I just got back from driving for two hours and talking and talking and talking and debating and debating and I feel like my fucking head is going to explode.

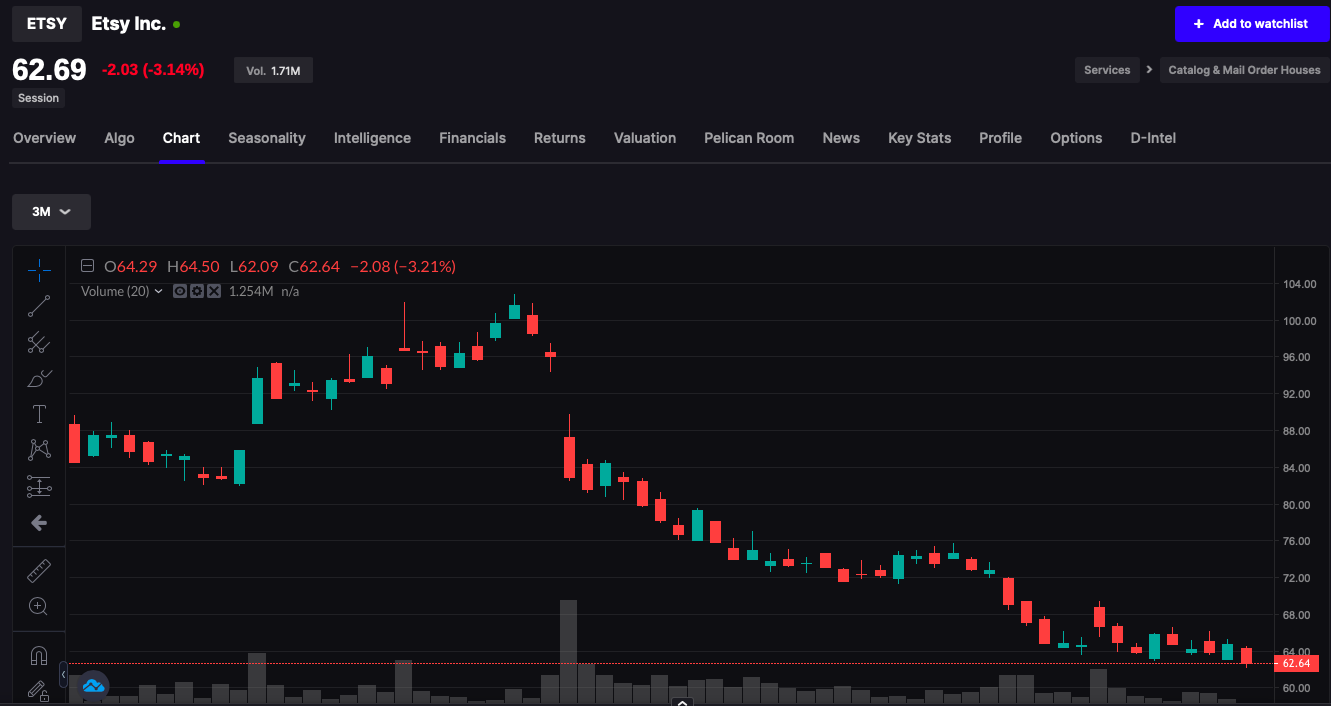

I bowed out from trading the last 2-3hrs of the day, closing up just 36bps — down from the session highs of +130bps. Make that two days in a row when I rather enjoyed good returns only to give them back in lackluster and abject stupid into the close.

HENCEFORTH: I will sell all of my stocks after achieving +1% gains, until this market improves. It should be noted, there is further upside ahead — into the terminal death of the entire economy. I am hedged, so my beta is low and my balls are small. I wanted to be brave — but I had to drive for 2 to 3 fucking hours to talk and babble about utter fucking nonsense.

Comments »