My swing trading is so very out of whack. I have shrunk my position sizes for a bit, and gone back to some of my favorite trades. In the meantime, I am satisfying my intraday desires in the futures.

I took but only a few actions today, buying some QQQ along with the illustrious Senor Tropicana and taking down a ½ position in DDD. I traded DDD well up unto the point I made a callous decision to stop out my trade a few weeks back. My own mind shook me out of the stock. Therefore when rumors of a buyout swirled around this morning I simply bought back in. I like this base forming and will be using it to define my risk.

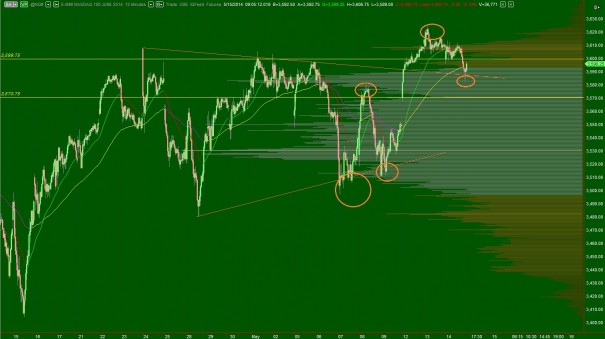

I power stalked the QQQ Powershares and earned a cost basis on a 2/3 size long at $86.89. For those keeping score is way below the midpoint of the day, nestled in the bottom quartile of the day. This pleases me. The later afternoon rally pressed value on the index higher which suggests we may see some higher prices into early next week.

I am interested in my old favorite CREE next week as the 30 minute is coiled tight and short interest is high enough to merit my attention. Aside from that, I will do very little, instead readying my systems for some next level futures trading.

Check in this weekend for a complete look at some very effective Nasdaq opening swings and the opportunities to trade them.

Comments »