In Stocklabs I compile valuation data going way back. I don’t need to examine stocks like $NVDA to show you how overvalued it is. We already know that — just like we knew $AMZN was overvalued in 2003, 10,000% ago. But what about the overall market?

Let’s examine the data.

A look a gross margins, so we get an idea about how profitable companies are now compared to the past.

2023: 48%

2020: 49%

2016: 46%

2012: 43%

2008: 42%

1993: 37%

Computers and technology have consistently increases corporate profits over time. Based on 2023 data, margin have really never been better.

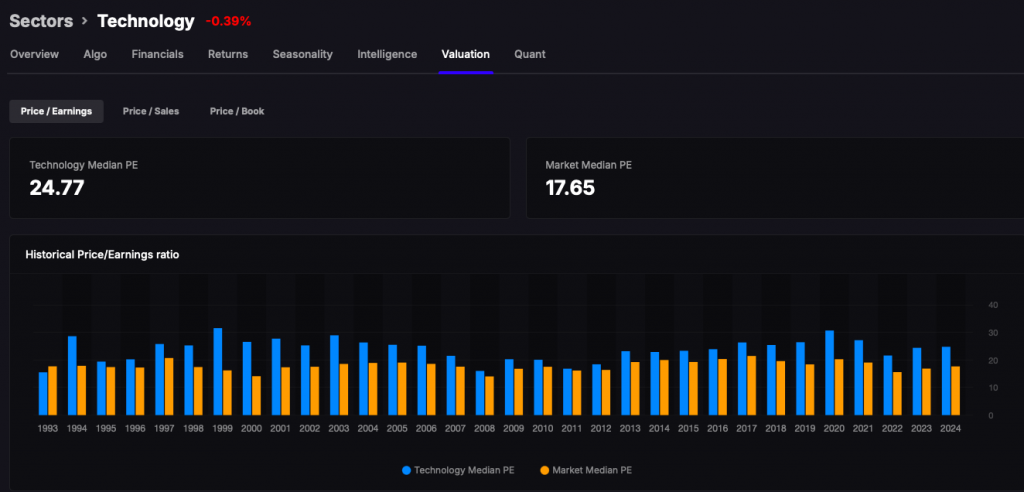

Now let’s look at price to earnings for the tech sector.

Median PE/% above overall market median PE:

2024: 24.7x / +40.3%

2020: 30.6x/ +51.3%

2016: 23.9x/ +17.5%

2012: 18.4x/ +12.4%

2008: 16x/ +14.2%

1993: 15.5x/ -12.2%

How about that data!Tech is so profoundly dominant in the market is now sports a 40% premium to all other stocks in the $SPY. You can see how this progressed higher over time and what about 1993 being a 12% discount to the overall market? This is before the internet revolution and all of the hype that came with it.

Price to sales/% above overall market median PS:

2024: 2.33x/ +14%

2020: 3.69x/ +52.5%

2016: 2.12x/ +4.4%

2012: 1.57x/ +0.45%

2008: 1.36x/ +12.7%

1993: 1.03x/ -7.3%

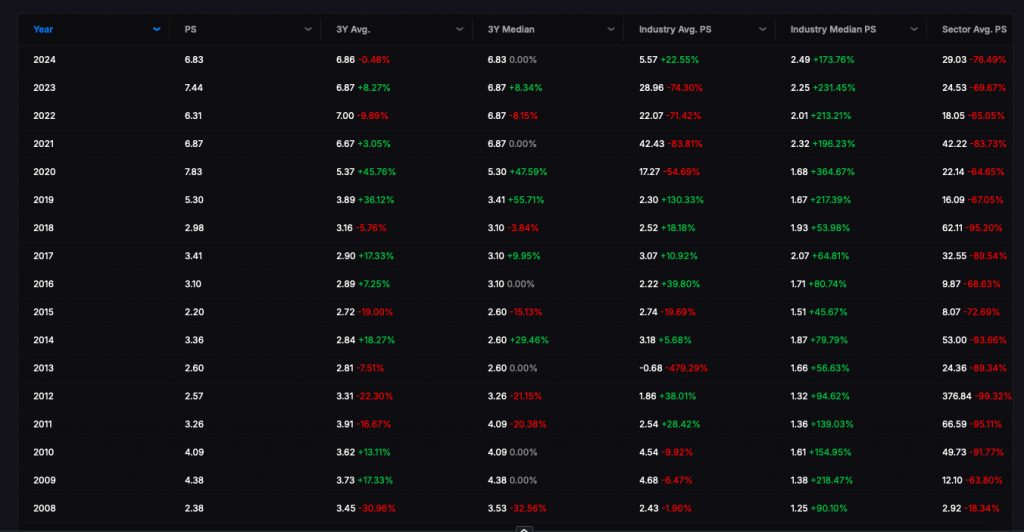

Here is the PS table on $AAPL

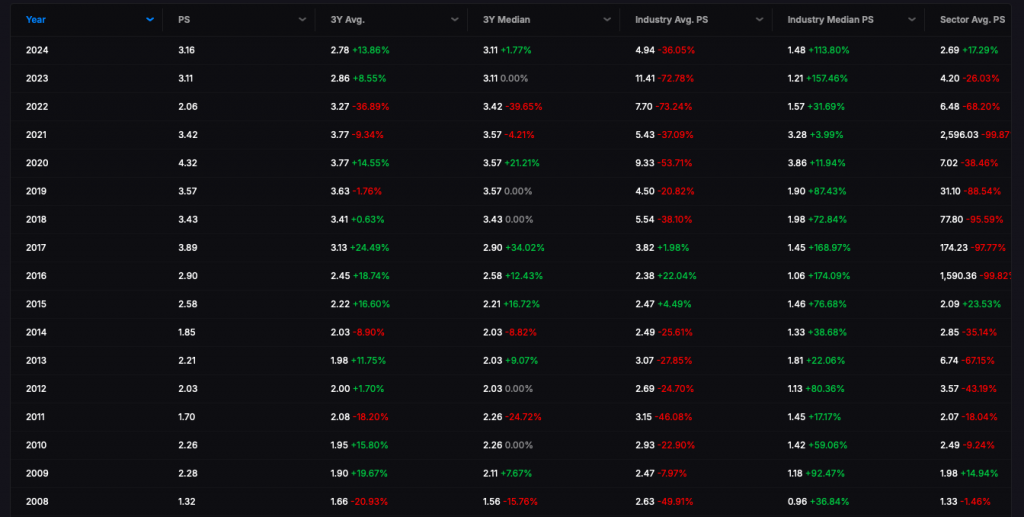

$MSFT

$AMZN

The most undervalued part of the market?

I have a tool that measures the future price to sales or earnings ratios against a 3 year average to produce price targets. To filter out bullshit, I will only include stocks with market caps above $5b. Here is the upside from current valuations, based on next years sales estimates, per sector.

TECH: +0.6%

BASIC MATERIAL: +5.1%

CONSUMER GOODS: -1.9%

FINANCIALS: -3.7%

HEALTHCARE: -3.2%

INDUSTRIALS: -8.8%

SERVICES: -2.6%

UTILITIES -3.1%

Within basic materials, here are the industries with most upside, based off a median 3yr price to sales valuation metric.

Alt Energy: +47%

Ag Chems: +16.9%

Major Oil: +13.2%

Independent Oil +12.2%

Now for tech.

Solar: +28.7%

Chinese stocks: +25%

Semi memory: +18%

Semi equipment: +16%

Data storage: +15%