I want to believe in the fairy tale — the good guys on Wall Street winning for America — making stocks go up not because they’re rigging it but because Americans deserved it. I miss the days when we’d play sticked ball and hit homeruns into the windows and into the living rooms of the people who were unfortunate enough to get in our way. But I’m taking a look at this tape and do not like what I see.

Maybe it’ll clear up tomorrow and we can all but happy and sashay about the office in linens. But as of right now, I want zero bid trading.

Here’s what I hate about today.

Rates are lower — but no one gives a shit.

WTI is down 5.3%, behaving as if the world entered a depression.

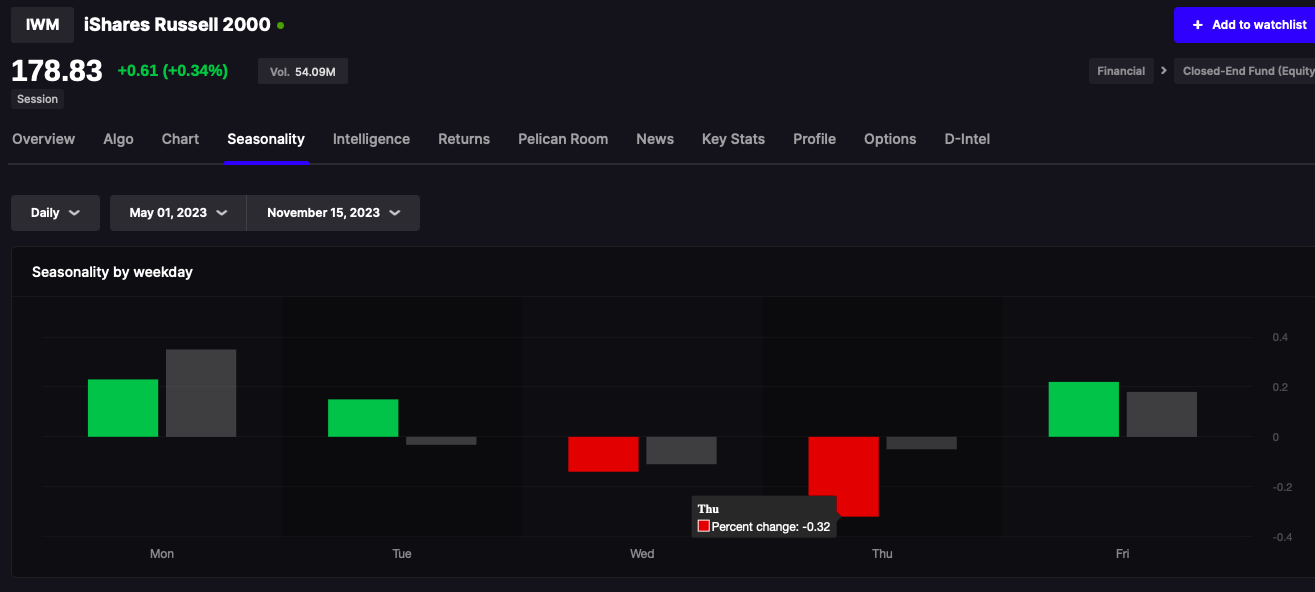

The homosexuals have kept the NASDAQ flat — but the plebeian class suffer immensely in the Russell down 1.7%

Names on the chopping block include:

$CSCO -11%, $PANW -6%,$PLCE -27% on news everyone is gay and there’s no need for children’s clothes, $ABR -12%, $IEP -12%, $BABA -9%, $WMT -8% and on and one.

I can keep going you fucks. It’s fucking over.

It’s important to remember, when seeing pain and suffering amongst the third estate, the catamite elite are still doing quite well and shares of $AAPL, $AMZN, and $GOOGL are strong. The trade is simple and as follows:

