This is a story worth telling if you haven’t heard it yet.

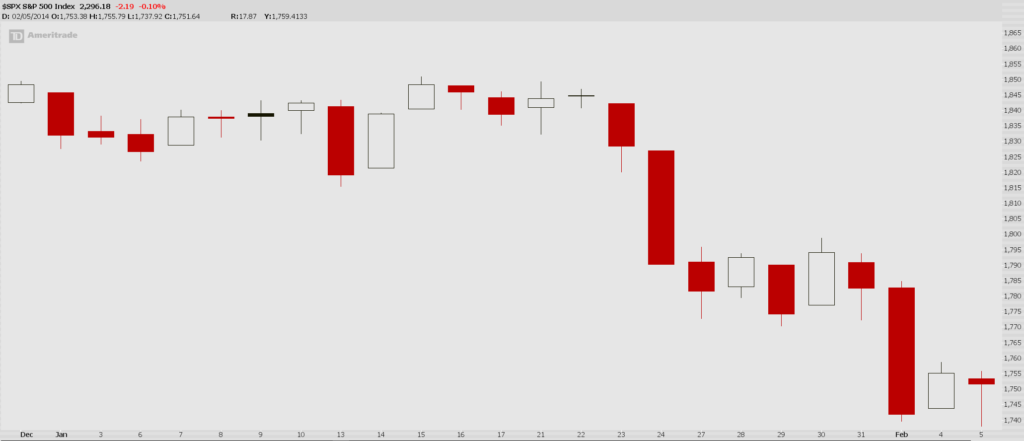

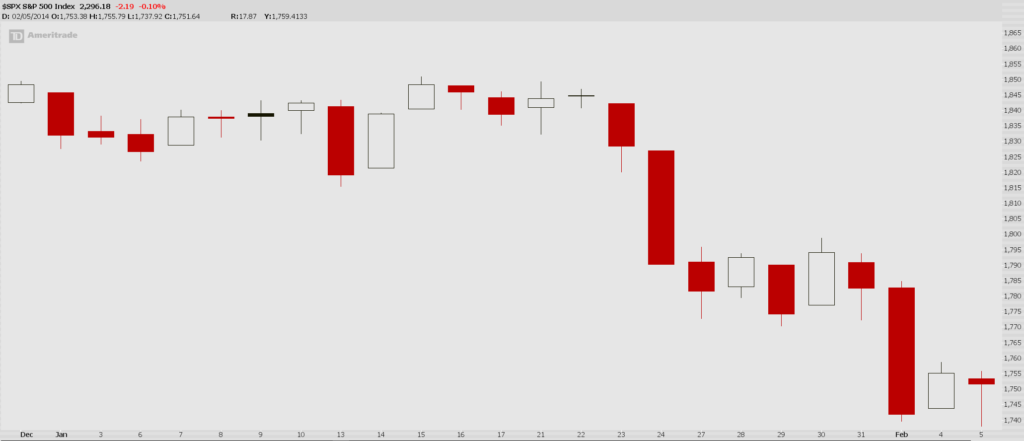

It was January 2014. I came off my second best year in my career and the first few weeks on January 2014 was my most profitable start to a year ever. The $SPX started the year in a fairly flat and tight range, but the high beta growth stocks were in blow-off moves everywhere.

After a flattish start in the first few weeks of January, the $SPX took a nose dive out of nowhere towards the end of January.

That transition is where growth stocks hit euphoria, and started a move that would take them down more than 50% on average over the next couple years.

That transition is where growth stocks hit euphoria, and started a move that would take them down more than 50% on average over the next couple years.

