This is a story worth telling if you haven’t heard it yet.

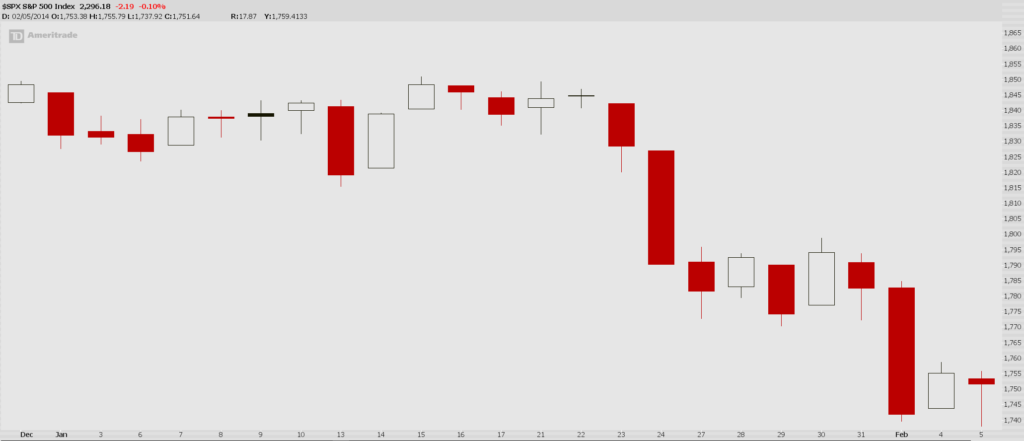

It was January 2014. I came off my second best year in my career and the first few weeks on January 2014 was my most profitable start to a year ever. The $SPX started the year in a fairly flat and tight range, but the high beta growth stocks were in blow-off moves everywhere.

After a flattish start in the first few weeks of January, the $SPX took a nose dive out of nowhere towards the end of January.

That transition is where growth stocks hit euphoria, and started a move that would take them down more than 50% on average over the next couple years.

That transition is where growth stocks hit euphoria, and started a move that would take them down more than 50% on average over the next couple years.

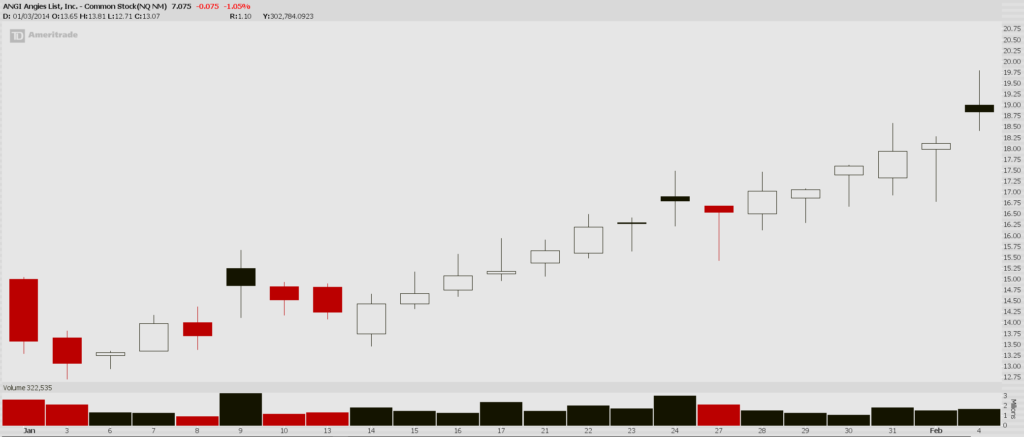

While the market was getting nuked, I initiated a group buy on $ANGI on January 6th. It was an aggressive bet, looking for $ANGI to hit $20 by the first week of February. Take a look at how $ANGI traded up til Friday the 4th, which was expiration day.

You might have heard stray comments in the chat about “that bitch $ANGI” or something similar. When you look at this chart, the anger, frustration and constant mocking makes little to no sense, right?

I was a few days early in this trade, but there was a point where this stock was up 14 of 15 sessions. This also happened to occur in the context of a MASSIVE downtrend for $ANGI, as it had traded as high as $27 6 months prior.

You have to keep in mind that I was also in an insane winning streak, and had been printing money for people on the site for all but one month of 2013. People had become so used to massive wins, that the fact that this stock defied gravity with so many things working against it, and had been as high as a 200% gain on expiration day, but as it faded into the close on Friday, so did everyone’s profits. Friday’s big gap had everyone’s eyes on my $20 price target, and the stock only climbed as high as $19.80.

This trade, at that time, became known as one of the worst trades I’ve ever called on iBC.

It wasn’t until a few weeks had passed that I realized that expectations were out of alignment. This is the type of activity that happens at tops. People are drawn in, experienced a positive feedback loop for months on months, expectations are skewed into the favor of big winship.

In response to my rant yesterday…no. We are nowhere near this same environment. We will be though. It would be in your best interest to watch how chatty it gets, as novices become experts, and genius is born and bragged upon daily.

Until we reach that mood, there’s nothing for you to do than to “make hay while the sun is shining.” Interestingly enough, that was my Podcast tagline back in the summer of 2007.

Enjoy yourself.

