The article below is from last week’s Weekly Strategy Session. We also caught a nice chunk of this move in Google live in the 12631 trading room:

If you enjoy the content at iBankCoin, please follow us on TwitterLet’s revisit the 4 pillars of technology and add in some of the supporting cast members.

To recap, during the 01/19/15 Strategy Session we began looking at shares of Amazon as a “tell” to the durability of momentum stocks. It had a bearish technical setup to start the year and many short-term traders were leaning short. The stock started to “work” for shorts only to sharply reverse back into its consolidation pattern and then gap-and-go higher on earnings.

Then on 02/02 we looked at the potential “failed auction” in shares of Apple. In essence, this technical setup is the opposite of what was occurring in Amazon. On the surface, Apple was making new highs in an uptrend. But, it briefly took out the prior high and then had a fast move lower. Therefore, we hypothesized it may do the opposite of Amazon and punish short-term traders who took the obvious long. It did not. Instead it turned out a strong week for the bulls.

Last week our attention was on Facebook. It was up to bat for the bulls and managed to hit a proverbial double, gaining over 5% on the week.

Following this logic, Google is the next pillar to have on watch. If you recall, the four pillars of technology is a naming convention Google Chairman Eric Schmidt used during a 2012 Bloomberg interview.

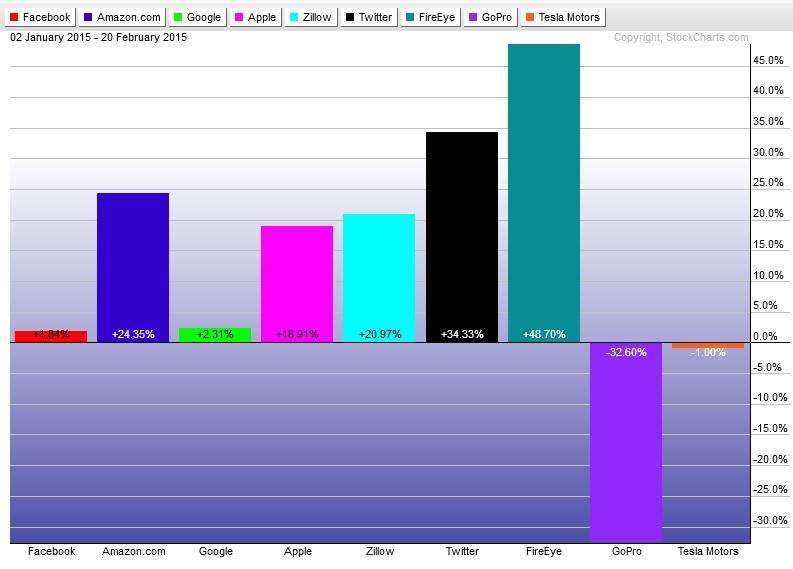

From a year-to-date performance standpoint, Google is still slightly outperforming Facebook. But from a rotational point of view, Google is quite a bit behind some of the other marquee names. Check out the year to date performances of these hot money stocks: