I am pressing though waves of exhaustion, much like the market is attempting to climb through the upper atmosphere of intermediate term balance. If you cannot sleep, then you cannot sleep and you might as well work.

I scaled out of TSLA this morning and rolled right into YELP. I could have pressed a bit more juice from the TSLA trade but with the options set to expire tomorrow and various “obligations” perking up intro the weekend, I thought it wise to roll into next week’s YELP if I want to continue riding the momentum train.

It turns out my knife catching idea in DDD was a winner, unfortunately I was not. I planned this trade out almost perfectly and then fumbled at my own 15 yard line. Had I executed properly I would be at the 75 yard line and in field goal range. This milk, I spilt, much like pondering a YGE long 20% lower…you really do not need to waste much time on these would have, could have thoughts. However, stick to your plans my friends.

CREE is working, and with the big lighting convention coming up in the first week of June, I think additional buzz and hype may allow me to reach my first target of 50 before my option expiration. Will RVLT chase behind, the chart is coiled nicely, looking like the CREE of two days ago….thus it could. No position for me in RVLT….yet.

Elsewhere I started looking for small bombs, I came up with FCEL. You know, fuel cells, those hydrogen powered cells that power, stuff. Come’on folks this is not high level research like The Fly generates, this is dumpster diving.

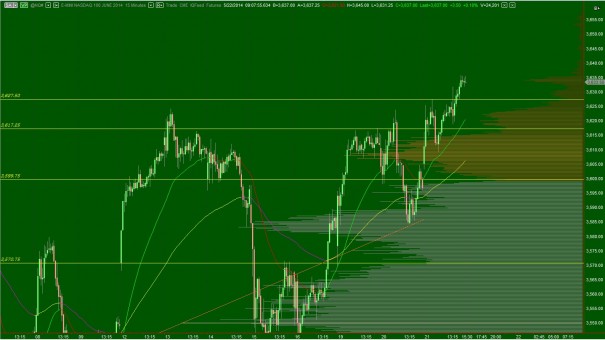

Speaking of which, I took a long in XON right off the rip this morning. I love a good story stock, and I like what the IBB is doing here. Have a look:

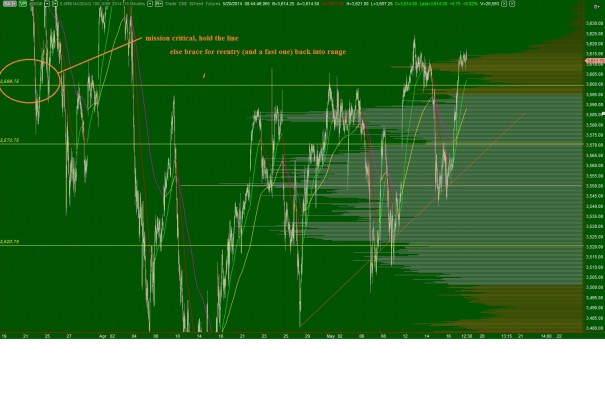

There is no one right answer to the momentum game. You pick your few favorites, hopefully before they pop, and scale at logical price levels. Like engineering, trading works best when you keep it simple. I took a 1/3 scale on my QQQ long, long live the mighty PPT. With a bit of luck, I can buy a pullback and trade the rest of the 10 day holdings period. ALL HAIL The PPT.

Comments »