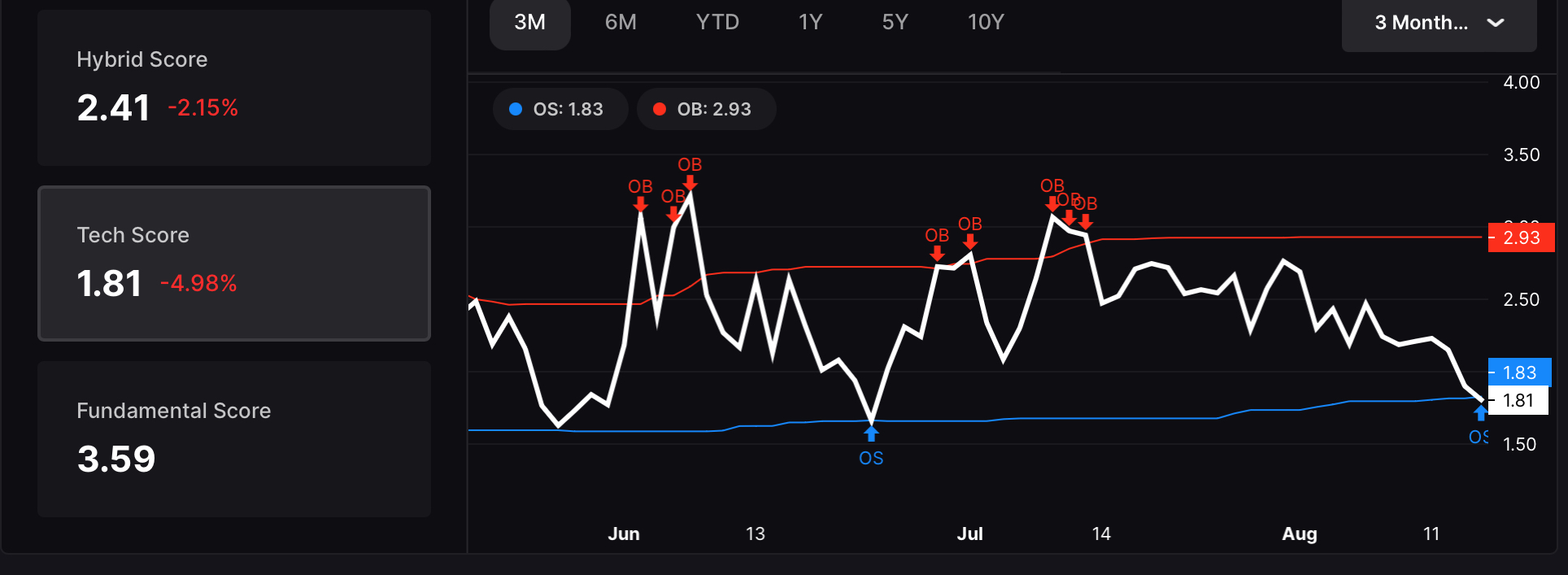

Before I delve into my unimportant life, I’d like to convey the fact that our mean reversion oversold signal was activated today, which is a rare event. It wasn’t oour 12mo dated algorithm, which is now super rare, but the 3mo. The way these mean reversion signals work is as follows.

Stocklabs grades all stocks by fundamentals and technicals, producing an aggregate score. This score is then transposed against price action for the $SPY over a 10 day holding period and from that we get data. The details of producing the scores are way above your pay grade, including treasuries, currencies, stocks, and commodities. Explaining them to you in a blog would be on par with teaching trigonometry to a gorilla. Just know, I’ve made fortunes by trading off these signals since 2008.

I will admit, there are occasions when the oversold flops and during those times there are seminal moments or pivots in the markets that distinguish them. The hallmarks of them are when we get “clusters” of OS signals over consecutive days. Since this is day 1 of the signal, it’s too early to know if “this time is different.” We can easily acknowledge the spike in rates and how that is causing people to panic.

