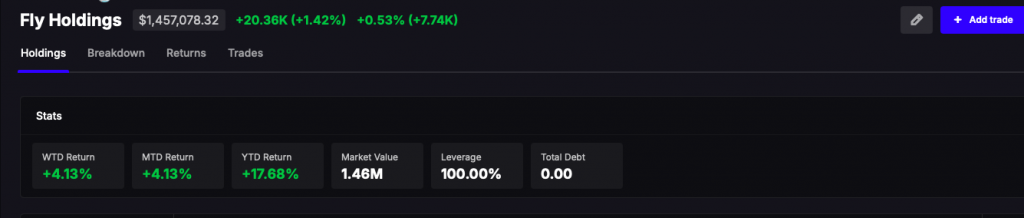

I won’t draw this out into an elaborate missive about my feelings and what I believe to be happening. I was very long into the open, sold it all into 10am. I flipped to net short in the afternoon after viewing the tape. I made several long attempts and got fucked every single time. I closed out my losers, kept my shorts, comprising of 18% of my book in LEVERAGED ETFs — and closed the day +49bps. At around 3:30pm I was talking extreme shit IRL, telling friends and family not to address me informally and how to speak to me was in fact an honor and a privilege. At that time I was up 1%.

I gave half my gains back into the close, mostly due to this fucking $ZPTA, some Mexican AI, an oxymoron if I’ve ever seen one. NEVERTHELESS, I remain, inexorably, at RECOURD highs, in spite of all of the tumult and grift and misdirection. It’s important that you understand that I am the very best trader alive. You will never meet someone better. Although you will try to best me and believe yourselves to be the main characters of the simulation, I in fact am him and you attempting to fade me only serves to injure you.

Do not harm yourselves by way of idiotic gambits.

The macro is all very convoluted and the wars to come aren’t truly understood. For all we know, war with Iran might bid stocks higher, since we’re all so very comfortable across the Atlantic, safe from missiles and capital ships. Although I have my hardened biases, which are mostly nationalistic, peaceful, and filled with ideas of building a nation of content people producing things for the betterment of society, I am keenly aware that those things are racist now and to hold many of you to high standards would, in fact, impose my white culture onto you — a horrible predicament to be in — especially when considering your forefathers rampaged the jungles of African in search of gold hidden inside the heads of albinos — riding heavily throughout the unpaved roads with wheels made of triangles.

Comments »