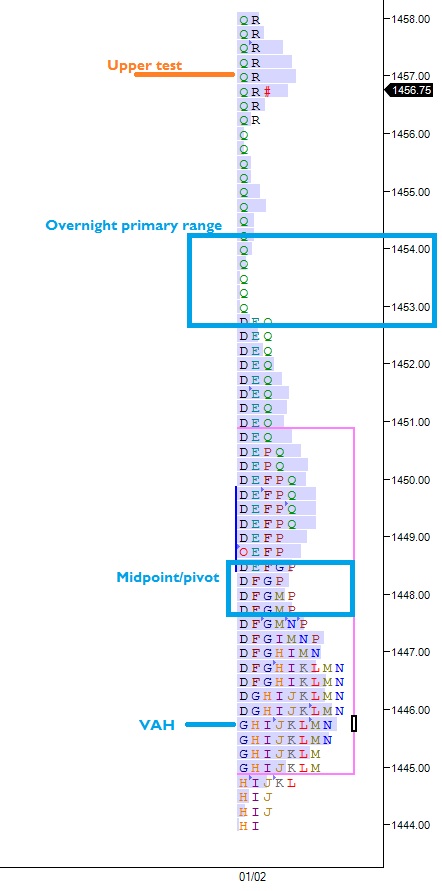

The overnight session traded almost entirely in the low volume void of yesterday’s profile from 1452.50-1454.50. Overnight digestion up at these levels tells me nothing occurring overnight throughout the rest of the world was of greater impact than our political theater.

Levels we can monitor and cue off of from yesterday include the high volume node at 1457 where the market squeezed up to into yesterday’s close to gauge as resistance and the reactionary aggression of the sellers.

Below, should price sustain trade below 1451 we could expect a quick trade back to the middle of value at 1448 then a test of the volume peak at 1445.75.

Seeing today’s price digest yesterday’s gains within the range (inside day) would be impressive. More importantly, I want to see how today’s profile shapes. I’m looking for cues of balance, seller aggression, or the coveted initiative buying. Let’s see who wants to work these areas hardest. I’ll play my positions accordingly.

Comments »