Time to face the music. Let’s hope we do not suffer a completely frozen banking system….

Comments »Monthly Archives: September 2011

Goldman’s Full Outlook Through 2012

Nikkei Steps Into a Murder Hole

Nikkei down a little over 2% for this week’s opening trade,

Spot gold trades higher, but pares gains quickly,

Euro weak out of the gate,

U.S. dollar up against most currencies except for the Yen

Brent and NYMEX crude down 1%+

U.S. futures off by 1% on Greek debt fears

Comments »China Puts on African Masks

Africa’s New Friend China Financing $9.3 Billion of Dams for Hydropower

When completed in 2013, Gibe III on Ethiopia’s Omo River will beAfrica’s tallest dam, a $2.2 billion project that conservationists say will deprive birds and hippos of vital habitat.

Some 600 miles (965 kilometers) to the north, Sudan is preparing to build the $705 million Kajbar dam on the Nile, which would inundate historic towns and tombs of the Nubian people, descendants of the pharaohs of ancient Egypt. The $729 million Bui project on the Black Volta River, to be finished in 2013, will boost Ghana’s hydropower capacity by a third — and flood a quarter of Bui National Park while displacing 2,600 people.

What these megaprojects have in common is Chinese money and know-how. Companies such as Sinohydro Corp. and Dongfang Electric Corp. are key players in their construction, and they’re financed by Chinese banks with support from the government in Beijing, Bloomberg Businessweek reports in its Sept. 12 issue.

The country’s engineering and manufacturing giants have recently completed or are participating in at least $9.3 billion of hydropower projects in Zambia, Gabon, the Democratic Republic of Congo, and elsewhere on the continent, according to data compiled by Bloomberg and International Rivers, a Berkeley, California-based environmental group.

A similar, if smaller, push is happening in newer renewable technologies. Chinese enterprises are now the top investors in African solar power,and China’s government in June earmarked $100 million for solar projects in 40 African nations.

Street Lights, Refugee Camps

Chinese photovoltaic panels already power street lights in Sudan, sit atop schools and hospitals elsewhere and can be found in United Nations-supported refugee camps in the Sahara.

“Renewable energy is merely the latest” facet of China’s move into Africa, says Martyn Davies, chief executive officer of Frontier Advisory, a consultant in Johannesburg working with Chinese companies on the continent. “The traditional actors — the Germans, the French, the Spanish — won’t be able to compete on price.”

Overall Sino-African trade reached $127 billion in 2010, up from $10 billion in 2000, Beijing’s commerce ministry reports. In 2009, China unseated the U.S. as Africa’s biggest trading partner, accounting for 14 percent of the continent’s total trade, according to the African Development Bank. The state- owned China Development Bank Corp. in 2007 established a $1 billion fund to finance Chinese enterprises in Africa and now plans to increase that to $5 billion.

Opens New Markets

China’s initiative in renewables will open up new markets for its growing green energy sector. Only Chinese panels will be used in solar projects the country backs, says Sun Guangbin, secretary-general of the China Chamber of Commerce for Import & Export of Machinery and Electronic Products.

“China needs new emerging markets to consume solar products,” Sun says.

China’s Suntech Power Holdings Co. is supplying panels for a 50-megawatt solar plant at Droogfontein, South Africa. China Longyuan Power Group last year said it would open wind farms in South Africa, and Hua Lien International Holding has established ethanol joint ventures in Benin, Sierra Leone, and Mozambique.

Sub-Saharan Africa, with some 800 million residents, generates about the same amount of power as Spain, population 46 million, according to the World Bank. The bank says that since 1995, Africa’s power sector has grown an average of 1 percent annually, or less than 1,000 megawatts a year, even though capacity needs to expand more than 10 percent a year to meet demand.

Few Strings Attached?

One attraction for African governments is that Chinese investment comes with few strings attached, researchers and conservationists say. China doesn’t tie its aid to human-rights progress, environmental issues, or democratic governance, as the U.S. and Europe do.

“Many African countries find that very acceptable,” says John Mitchell, an associate fellow at Chatham House, a foreign affairs research group in London.

Due to human-rights concerns, Sudan had trouble raising money for its $1.8 billion Merowe Dam until Chinese banks came up with funding, International Rivers says. The project was finished two years ago.

Chinese investment is helping Africa reach levels of dam- building not seen in years, bringing back memories of hydropower campaigns that conservationists deem a disaster.

‘Very Sobering’

“The social, environmental, and economic track record of large dam projects in Africa is very sobering,” says International Rivers Policy Director Peter Bosshard. While Chinese companies have improved their environmental record in the past few years, “there also continue to be big gaps,” Bosshard says.

Advocates say hydropower can help make up Africa’s chronic power deficit. Gibe III, for instance, will double Ethiopia’s power generation capacity. That, says Prime Minister Meles Zenawi, will be instrumental in fighting poverty in a country nicknamed “Africa’s water tower” for the rivers coursing out of its highlands.