If you enjoy the content at iBankCoin, please follow us on Twitter

Haha. Well written story. Definitely get a sense that cautious investing may be needed these days. Plus, Fokin Gartman is long again. What a bitch . Fml

🙁

lol! love the stories from the battlefield. Forgive me though, how is a buy from $13 and a move to $19 a bad call? Were you into the $20 calls and they expired on ya?

It was the daily rejection of breakout that irked people… Everyone thought the stock was about to go and run and then it went lower… even as it rebounded from those lower levels and trended higher. Everytime you’d get excited that it was going to post the 500% return it reversed those gains.

ANGI as a tease

2013 was a supernatural year for you, if I remember correctly.

Yeah, I almost retired and bought Canada.

confirmed

Valuable lesson learned within a story of winship.

Important to stay rooted, take temperature of surrounding sentiment, act more and more cautiously as euphoria sets in…

Good to have this mantra repeated, much appreciated…

A lot of people that got shaken out of funds 2015 through early 2016 have yet to pile back on from what I personally see. Some of my co-workers have recently begun to buy marijuana and pipeline speculative stocks though. It’s definitely the beginning.

if one of the weed stocks from the basket we bought a few years ago has a $DRYS moment, that would be spectacular.

Based upon the number of setups with high short interest that I found, that’s the next “theme”.

January 2014 was the greatest feeling of euphoria ever. I want that feeling again, with the knowledge to better play it next time. (ie, get the fuck out for a few months)

TWTR dec 2013 and the ANGI trade were life changing at the time.

She used to be my homeboys lady…..

That was a fun run indeed! We were 3D printing money and learning about rotations. ANGI, the one we didn’t want to let get away 🙂

Where is Hartmann these days? I miss his insight.

I am rebalancing 20% of my portfolio from my most risky assets, China, small cap and tech into large cap value. I may be jumping the gun here but the gains need to be banked in any event.

Gold and oil prices suggest that no one is panicking and fund managers continue to pour money into the market so there is no fear of the Dow -400 days that we saw last year….yet.

The AZO / AMZN battle is getting interesting and TWLO is acting much better.

OA. Is the Russell just consolidating for a while?

You and I, we’re looking at the same charts.

What else would you say to describe this?

As opposed to what?

Not to be a dick, but I absolutely loathe weekly reassurance. I’m no fortune teller. You ask so often as if you’re terrified out there.

Can we do something to switch this up?

Yeah point well taken. Just that market and stocks have had so many rug-pulls over the past few years that you start looking for them everywhere.

To eliminate the fear of the unknown, go study the rug pulls. Or login and ask to learn more about them.

Hasn’t it been the opposite? For years there have been so many times people think the market is finally going to get the rug pulled out from under it and then instead a massive week after week after week move higher takes place.

People still trade in fear. It will take more than a year for that to go away.

OA – how do you think AAPL looks for earnings on the long side? Has basically spun its wheels for years on a longer time frame, breaking out short-term, not at all-time highs like the FANG and not as many eyes on it as in the past. I know you have your three point criteria – don’t know what you think in terms of that.

Last earning trade opinion I had was a year ago. No opinion.

I had the unfortunate experience of really starting my options trading in late-2012 and early 2013. I still have the trade logs if anyone wants to see them.

We were deep in the passionate throws of QE-infinity and I $SPY call options on any dip. I don’t remember what my average trade size was but I was probably risking $$10,000 to $25,000 a trade at the end and was up $180,000 before I gave it all back and more.

I learned a lot about capital at risk, how to hedge and how to read markets. I like to think I’ve learned enough to avoid another blow up.

YTD I’m up 41% in my trading account. Winning!

Actually, I believe the top tick for the old bitch was $19.88.

The Crazy Eights – I remember.

Crazy Eights was a different stock – checked history – 19.80 was HOD.

How do you like the uranium plays in URG/UEC?

OA, is $ANGI broken?

Just kidding.

Bought SRPT consolidation. A crapshoot with managed risk.

Nice entry point for FPRX.

Selling pressure to open, then slow grind up for the rest of the day.?

SHOO is down because some analyst is concerned that a small portion of the company’s manufacturing comes from Mexico and there might be a “wall” tax. This is the shit we have to deal with now. Trading isn’t hard enough?

GOOGL – wow definitely chewing up some people today

the option sellers have to win one every now and then.

They had 2014.

Fuckers.

Labu anyone?

notice that volume in declining names like $MTCH and $YY is very small….

RH – ugh.

Seriously, it Wily Coyote’d a hole in the floor.

What’s the most reliable source for earnings dates? Finviz, yahoo and TOS all are providing different values for some stocks.

The investor relations page of the company itself is usually the most reliable.

I’ve gotten burned far too many times using anything but the company’s Investor Relations webpage. It’s more work, but it’s real information.

Ever try Estimize?

Nibbling at some PYPL and ETSY here. Restraining myself from chasing CX… that damn wall story is too damn good.

I like PYPL here.

Slowly but surely I am learning your ways. Looking forward to the next boot camp!

Anybody have an opinion on POWL?

Nice volume pocket above, looks like cup and saucer, but the shorter term looks like a bear flag…

I really like XOM here. Am I crazy? Maybe…

PBR is under 10.75.

SGY reentry here or lower?