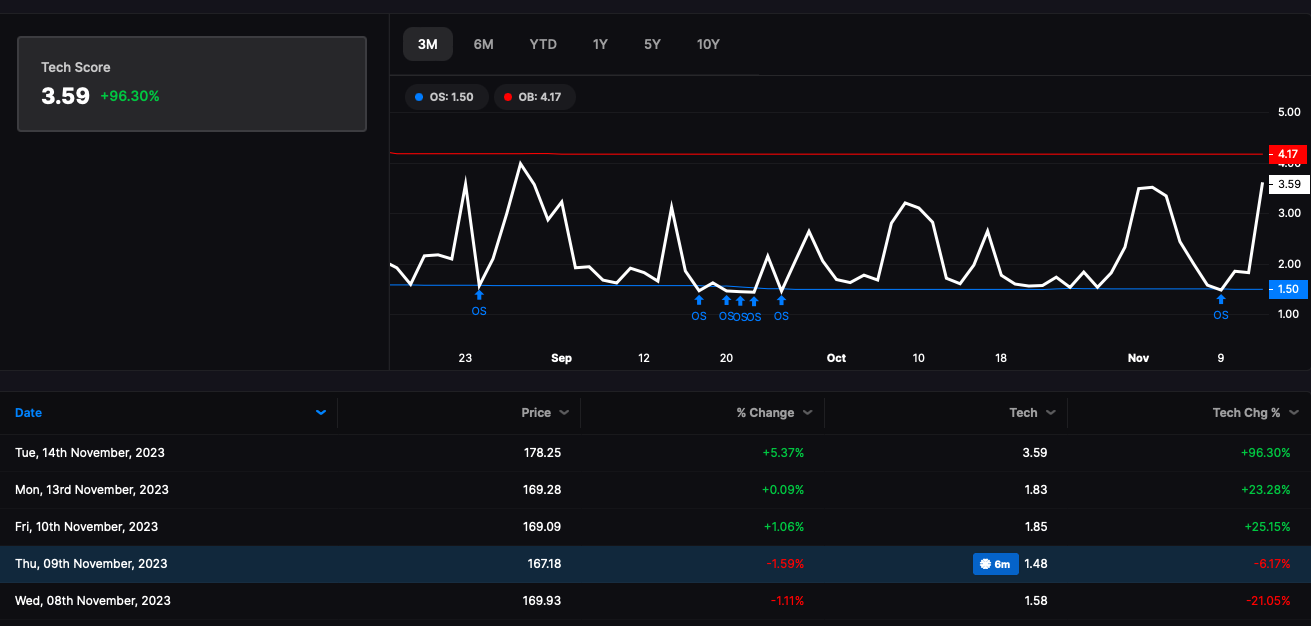

SHORT THE FUCKING RUSSELL INTO THE GROUND, hedge that with longs in the catamite tera cap techs, and possess cash in excess of 50%. For sport, even though it’s likely to lose me money, I am long some $UVIX here — as I hope the bears start eating the bulls like Pacman into the final hours providing a spike in fear and panic on Wall Street.

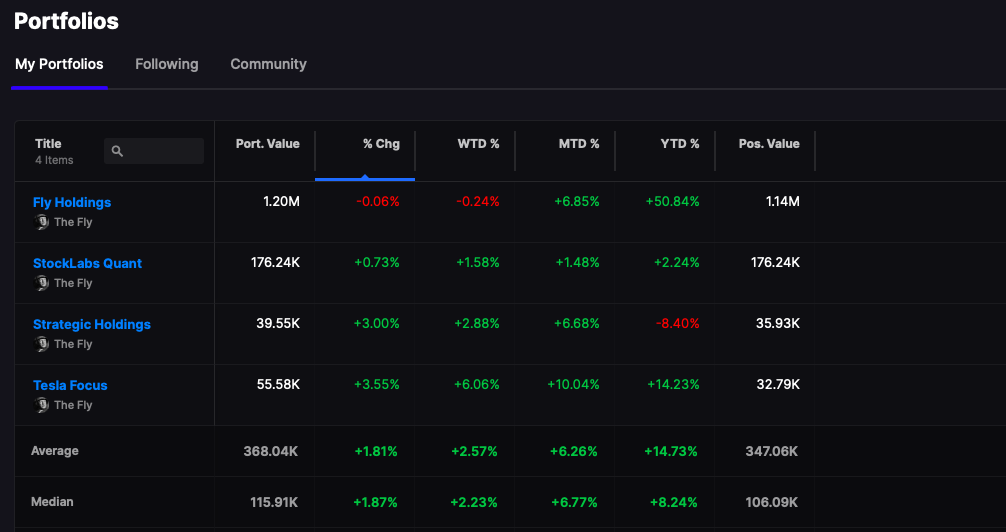

Thus far, my forays into the market have resulted in a loss of 113bps.

Comments »