Lads one thing I’ve always loved about being an index futures trader is the quarterly nature of our dear derivatives. Last Thursday most active traders rolled forward from the March contract to the June. I always wait until the weekend to do so, even if I am actively participating, which I most certainly was not last week. But I’ve spent the better part of this morning refreshing and rebuilding my charts for the June contract which inevitably leads to warm thoughts.

Try as I may to finish installing a new kitchen at Mothership quick enough to hightail it west for one last romp in the snow, that likelihood decreases with every passing week.

Sometimes the project seems to be moving along nicely. Other times I go to move a plug and make a real horror show of a mess of the drywall. I am not handy. I come from a long line of builders but I build out of necessity not passion. My passion is gardening and earth keeping and gathering natural resources.

Now I may be just a humble speculator, by trade, but I don’t let the challenges of installing a kitchen get me down. If I can understand high level physics books then I can most certainly install tile and plumbing. Moving water is one of my specialties, waste or otherwise.

And while I’d rather be building fountains I want a big ass farm sink for processing all the dang food I grow. So here we are.

The upcoming week is likely to be full of shenanigans. There is a FOMC annocement. The gambling halls down in Chicago are placing one hundred prercent odds that the Fed will leave the benchmark borrowing rate unchanged a 0-0.25%. There is still likely to be an EKG burst reaction around 2pm Wednesday. And as participants digest the language coming out of Powell’s Fed during the 2:30pm presser, we ought to gain a decent idea where the market is headed into the second half of the week.

What most of my peers don’t seem to realize is my approach to trading allows me to make 600-900 fiat american dollars real quick. And I do that a few times a week. I don’t glue myself to the terminal, addicted, going after trade-after-trade-after-traded. That is no way to live. I secure the bag then I go and enjoy life. If I cannot see all the stars aligned for me to become active, it makes money, long term, for me to do anything other than trade. Literally sitting completely still, in the yard, listening to birds, makes me more profitable than engaging my edge all the heckin’ time.

I never took up speculation for the sake of speculation. It was a means to a lifestyle I desired—one where I am free to do as I please. No one’s master. No one’s slave. Cooking tasty food. Swimming. Drinking hootch and being the rock of my familia. That’s it.

So while there is always the opportunity to go after more.MORE.MOAR…I ask myself, “at what cost?” Right now I work too hardt. This heckin’ kitchen has me stressin’. And if it’s not wrapped up by about April 20th, then it’s going to start to infringe on my outside work. My passion.

We cannot have this.

Therefore I must focus on making incremental progress on the Mothership kitchen even if it means falling behind on my speculative finance work. I do not apologize if this leaves any of you hanging.

I’ve never promised to feed any of you fish. At my best, I am a resource for generating your own ideas on how to fish. That way, when I am gone, you don’t cease up. Psychologically you are unchanged and you make your way just fine, emotionally convinced that you can handle your own self business.

At my worst I am just a heckin’ distraction.

I will likely find time to trade the opens most days this week. But my screen time will remain limited until this dang kitchen is back operational.

Raul Santos, March 14th (Pi Day!), 2021

And now the 329th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 03/15/21 – 03/19/21

I. Executive Summary

Raul’s bias score 3.58, medium bull. Continued upward momentum early in the week. Then look for third reaction to the FOMC announcement Wednesday afternoon to dictate direction into the second half of OPEX week.

