“Make things as simple as possible but no simpler” – Albert Einstein

I know some of you don’t like posts about individual setups and I kindly invite you to take your reading elsewhere. However, if banking coin is your top priority, more so than amusement, I suggest you add Chipotle to your watchlist this evening for potential long trades tomorrow.

Since I’ve just returned home and I’m in the sharing is caring mode I want to explain exactly how to trade this setup. Young guys, listen up because you won’t get much advice like this for free on the internet.

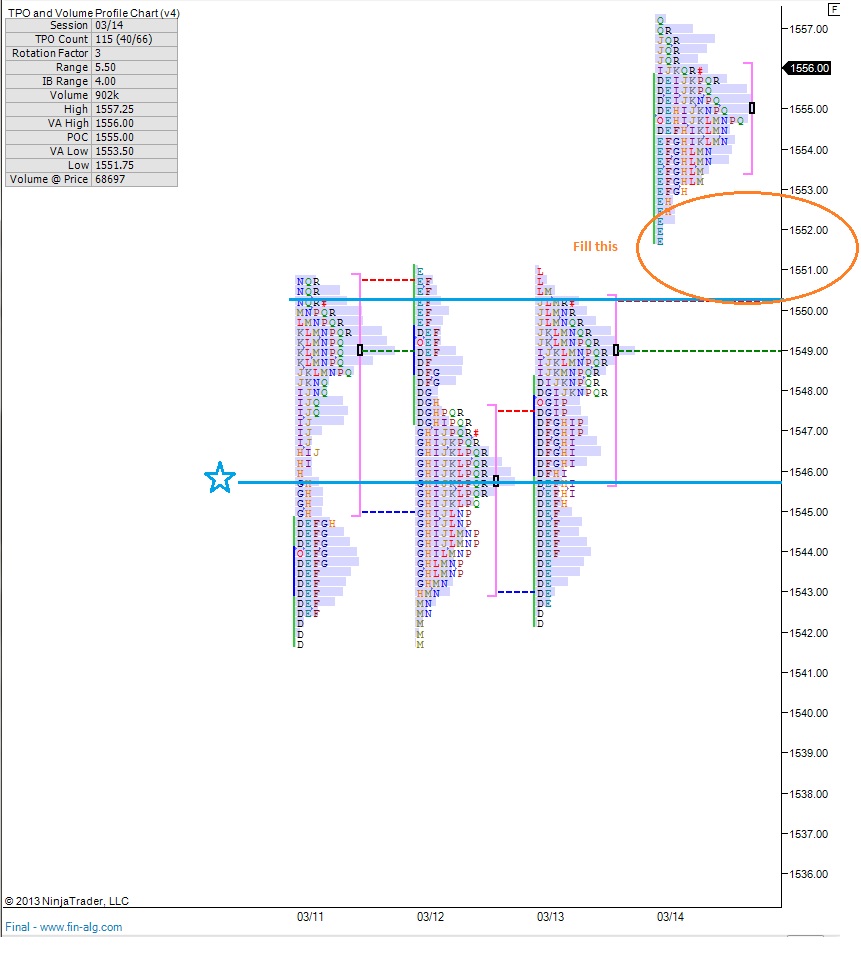

A tight moving average like the 9ema (or 10 sma, 13 ema, etc.) is excellent to key off of because it’s close to the price action. To get even closer, look at the open, high, low, close of the previous two sessions using daily candles. With this information we have enough data to cue off of for a trade.

In the case of the CMG play, we like how price has behaved recently, check it out:

I’m already long this name, and took some profits before heading on vacation. Now that it has pulled back in a reasonable manner, I’m ready to get back to full size in the name. I want to see exactly the following occur to get me to buy more:

Take out Tuesday’s high

That’s it! If it sounds simple, that’s because it is simple to trade. Our first profit target is the most recent peak around $335. If we approach those levels, closely monitor intraday action and find a good price to scale out. Then keep a piece on in case the momentum picks up and the trade gets legs, the crème if you will.

Your risk is down to $314 so you’re risking $9 to make $12 on a setup with around a 68% win rate. Believe me, the numbers work in your favor. Just trade it well.

Comments »