Government Debt/GDP ratio or the total amount a country has as in percentage of its GDP. It seems that Greece’s Debt/GDP ratio is currently way above 100% and as of end of 2012 it at 161.6%. A high Debt/GDP means more funds are needed for interest payments and hence less will be available for development. We will foresee this trend will extend much further into the future because 1) its ratio is still considered dangerously high and 2) many of its economic indicators are still recording negative readings and hence may dampen its ability to quicken its repayment schedule….”

Comments »