II. RECAP OF THE ACTION

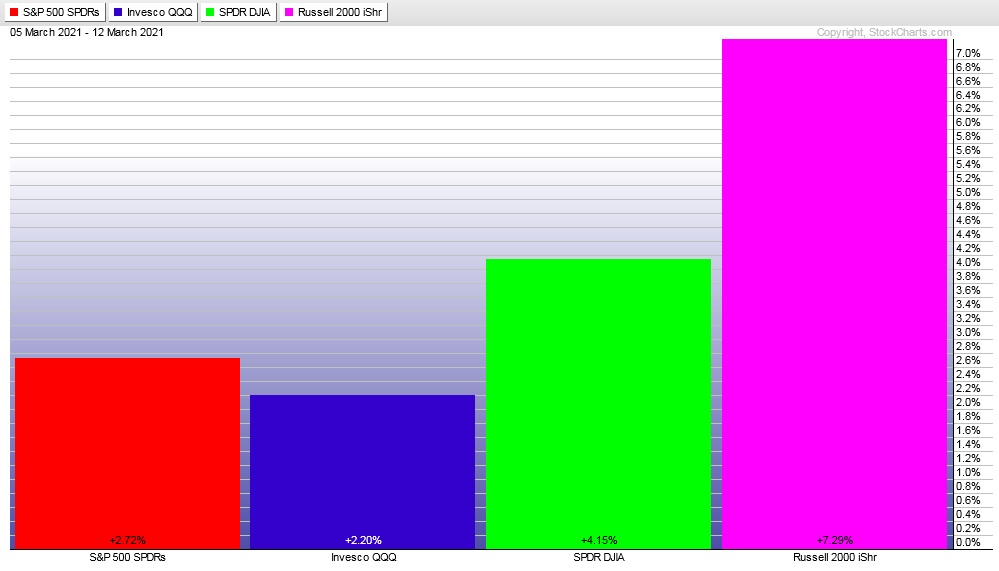

Buyers in control all week long everywhere except the NASDAQ. The NASDAQ saw a hard sell Monday then sort of chopped higher for the rest of the week.

The last week performance of each major index is shown below:

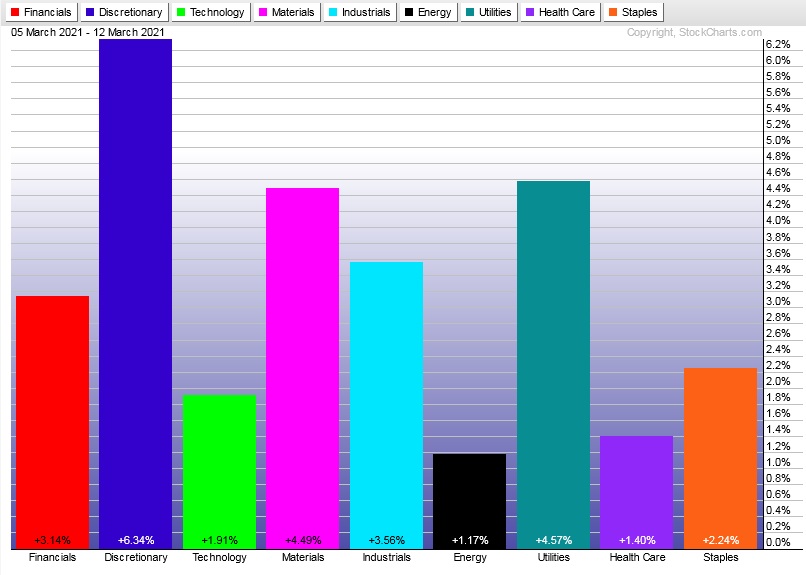

Rotational Report:

Rotations higher across the board. Slightly risk averse to see Utilities as the second best performers. The lagging Tech sector also not suggesting a clear bullish week ahead.

