Nasdaq volume and range went 2nd sigma overnight as the index traded lower for much of the session. As we approach cash open prices are below Tuesday’s range and we are in a “pro gap” type environment. The selling accelerated at 8:30am when weaker-than-expected Advance Retail Sales data hit the wires. We also had an corrective-type event in copper prices, the Japanese Yen is very active, and JPM missed earnings. WFC is trading lower premarket as well after reporting earnings.

Today we have crude oil inventory stats out at 10:30am. The weekly report is likely to be closely followed by all speculators as the commodity continues to correct lower. We also have Business Inventories at 10am and the Fed Beige Book at 2pm. Premarket tomorrow we will hear Continuing/Initial job claims and also earnings from BAC and C.

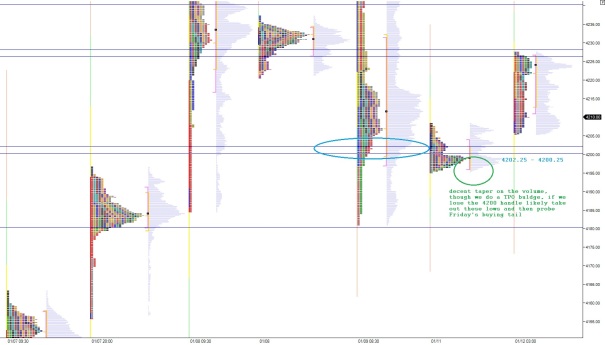

Yesterday prices opened gap up and we had an opening drive higher. After a strong first hour of trade buyers pushed us above the IB and we unable to test Friday’s high. The lack of order flow above the high was ominous and we quickly fell back to the daily mid. From there buyers were unable to defend and we gave back the entire opening drive and then some in a large impulse-type move. The overall print was a neutral print, perhaps barely able to classify as a neutral extreme.

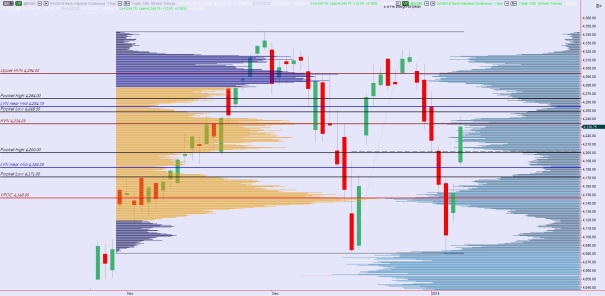

The overnight session looks like a completion of the impulse wave. Early on my expectation is for buyers to push into the overnight short inventory and test Tuesday’s session low 4126.75 and likely push into the range a bit up to the LVN at 4138. From there I expect responsive sellers will step in and continue pressing lower to close the open gap at 4102.25 and test recent swing low 4082.

Hypo 2 is an open drive down. The risk of a drive is elevated given the recent price action on open and how we are out of balance to start the day. Drive down looks to test recent swing low 4082 early and push through to test 4069 then 4053.

Hypo 3 is a stronger than expected open which takes out the LVN at 4038 and sustains trade above it. This type of action likely builds into a full gap fill up to 4158.75.

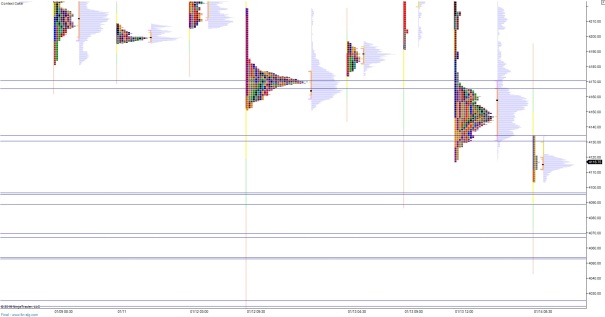

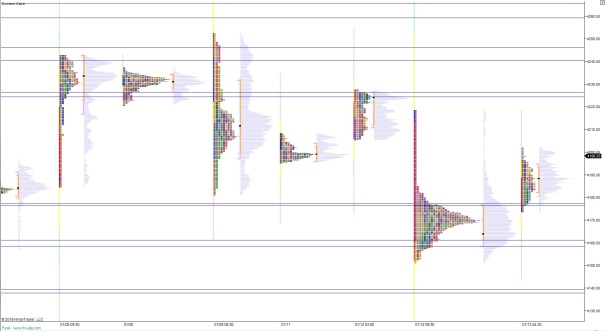

These levels are highlighted on the following profile charts:

Comments »