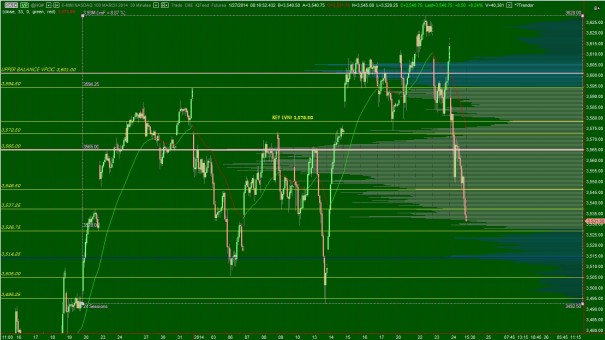

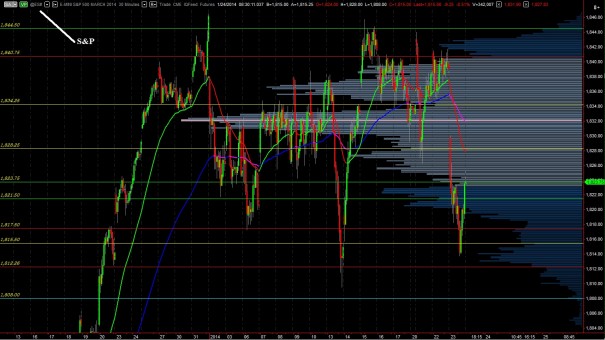

Trade was balanced overnight in the NASDAQ futures after prices worked a bit lower in the early pm hours. Price briefly took out yesterday’s low of the session before finding buyers and trading in balance. As the US comes online, the sellers appear to be reasserting themselves with another rotation down thus they claim control of the overnight session.

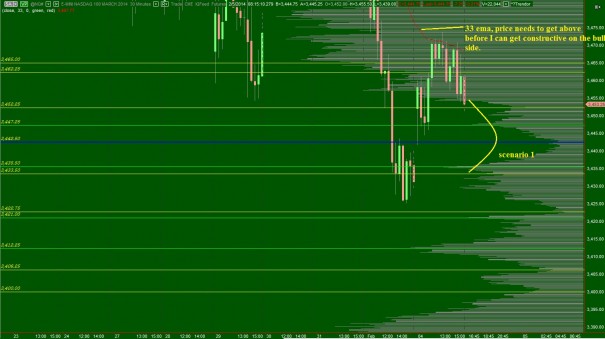

Yesterday prices traded higher, as did value, but the challenge was getting across the 33ema which held prices down all day. Prices fell out of their upper value distribution in the afternoon but ultimately closed higher. Buyers were in control during yesterday’s day session.

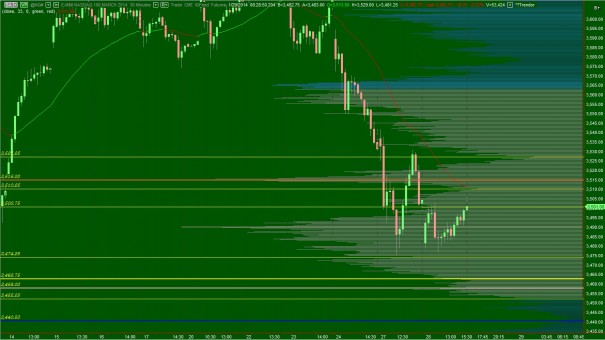

Intermediate term shows sellers in control also. This can be seen as a series of lower highs and lower lows. Their control of the intermediate term remains until we see the market put in a higher low.

The long term control can still be seen as dominated by the buyers, where the weekly chart has made a series of higher highs and lows since the beginning of 2012. However, the chart is trading below the weekly 9 period exponential moving average. This creates a higher risk environment t where price can accelerate to the downside rather quickly. The key level from the COMPQ appears to be 4000. A weekly close below this level could open the door for a test of the 33ema down near 3870. I have highlighted this action below:

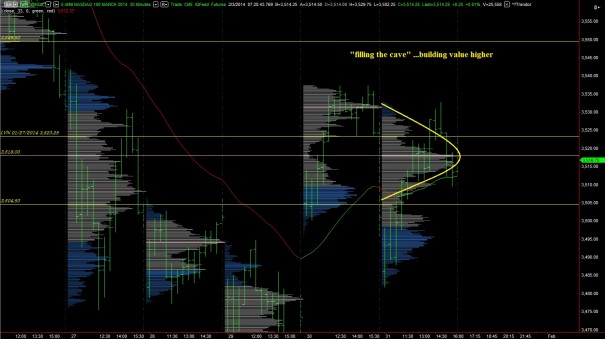

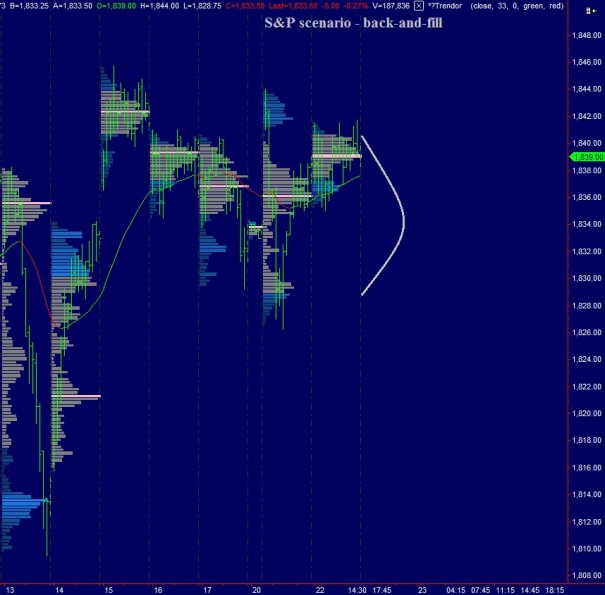

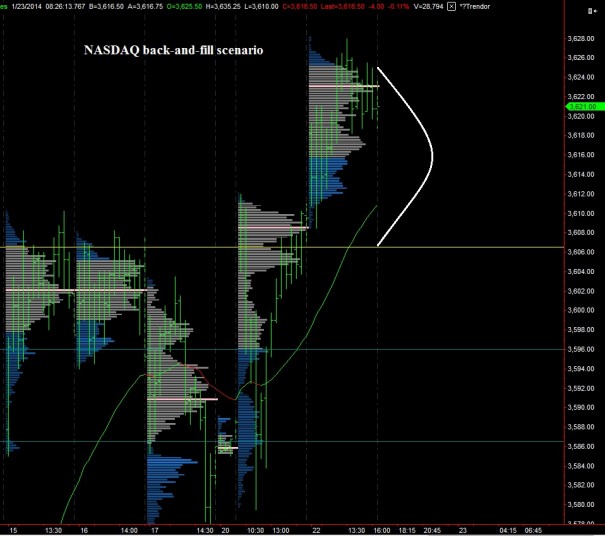

Taking to the composite, my expectation is for sellers the attempt another push early on. My algorithmic target is from 3435.50 – 3433.50. This level is near the Monday lows. I would expect these levels to hold price initially. This action would also shore up the gap left behind yesterday morning. From there, I expect us to trade higher and work inside of the volume cave from 3447.25 to 3433.50. I have highlighted these levels on the following composite profile:

Comments »