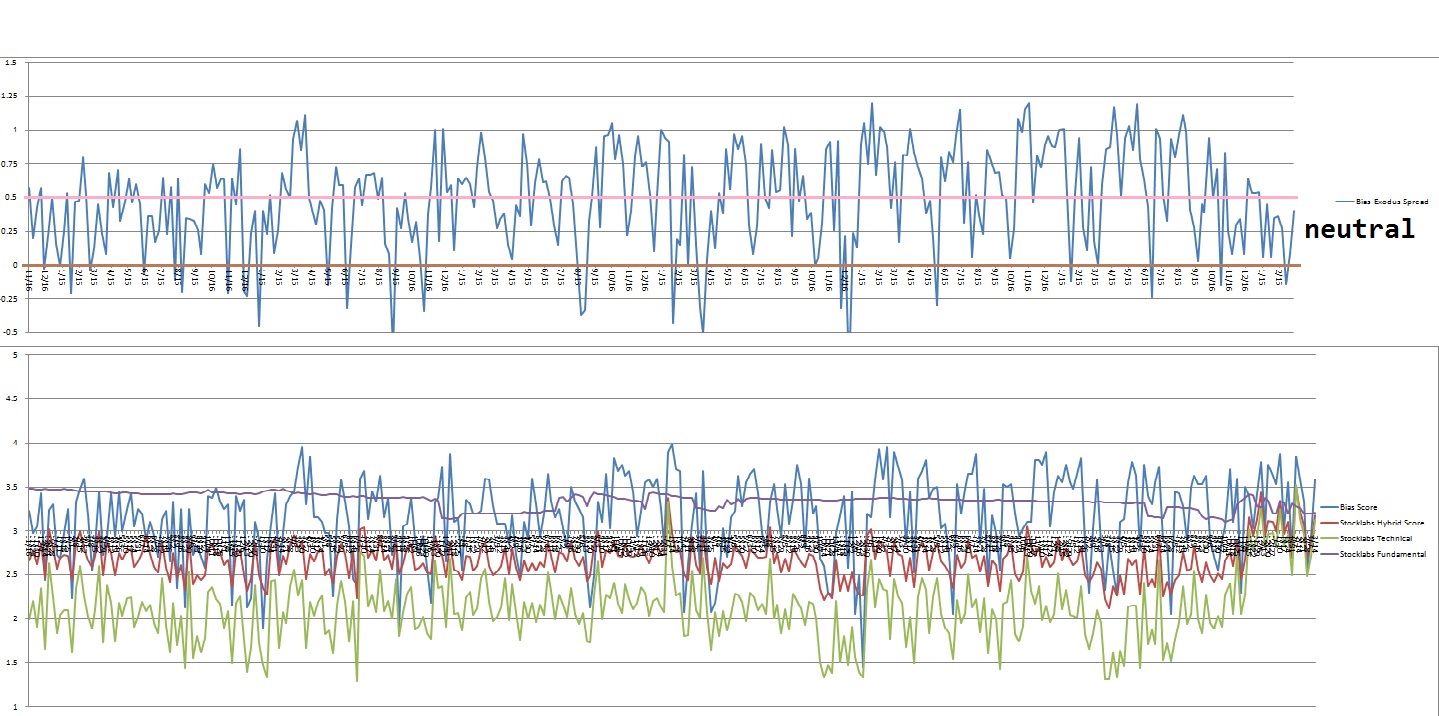

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Industry flows were heavily buy side, performance wide. Nearly seven pages of industries with returns over +3%. Median return was an impressive 5.74% while 30 day volume delta skewed negative, perhaps due to accounting for the recent sell off several weeks back.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

No signals

Scanning through the various OBOS signals for the Stocklabs algo quickly reveals we have no statistical backing from the software heading into the week that we can use to form a bias. Nothing from IndexModel either. Therefore being neutral, the focus is on only taking high quality trade set-ups and only for scalps. No reason to press winners in this environment.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Continued upward momentum early in the week. Then look for third reaction to the FOMC announcement Wednesday afternoon to dictate direction into the second half of OPEX week.

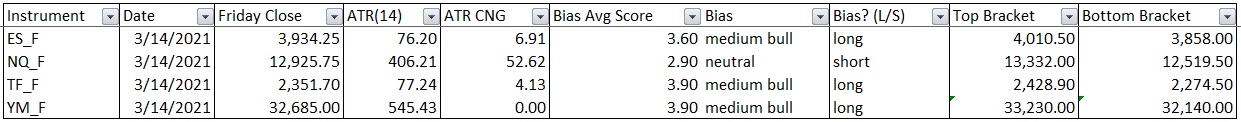

Bias Book:

Here are the bias trades and price levels for this week:

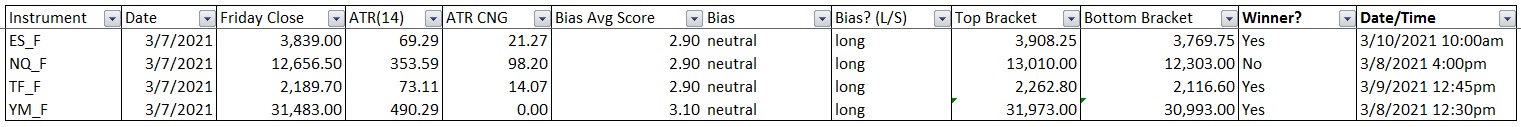

Here are last week’s bias trade results:

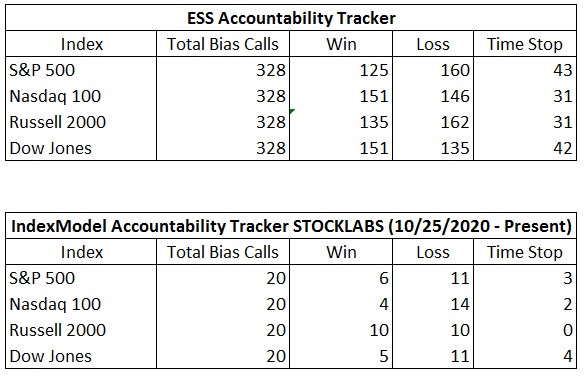

Bias Book Performance [11/17/2014-Present]:

Semiconductors come into a choppy balance

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports in a clear discovery up phase.

See below:

Semiconductors appear to be in a choppy range. The Fibonacci retracements above and below current prices are broad areas where I expect price to bracket and work sideways.

See below:

V. INDEX MODEL

Bias model is neutral for a second week after signaling Bunker Buster two weeks ago and being neutral for the thirteen weeks prior to that. No bias heading into next week. Here is the current spread:

VI. QUOTE OF THE WEEK:

“All cruelty springs from weakness.” – Seneca

Trade simple, be kind

If you enjoy the content at iBankCoin, please follow us on Twitter