Dams can help Ethiopia electrify remote villages, increase irrigation and earn money from electricity exports, Meles said at an Addis Ababa news conference in March.

“Hydropower,” he said, “will have to be at the center of Africa’s energy future.”

To contact the reporters on this story: Randall Hackley in Zurich at [email protected]Lauren van der Westhuizen in Cape Town at [email protected]

To contact the editor responsible for this story: Reed Landberg at [email protected]

Comments »

FLASH: Futures Open Lower

S&P futs are down 13 and oil is down a buck.

Comments »FLASH: American Airlines Flight 34, from LAX to JFK, Has Landed Safely

Three idiot passengers holed up in a bathroom caused a panic that resulted in fighter jets scrambling to monitor the flight. All is well now, as the plane landed safely at JFK.

Comments »ALERT: Fighter Jets Launched in Response to Security Scare on LAX to JFK Flight

Three passengers caused a scare on a flight from Los Angeles to John F. Kennedy airport when they refused to come out of a bathroom.

A security official initially said fighter jets had been launched. Another security official said later that they had been set to launch and it was not immediately known whether they were in the air.

The three passengers on American Airlines Flight 34 went into a bathroom and were “not compliant.”

The passengers are reportedly now back in their seats.

The flight is set to arrive at JFK at 4:25 p.m. Investigators are waiting for the plane to land.

New York City has been under heightened alert since intelligence was picked up overseas indicating a possible plot to coincide with the 10th anniversary of 9/11.

Source: NBC

Comments »All Eyes on Italy as Tuesday Bond Auction Looms

They will try to raise 18.5 billion Euros. Good luck.

Comments »QUAGMIRE: 77 U.S. troops Wounded in Attack on Afghan Base

Saturday Night Magic Trick

http://www.youtube.com/watch?feature=player_embedded&v=JpU2MeTZiLo

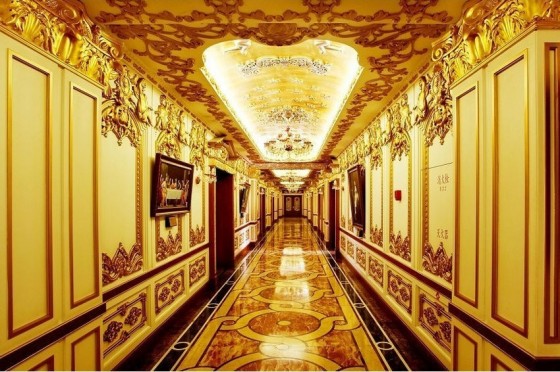

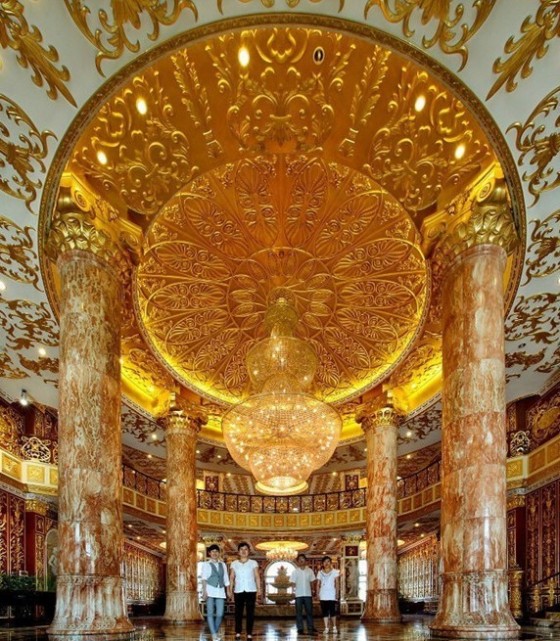

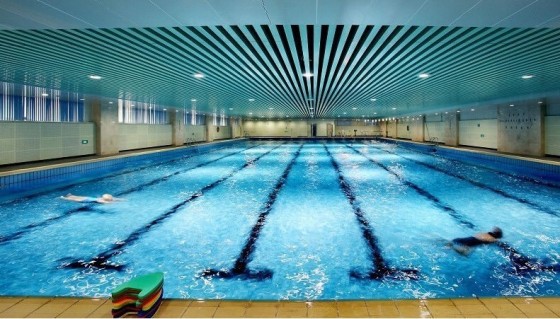

Comments »SHOCK PHOTOS: China Rubs Transfer of Wealth in America’s Face

If you had any doubt about The Fly’s recent post entitled, “The Decade that Destroyed the West,” check out these pics from the new headquarters for a state-owned pharma (Harbin Pharmaceuticals) company in China:

SOURCES:

- @thestalwart (Joe Weisenthal of TBI)

