I want to get sappy very quickly to express my gratitude to you, kind people of the internet, and wish you wealth and happiness in the year to come. It truly is a pleasure interacting with each and every one of you.

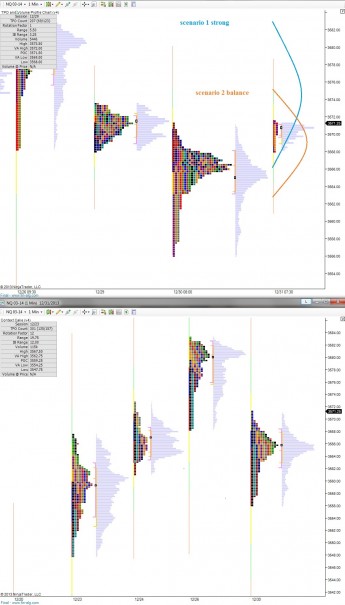

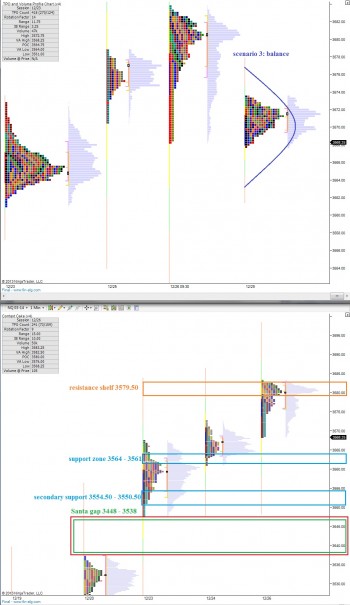

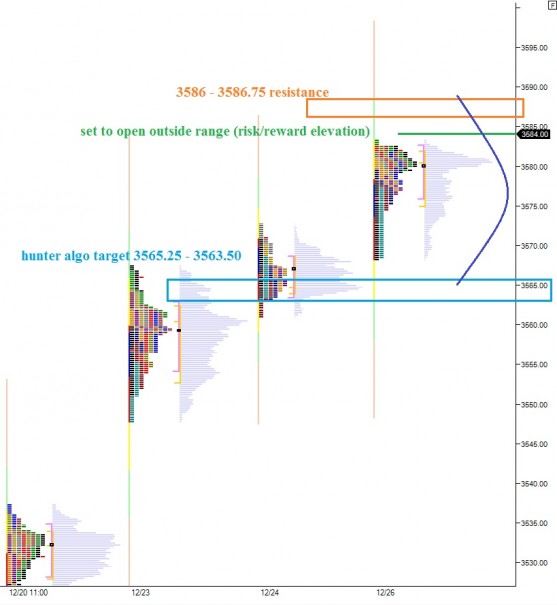

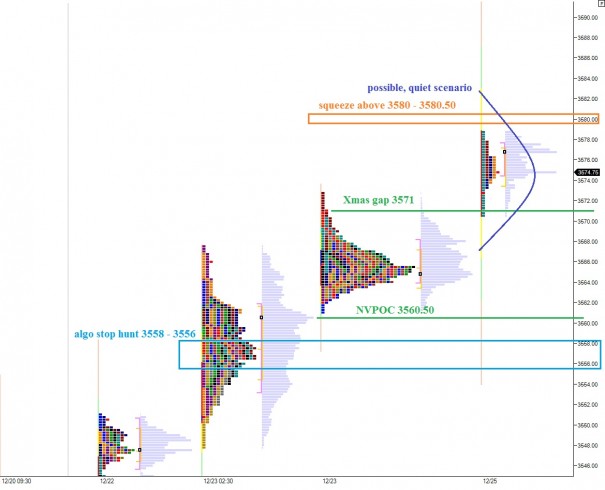

My market profiles are back up and running after my instruments went down Friday afternoon. I write about market profile every morning because it is important to understand as a trader. Many know it and they hide in the corner selling their ‘secrets’ in back alleys. If you truly cared to learn this stuff it’s all out there. There’s one good book on it and a full year of the logic applied live in the hallowed halls of iBankCoin.

I’m going to teach the old people something very quickly—do you see the section on the right edge of our website that says Categories? Bloggers use those to aggregate posts of a similar nature.

Click market profile and go nuts…tell you kids too.

It is of no threat to me to share my ideas freely because market profile follows the laws of nature. Laws like force, resistance, vacuum, velocity and more that we as earthlings are bound to. And as long as you do not bother me too often, I’ll talk it out with you because discussing it breeds insight and learning, you see? We are learning together this is good.

Happy New Year!

RIP Madison Montana, may a short squeeze propel you into the heavens like they always have

Comments »