Friday we experienced a trend day down in both the NASDAQ and the S&P, with equities trading as correlative instruments to other macro products. This corrective-type trading was different in behavior from recent trade, and the selling pressure was dynamic enough to push the S&P out of intermediate term balance dating back to 12/20. What I find interesting however, is that the NASDAQ futures have not been pressed outside of the intermediate term balance dating back to the same date.

There are a few other divergences. The volume price of control for the NASDAQ never moved to its uppermost distribution. Instead is stayed in the middle of the action at 3565. I will be focusing on the NASDAQ as the market works though this correction, as it attempts to demonstrate relative strength.

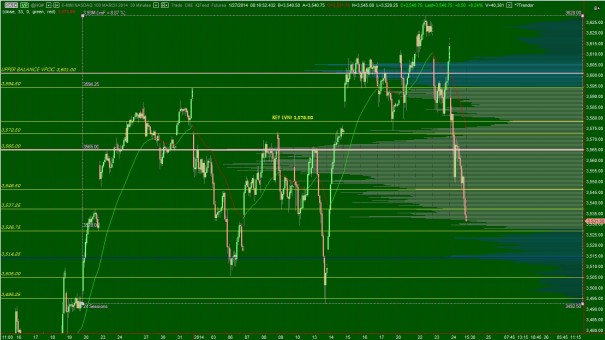

First I have drawn out a volume distribution dating back 24 sessions to 12/20/13. This set of trading days represents the intermediate term NASDAQ balance. From it, I have highlighted the key high and low volume nodes to monitor:

If the NASDAQ is going to sustain trade within the intermediate term, prices need to hold 3495.25. In the past, these lower regions have been the site of strong buying demand. Should that not be the case this time around, we may need to rethink our market stance.

The buyers are still in control of the long term auction, which can be seen on the daily and weekly composite charts (not pictured).

The trend down from Friday followed through for a bit in the globex session Sunday evening and into the morning, but buyers came in overnight and auctioned us higher. Their actions left a tail on the overnight volume distribution suggesting responsive buying took place. Early on, I will be on watch for a gap trade back down to 3531.50. This would close the weekly gap and also take us back to the scene of overnight responsive buying.

I have a current upside algorithmic buy stop target of 3549.50 which coincides with a low volume node on Friday’s profile and an area of support that was converted to resistance during the final afternoon panic selloff.

To recap sentimental control:

Long term – buyer

Intermediate term – balanced with selling pressure

Friday – sellers, overnight – buyers.

Finally, here are the RTH profiles on the NASDAQ. Note the plunging 33ema. Price always returns to the 33ema. Will price revert to value, or will value catch up to price? See below:

If you enjoy the content at iBankCoin, please follow us on Twitter

cut $LITB runner +15%