- This Website

A Message To Congress From David Bennett

Obama’s ‘Green Initiative’ Crown Jewel Goes Bust

BLUE BLAZER SPECIAL: Max Keiser Interviews KARL DENNINGER

Russia Calls on EU to Bail Out Bankrupt Nations

Apple and Feta Shit Pie

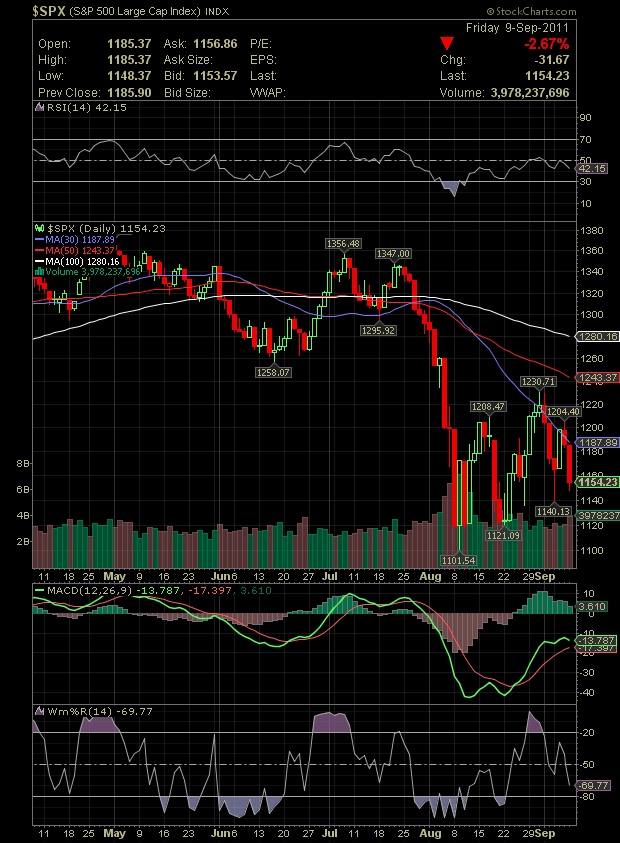

So the S&P failed again at the 30 day moving average yesterday. We briefly jumped to 1204, but fell back to close lower on the day. For the plebs sake I was hoping a better than expected initial claims would help us with some follow through trying to produce a 3rd higher high.

The 30 moving average now stands at 1187 and is dropping like a stone.

It would have been nice to see a close above 1161 today; not that it is a crucial level, but that it represents an average price from which one could have some hopes for a rally.

It would have been nice to see a close above 1161 today; not that it is a crucial level, but that it represents an average price from which one could have some hopes for a rally.

The only thing the bulls have going for them is that the volume was not explosive to the downside today and that we did not close on the absolute lows of the day.

At any rate, this market is beyond technical analysis for the moment. I believe this to be the case as we can not know how good or bad it gets across the pond.

IMO Greece will have to default very soon. Today’s bond auction for Greece was pitiful. They only raised $3-$4 billion of the $9+ billion needed for short term paper. I do not have to discuss yields with you as you know they have blown out to insane levels.

Of course the Greek finance minster came out to reassure the market place that there would be not immediate default, but if the clam can lie and tell us things are contained, that the mortgage problem will not spread to the broader economy then I’m sure some feta cheese eating minister can tell us that everything is a okay.

Interbank lending in Europe has all but halted to a crawl. Expect a frozen market shortly.

All in all debt problems can not be solved with more debt. Especially in a region where there are no real printing presses for currency; such as we have here with the clam and criminal company.

Even if some miracle occurs for Greece we still have many PIIGS to worry about.

Expect a major down draft soon. Keep the powder dry as we should have a great buying opportunity coming up in the next two weeks of trade.

Also remember that this is now a trading environment. Your on the other side of the mountain. It shall remain so for perhaps a few years imo.

This is due to the weak consumer getting weaker, a tragedy called government, and the PIIGS problem is not going to go away for at least 2 years.

GLT

Hey Greece Manamana….

[youtube:http://www.youtube.com/watch?v=ntNju2D4dIU 450 300] [youtube:http://www.youtube.com/watch?v=9Mjp8ox59WE 450 300]

Comments »

SHOCK PHOTO: ATTACKERS ON ISRAEL EMBASSY IN EGYPT BURN FLAG

_________________

Update: Egypt in state of alert, not emergency, after attack on Israel embassy in Cairo – Reuters

BreakingNews.com

Comments »

A New Lower Manhattan a Decade After 9/11

Photo Credit: Joe Woolhead; Courtesy Silverstein Properties

Revitalization seemed almost inconceivable at the time the grey powdery ash was floating through the air, thick with the smell of acrid smoke still rising from the rubble. It made your eyes sting for months..In less than two hours on the morning of Sept. 11, 2001, Lower Manhattan, the world’s financial district and bustling home to hundreds of thousands of workers each day, was transformed into a ghost town.

Hundreds of companies doing business in the neighborhood were forced out by the terrorist attacks that felled the twin World Trade Center towers and hundreds more left on their own in the aftermath.

Comments »Sarah Palin Speaks Truth to Power

FLASH: STOCKS GET EUROTRASHED

Dow Jones 10,992.13 -303.68 (-2.69%) S&P 500 1,154.23 -31.67 (-2.67%) Nasdaq 2,467.99 -61.15 (-2.42%)Comments »