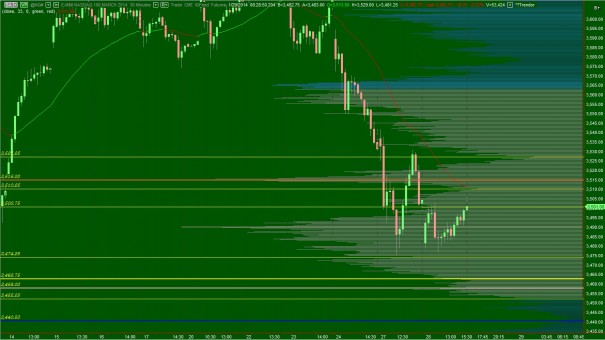

Index futures went for a ride overnight, with the S&P trading a 22 handle range and the NASDAQ trading over 45 points. There were several macro influences affecting the action as the market was given plenty of information to digest in the overnight hours. From the volume profile distribution that was printed, I can see there was no consensus reached.

Overnight, we are out of balance with sellers asserting control.

For traders, a market out of balance creates the greatest amount of opportunity. However, this is a high risk/high reward environment where tight stops, although prudent, are vulnerable to random market noise. The best strategy is often smaller position size with a larger profit target and stop loss.

Interestingly enough, we are currently set to open inside of yesterday’s value area which would typically mean we are in a low risk/reward environment. Should we sustain trade between 3500 and 3486.50 on the NASDAQ, we may see a very aggressive chop-like trade. This scenario would make sense, a violent waiting room ahead of the 2pm FOMC meeting announcement.

Another scenario would be for the intermediate term sell control to reassert itself early on and drive prices lower to 3474.25 then 3462.75 and ultimately to the naked VPOC at 3458. This would fit into the discouragement framework noted yesterday morning. If instead price continues to drive lower, cutting through 3452.25, then we are likely to see an acceleration of selling and may be entering the true panic phase of correction. With the market movers at the FOMC on tap, this possibility becomes greater, however this is still scenario number two for the day.

A third scenario is the long term timeframe entering the market and driving higher. This would require sustaining trade above 3527.25. I have highlighted these levels on the following intermediate term volume profile chart. I have also attached a daily volume profile for insight into a possible chop trade.

If you enjoy the content at iBankCoin, please follow us on Twitter

UPDATE: PRO GAP territory, caution on fading this sell flow early on

opening out of value, out of range, out of balance. HIGH RISK/HIGH REWARD

how’s elroi doing? he beating it up out there?

hasn’t taken any trades today, lazy robo cop