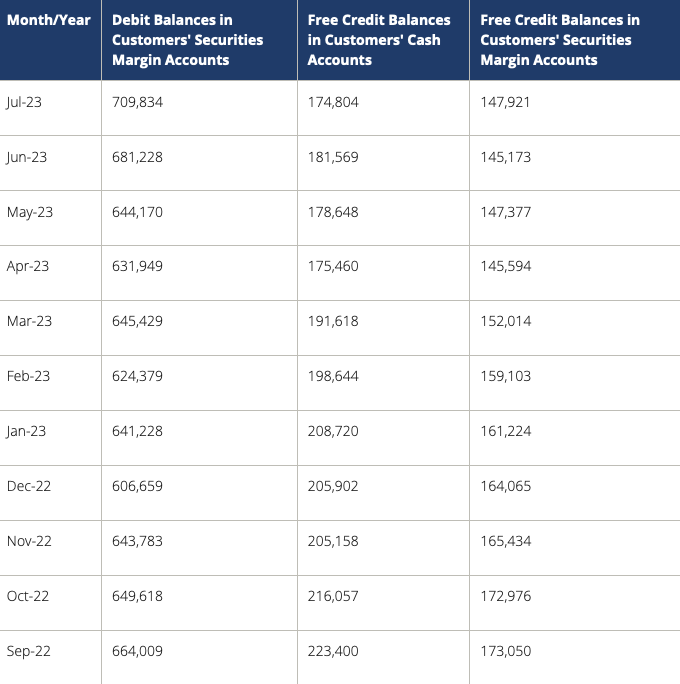

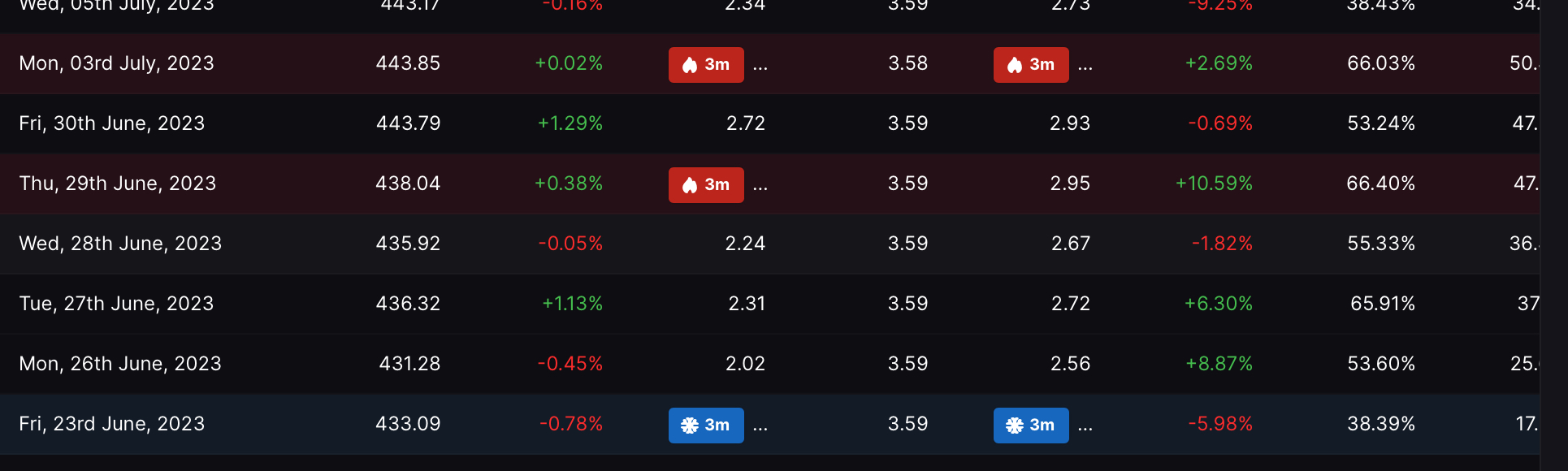

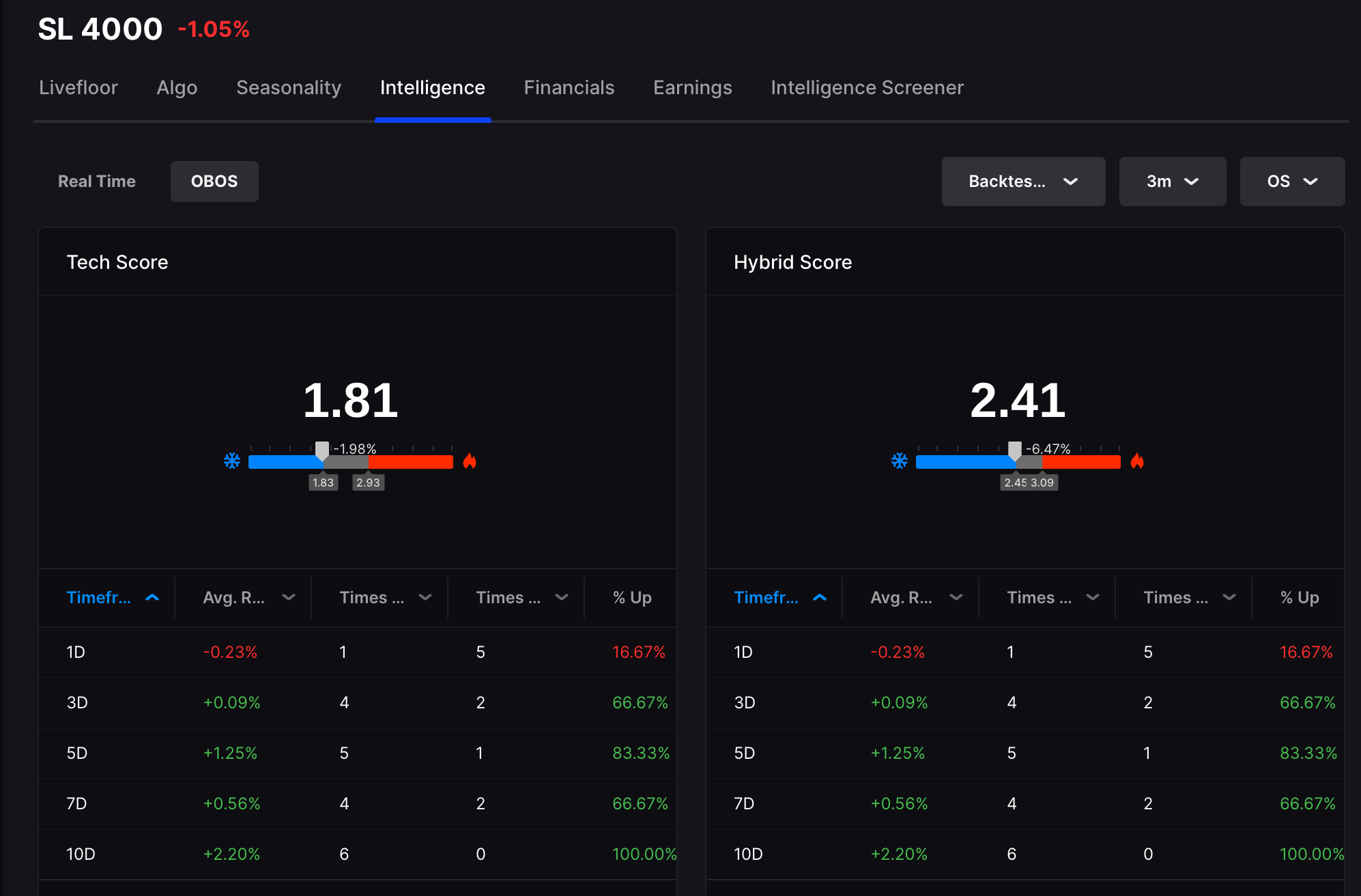

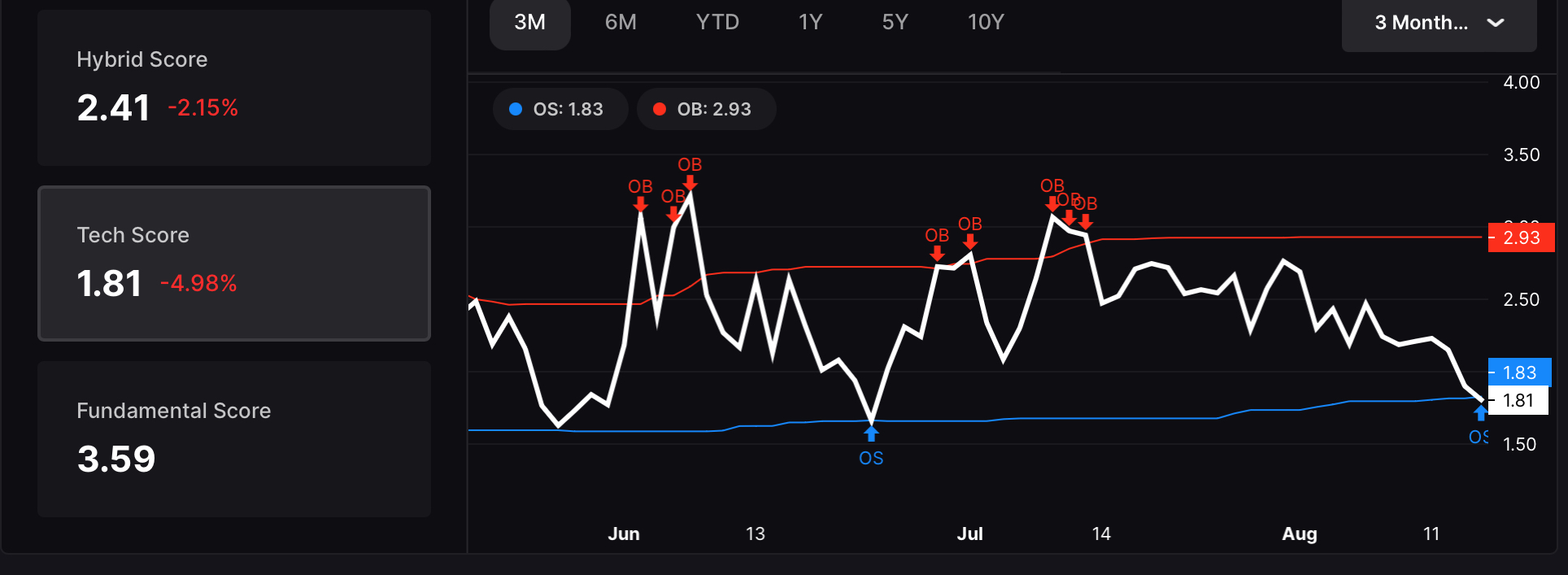

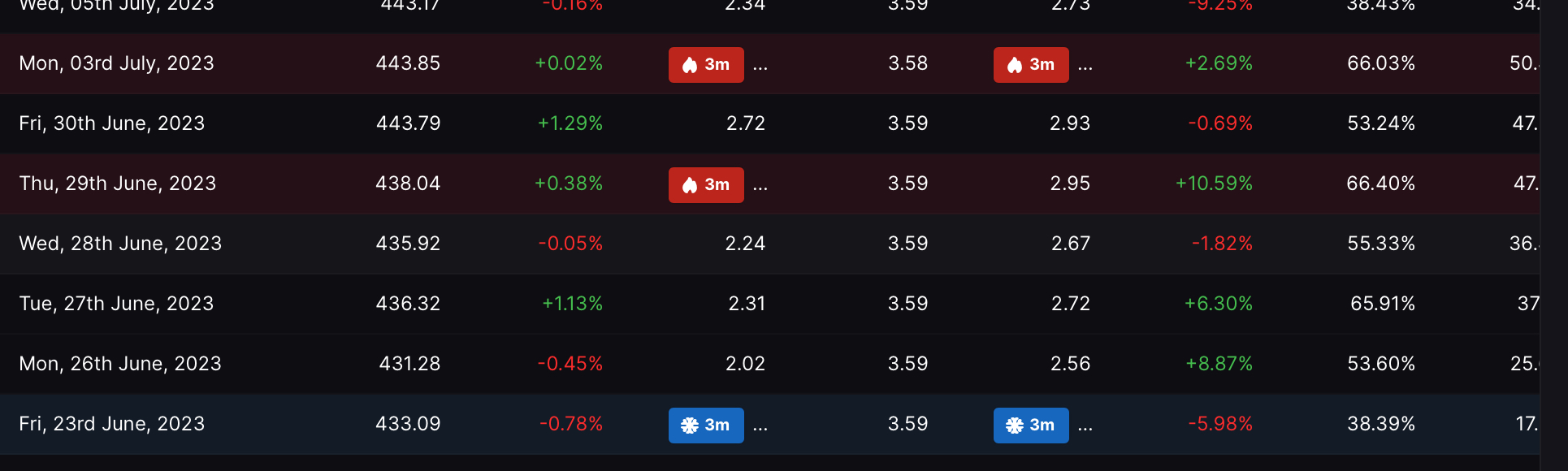

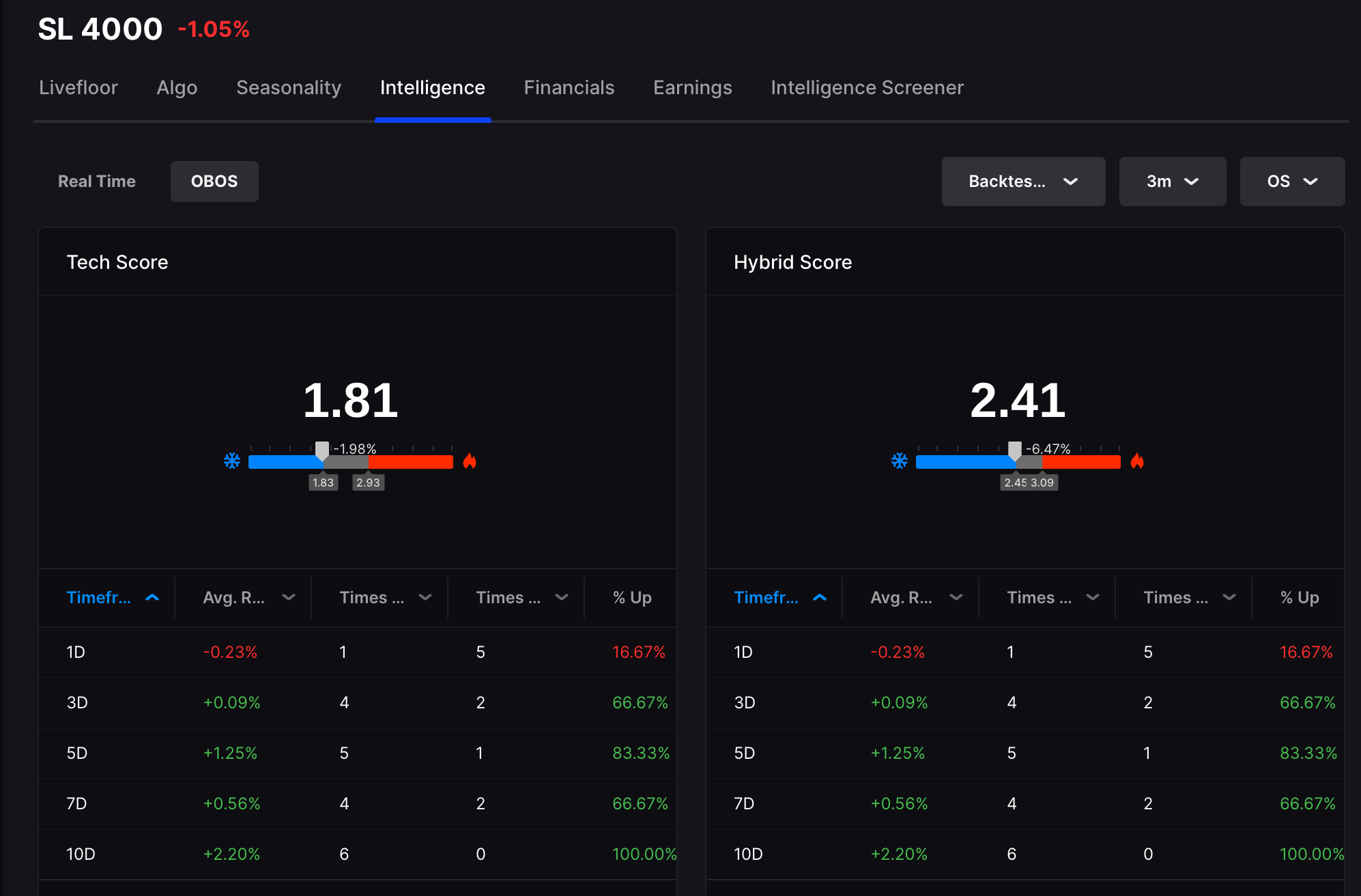

Here is the data for the oversold signal.

The last OS was on 6/23/23

The backtest data is flawless over 10 trading days, poor over 1. Backtest period is 1 yr.

Aside from important things like western finance, House Fly visited the entirely trivial JAMESTOWNE today, which is basically a scam recreated in 1994 to fool tourists into believing something old exists there. I hobbled along at a slow pace and enjoyed whatever sites I could. When I was younger, in my 20s, I’d get very excited over visiting places, really geeked out over the smallest things. I was truly alive and with verve, my entire life ahead of me. Now these days, I’m entirely black pilled, have a month old beard, and generally don’t give a fuck about any of it. These things happen of course — life wears you down and then breaks you into pieces and then, somehow, you drop dead.

Sorry to get all morbid, especially for the 20 something year old punks reading this. I really do wish you well and hope you can enjoy life the way I once did, stupidly cavorting throughout the planet in search of sport and truth.

Comments »