One of the recurring life lessons, one that comes with lesions and ego bruises, is that something too good to be true is usually a lie.

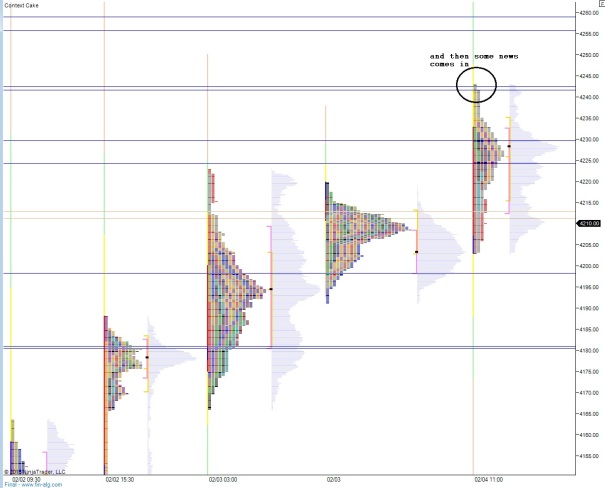

Neutral days by their nature are balanced. They like to revert back to the mean before they ultimately travel elsewhere. That’s what made today so curious—it through about reverting but could not penetrate the initial balance. Thus we were left to explore higher prices late into the session.

Then buyers pulled their favorite power move, the ramp. A flurry of buy programs hit the tape, sellers backed off, letting the bulls have a position of perceived control. They created space and then lurched with mystical speed at their prey.

One of the hardest parts of fading the second range extension is timing the entry. My early attempt, and it went okay, was around 4225. It never stuck though and I abandoned trying to short. While unfocused, taking in the late day ramp and providing some banter to Twitter, the market came right up to a level I scouted weeks ago—a high conviction level—and I missed it.

E.R.R.O.R.

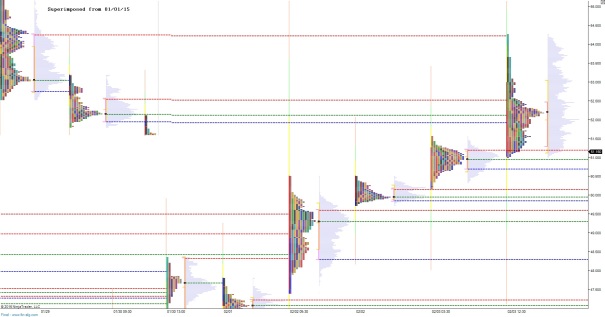

It’s okay, but if you think these market profile levels are just your old buddy Raul throwing darts, hopefully today can help persuade you otherwise, for your own benefit not mine, mates:

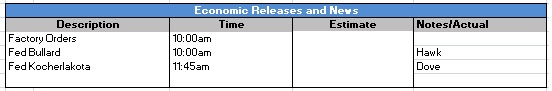

Listen, you and I both know the sovereign health of Europe and Greece doesn’t matter THAT MUCH. They don’t matter 40 Nasdaq points, right!?

Wouldn’t you rather have something more tangible to justify a move with? Neutral profile, day 3 unidirectional, NFP on Friday, oil down a hot 8, etc. etc.

I could go on, but this post already is too long. Instead soak in this tasty hit:

Comments »