The homosexuals in Brussels and DC said Ukraine is to join NATO. This is quite literally the fever at the decision centers of the west.

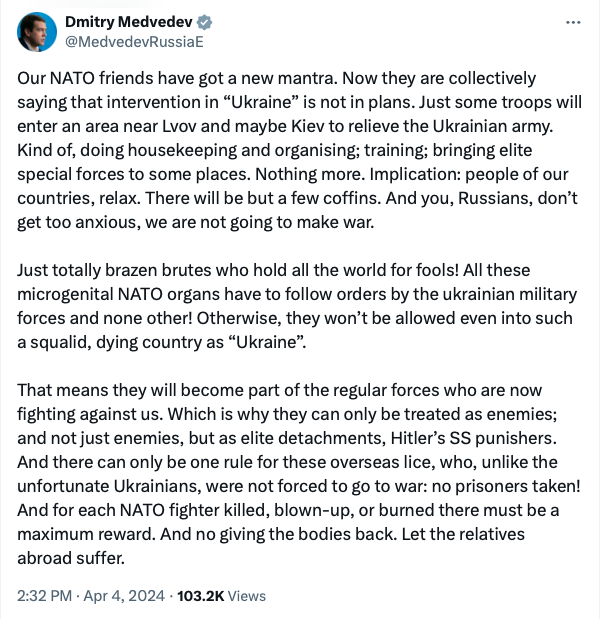

And this is the Russian response.

Due to the incompetence of our leaders, endless Ukrainians have been killed in a war against Russia and now with their army teetering on collapse, western leaders are bluffing with provocations to enter the war against Russia. The only problem with this idea, frankly, is that the west is entirely gay now and without industrial heft to produce enough weapons to fight. The left are the one’s most ardently in support of war vs Russia because they’ve been brain-fucked by their masters and would inject their 1 week old babies with highly toxic vaccines if told to do so. For the most part, the left are a worthless cadre of post modernism, caricatures of how a people turn from great to garbage in a generation thanks to success.

A great man once said “Success has defeated you.”

If there is a war against Russia, the west will lose it. Perhaps this is what the west needs to demonstrate to its people that those in control of every decision aren’t all knowing evil geniuses, but in fact incompetent dysgenic spiteful monsters in need of justice.

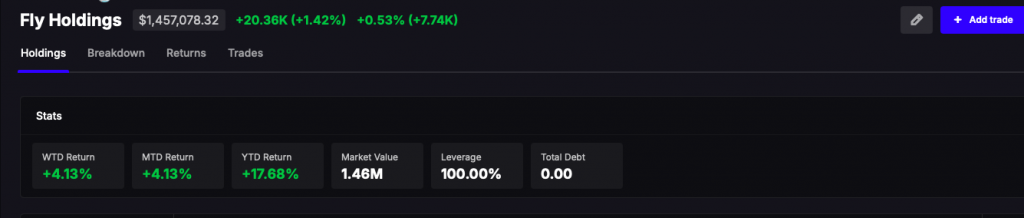

Oil is up, gold is bid, the Dow is down 400 counting into the bell, red heifers readying for slaughter.

Comments »