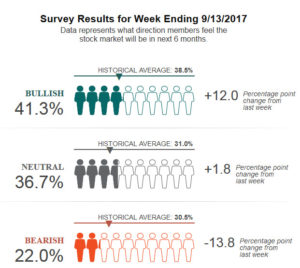

I suppose a congrats is in order. After years and years of downward spiraling sentiment, Intelligent Investors-R-US are now slowly starting to believe the market will be higher 6 months from now.

I specifically remember saying in 2015 that “regardless of your opinion of the state of this market, it is going to forcefully drag you higher until you have no choice but to change your opinions.” I’m surprised it’s now more than 2 years later and we’ve got our highest reading of bulls for the year.

Good timing, friends.

Also, this is the most bearish market development I’ve seen all year.

If you enjoy the content at iBankCoin, please follow us on Twitter

Totally – I’ve also been seeing headlines saying stuff like you’ve been saying for a year or two.

“So many people think a crash is coming that it won’t happen”

Shit like that.

As far as market setup, are you looking at this island being created in the S&P and thinking we catch a gap down that traps people?

Open air on semis. Heck of a call.

Seems like its just sentiment tho – there was an article out yesterday regarding how institutional exposure to equities was at a 10 yr low. Trying to find it…

Exposure is low, cash is high. I just don’t like playing in crowded boats.

In my Boot Camp back at the start of the year, I said the only thing that will dictate more than a 1-2 percent correction would be sentiment based.

..and consumer has started to extend herself …but markets usually run up a couple of years after this happens. You don’t think enthusiasm has yet run its course do you?

No, of course not.

just came back after ~2 years away and went all in snap calls

fml

You’ll fit right in

HA!

haha

“You’ll float too.”

I just saw allocation to U.S. equities is at a 10 year low, and short interest is highest since November.

geez. just saw morning prices for crypto currencies. wowzer. Buy the dip??

Hard to imagine a scenario where we bounce and don’t re-test lows. Moves this aggressive take time to work through. All the brilliant traders just got turned into investors.

Huge negative macd divergence on indices, SPY but also especially QQQ, has me cautious and ready to be aggressive on a short + long volatility.

On the other hand, a big failed signal has the potential to blow hard the other way… If FANG fails after a hard break to the upside (this monstrous Bull market imo has to end with a failed big breakout) then I think we have a real correction.

Till then, waiting on Fed moves and German elections to see the next break, right now trends are intact and the global growth narrative is just getting going. With individual names getting crushed and some exploding, ie healthy market… BTFD until next financial crisis seems the high probability play.

Hell yes…let’s Mac D bro.

As in, it’s a b.s. signal in your opinion. or you think it’s valid? It’s not a gamechanger for me, but it does set up rather infrequently and portend some big reversals after long trends. AAPL, JD recent highs, MU 2015 lows, Gold highs 2016, VRX lows 2017.

Looks like QQQs damage is real now huh. FAANGT really looking good atm.

Damage? This is one of the most bullish looking charts in the market.

$AAPL Yolo.

out for a triple.

hmm…this is the most bearish I’ve seen OA in some time. tides changing?

You’re retarded. I said this is a development. A one liner is the most bearish thing eh?

hey man. This is all relative. I said it’s the most bearish. Not that you are full on bearish. This being compared to “we go straight up mode.”

Go easy with that stuff because it gets out of context. Let me speak for me, you speak for you.

I’m going through some charts and am noticing a trend among gold miners. There are several consolidations that converge toward the end of December.

This timing seems confirmed by my chart of a $GLD breakout in late July, which should trickle down to miners. Add the debt ceiling discussion that will rage in December to the possibility of no fed rate hikes between now and Jan2018; you have a situation where gold could become very attractive to the masses. Perhaps there is even a cryptocurrency chapter to this development?

Trying to reconcile what I’m seeing in the charts and what I’m reading on this blog…

Keeping score or taking risk here?

It’s not a popular opinion, so that should be the primary context.

Def not keeping score. I meant what I read on this blog and the comments, not just you. I’m not playing gold one way or the other right now, rather, looking to raise cash for more equities.

The issue I have is that you always speak of volume and price action as the guide. This however, seems to be a popular sentiment play, in direct contrast to what the charts are saying (to me at least). Not sure how to square the two…

Gartman just bought Gold, if that helps for sentiment purposes.

ok. just quadrupled my short

Ha. That’s all you need to hear.

The inverse Gartman is about 90% accurate.

my long term FEYE position is solidly in the green now…..that’s as good of a top indicator as it gets for me. Am i cashing out? No. Will i regret not doing so in a couple weeks? Probably.

Take a look at a 10yr chart and you’ll feel better.

AHOWA recording is busted … link doesn’t work

Thanks. Fixed now

ICPT long for the squeeze large

94.50 and the chasers chase ICPT

Love the look of $BX.

And you’re $MNK looks just about ready too.

I’m holding $BX stock (pays a good dividend) and I think I’ll add around 31 if it hits. I bought $MNK yesterday.

Went in on $MNK today and am already holding $BX too…

This can’t be a good sign.

Great call on semi’s.

Time to sell NVDA/AMD and rotate to smaller players that haven’t popped yet?

Can I buy your $AMD on margin?

$SODA coiling.

$EVGB enters the hallowed halls of names that waited for the day after expiry to make their 10% move.

$RAD also

$PLUG and $BLDP ripping. Protec yo neck if long, son.

I ended up in this weeks $LVS instead of October, so I closed them on this pop into resistance given the short fuse. 300% Hopefully you guys that bought longer term can enjoy higher prices, as I think they’re coming.

Does anyone know of any resources for tracking implied volatility? Or more importantly, relative implied volatility?

http://www.ivolatility.com/

GBTC buyers get that dip into fear? sub 700