Your bets were driven south today, as markets bargained with the idea of a once beautiful nation rotting away, withering into the easterly winds. As time carries on, all of the successes achieved by previous generations are slowly but surely cracked asunder — deficits to the moon, national debt heaving over and unable to sustain any semblance of normalcy.

Ladies and Gentlemen, we are in the opening salvo of societal collapse. You can see it everywhere, every single facet of Americana — from our borders to our cities to our schools and even our military. To say that it’s over is a gross understatement. It has been over for some time now and we’re simply running out the clock now. But as we sink lower into the crevasse of ruin, we lash out with anger and malice, exaggerate our might through words and gestures — attempting to conceal the hallow interior that we all know exists due to negligence and grotesque corruption.

All of the problems in America could be fixed, if only we had patriots who worked for the glory of America led her. Sadly, this isn’t the case now and will not be the case tomorrow — as we are prisoners to foreign interests, foreign wars — captive to internal deterioration thanks to the weakest leadership in American history.

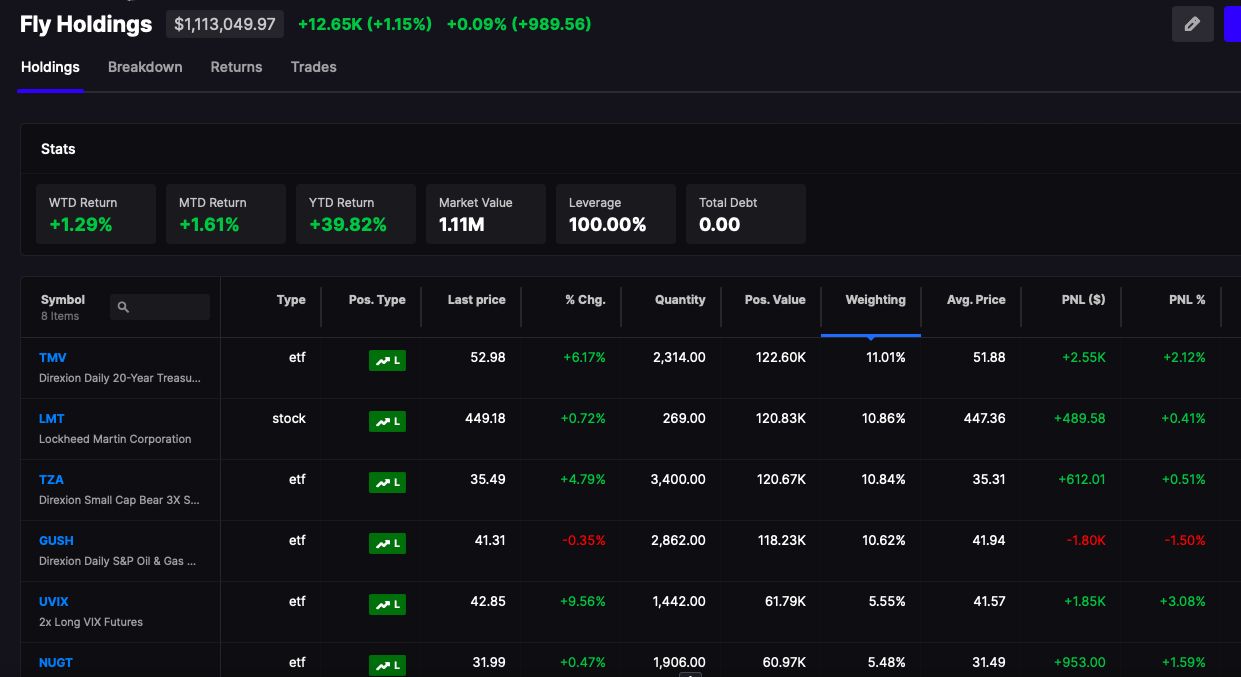

As for markets — we cascaded into the close amidst aggressive selling — older hedge fund managers drinking themselves into oblivion — tipping over and out of windows — free falling directly to hell. I closed +121bps for the week, now presiding over gains of 1.5% for October. I am positioned into Monday accordingly: short the NASDAQ, short bonds, long volatility, long gold, long oil, and long Bitcoin — which has once again proven to be incredibly defensive in a market wrought with perils.

Comments »