“The political class set in motion the eventual obliteration of our economic system with the creation of the Federal Reserve in 1913. Placing the fate of the American people in the hands of a powerful cabal of unaccountable greedy wealthy elitist bankers was destined to lead to poverty for the many, riches for the connected crony capitalists, debasement of the currency, endless war, and ultimately the decline and fall of an empire. Ernest Hemingway’s quote from The Sun Also Rises captures the path of our country perfectly:

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.”

The 100 year downward spiral began gradually but has picked up steam in the last sixteen years, as the exponential growth model, built upon ever increasing levels of debt and an ever increasing supply of cheap oil, has proven to be unsustainable and unstable. Those in power are frantically using every tool at their disposal to convince Boobus Americanus they have everything under control and the system is operating normally. The psychotic central bankers, “bought and sold” political class, mega-corporation soulless chief executives and corporate controlled media use propaganda techniques, paid “experts”, talking head “personalities”, captured think tanks, and the willful ignorance of the majority to spin an increasingly dire economic descent as if we are recovering and getting back to normal. Nothing could be further from the truth.

There is nothing normal about what Ben Bernanke and the Federal government have done over the last five years and continue to do today. Truthfully, nothing has been normal since the mid-1990s when Alan Greenspan spoke the last truthful words of his lifetime:

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

The Greenspan led Federal Reserve created two epic bubbles in the space of six years which burst and have done irreparable harm to the net worth of the middle class. Rather than learn the lesson of how much damage to the lives of average Americans has been caused by creating cheap easy money out of thin air, our Ivy League self-proclaimed expert on the Great Depression, Ben Bernanke, has ramped up the cheap easy money machine to hyper-speed. There is nothing normal about the path this man has chosen. His strategy has revealed the true nature of the Federal Reserve and their purpose – to protect and enrich the financial elites that manipulate this country for their own purposes.

Despite the mistruths spoken by Bernanke and his cadre of banker coconspirators, he can never reverse what he has done. The country will not return to normalcy in our lifetimes. Bernanke is conducting a mad experiment and we are the rats in his maze. His only hope is to retire before it blows up in his face. Just as Greenspan inflated the housing bubble and exited stage left, Bernanke is inflating a debt bubble, stock bubble, bond bubble and attempting to re-inflate the housing bubble just in time for another Ivy League Keynesian academic, Janet Yellen, to step into the banker’s box. This genius thinks Bernanke has been too tight with monetary policy. It seems inflated egos are common among Ivy League economist central bankers who think they can pull levers and push buttons to control the economy. Results may vary.

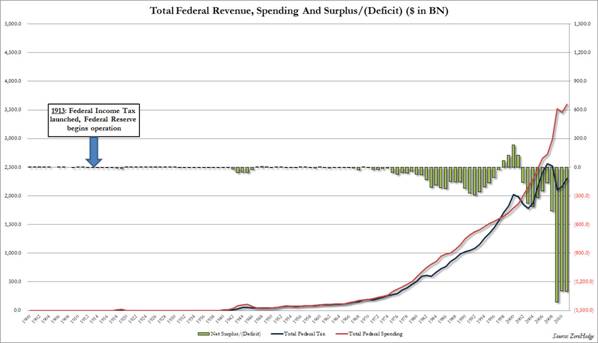

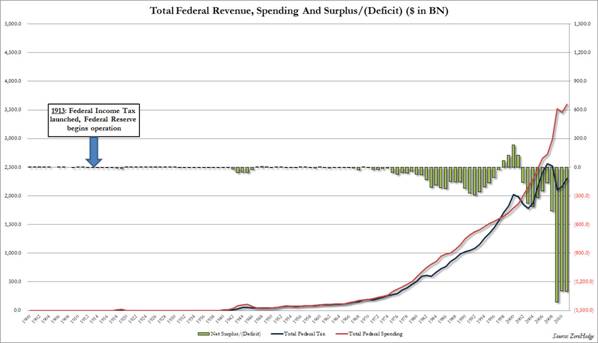

The gradual slide towards our national bankruptcy of wealth, spirit, freedom, self-respect, morality, personal responsibility, and common sense began in 1913 with the secretive creation of the Federal Reserve and the imposition of a personal income tax. Pandora’s Box was opened in this fateful year and the horrors of currency debasement and ever increasing taxation were thrust upon the American people by a small but powerful cadre of unscrupulous financial elite and the corrupt politicians that do their bidding in Washington D.C. The powerful men who thrust these evils upon our country set in motion a chain of events and actions that will undoubtedly result in the fall of the great American Empire, just as previous empires have fallen due to the corruption of its leaders and depravity of its people. Creating a private central bank, controlled by the Wall Street cabal, and allowing the government to syphon the earnings of workers through increased taxation has allowed politicians the ability to spend, borrow, and print money at an ever increasing rate in order to get themselves re-elected and benefit the cronies, hucksters and bankers that pay the biggest bribes. None of this benefit the average American, who sees their purchasing power systematically inflated and taxed away. This is not capitalism and it is not a coincidence that war and inflation have been the hallmarks of the last century.

“A system of capitalism presumes sound money, not fiat money manipulated by a central bank. Capitalism cherishes voluntary contracts and interest rates that are determined by savings, not credit creation by a central bank. It is no coincidence that the century of total war coincided with the century of central banking.” – Ron Paul

As you can see, the bankruptcy of our country and our culture began gradually, accelerated after Nixon closed the gold window in 1971, really picked up steam in 1980 when the debt happy Baby Boom generation came of age, and has “suddenly” reached maximum velocity as we approach the true fiscal cliff. There were many checkpoints along the way where fatefully bad choices were made. They include the New Deal, Cold War, Great Society, Morning in America, Dotcom New Paradigm, Housing Wealth Retirement Plan, Obamacare, and present belief that creating more debt will solve a problem created by too much debt. The Federal Reserve allowed interventionist politicians to fight two declared wars (World War I, World War II), fight five undeclared wars (Korea, Vietnam, Gulf, Afghanistan, Iraq), conduct hundreds of military engagements around the globe, occupy foreign countries, begin a war on poverty that increased poverty, begin a war on drugs that increased the amount of available drugs, and finally start a war on terror that has increased the number of terrorists and pushed us closer to national bankruptcy. The terrorists have already won, as the explosion of stupidity and irrational fear has allowed those in power to acquire more power and dominion over our lives.

Abnormality Reigns…”

Full article

Comments »