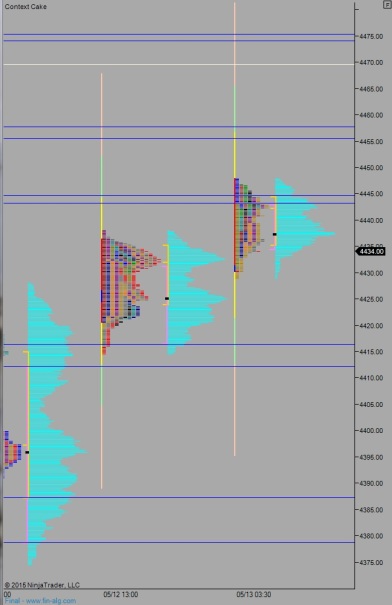

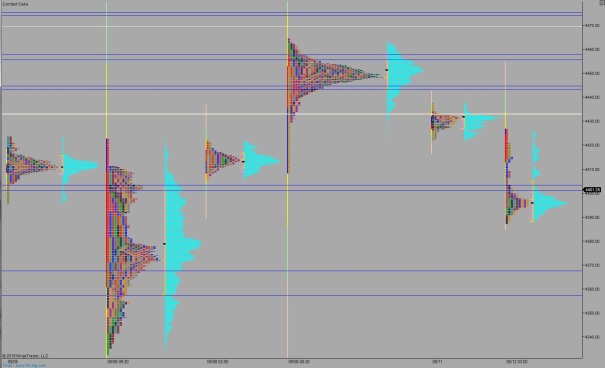

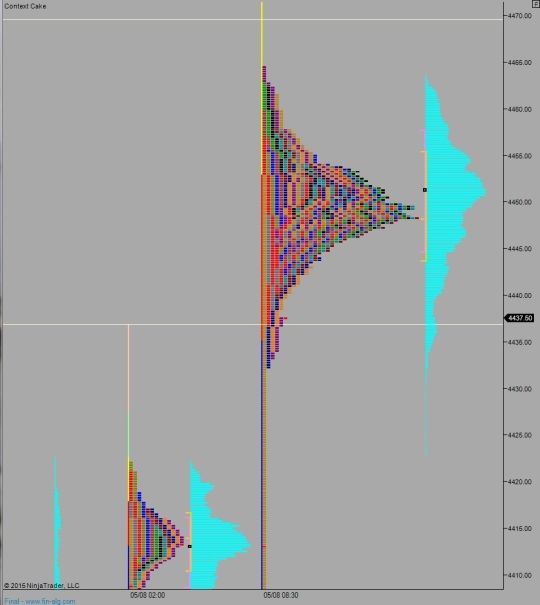

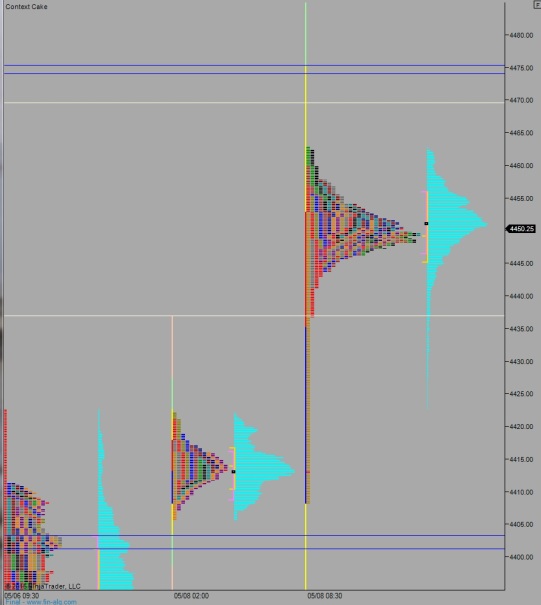

Nasdaq is set to open pro gap as we head into Thursday. The overnight session features 44 point of range so far, nearly 2nd sigma which is 46.75 points. That tells us the session was quite abnormal, and on the borderline of being different than 95% of all overnight sessions over the last three years.

Volume behind the move is light, in typically upward fashion, currently within the threshold of normal.

We heard the initial/continuing jobless claims at 8:30am and so relatively little reaction to the data point. The only other economic event scheduled for today is the EIA Natural Gas Storage data at 10:30am.

The Nasdaq is auctioning in a methodical manner. Tuesday’s big gap lower was faded. We found responsive buyers Tuesday and spent the rest of the session trading higher. Yesterday we opened gap up and spent the entire session slowly working the gap fill lower. Today’s gap up is on the professional variety but still at risk of being filled. Conversely, there I an open gap up at 4476.25 which may entice the market upward. Overall the market has been an objective mechanism of price discovery all week.

Heading into today, my primary expectation is for sellers to push into the overnight inventory. There’s a big HVN at 4450 that might behave like a magnet once markets open. I will look for buyers to defend north of 4440 to set up a move to fill the gap up to 4476.25.

Hypo 2 is gap and go higher, push up to 4476.25 and find sellers who defend the 05/04 range.

Hypo 3 sellers push down though 4440 and sustain, setting up a fill of the overnight gap to 4424.25.

Hypo 4 bulls sustain trade above 4476.25 to target the NVPOC at 4489. Stretch target is 4493.

Levels:

Comments »