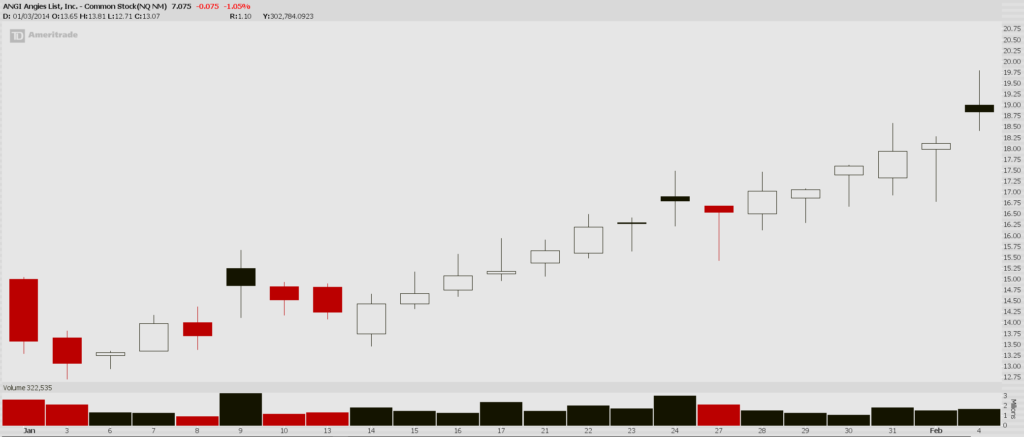

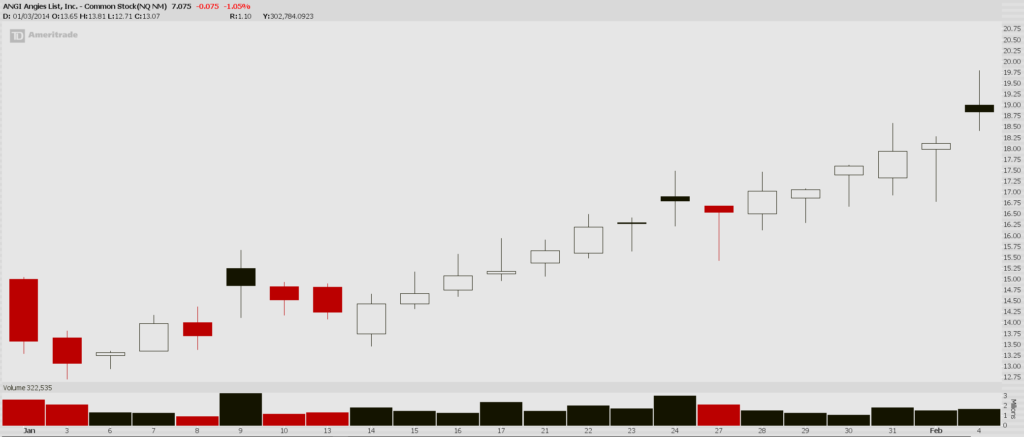

While the market was getting nuked, I initiated a group buy on $ANGI on January 6th. It was an aggressive bet, looking for $ANGI to hit $20 by the first week of February. Take a look at how $ANGI traded up til Friday the 4th, which was expiration day.

You might have heard stray comments in the chat about “that bitch $ANGI” or something similar. When you look at this chart, the anger, frustration and constant mocking makes little to no sense, right?

I was a few days early in this trade, but there was a point where this stock was up 14 of 15 sessions. This also happened to occur in the context of a MASSIVE downtrend for $ANGI, as it had traded as high as $27 6 months prior.

You have to keep in mind that I was also in an insane winning streak, and had been printing money for people on the site for all but one month of 2013. People had become so used to massive wins, that the fact that this stock defied gravity with so many things working against it, and had been as high as a 200% gain on expiration day, but as it faded into the close on Friday, so did everyone’s profits. Friday’s big gap had everyone’s eyes on my $20 price target, and the stock only climbed as high as $19.80.

This trade, at that time, became known as one of the worst trades I’ve ever called on iBC.

It wasn’t until a few weeks had passed that I realized that expectations were out of alignment. This is the type of activity that happens at tops. People are drawn in, experienced a positive feedback loop for months on months, expectations are skewed into the favor of big winship.

In response to my rant yesterday…no. We are nowhere near this same environment. We will be though. It would be in your best interest to watch how chatty it gets, as novices become experts, and genius is born and bragged upon daily.

Until we reach that mood, there’s nothing for you to do than to “make hay while the sun is shining.” Interestingly enough, that was my Podcast tagline back in the summer of 2007.

Enjoy yourself.

Comments »