I’ve been dabbling in a few earnings plays last week and am enamored with the conditions that are set-up for this particular quarter.

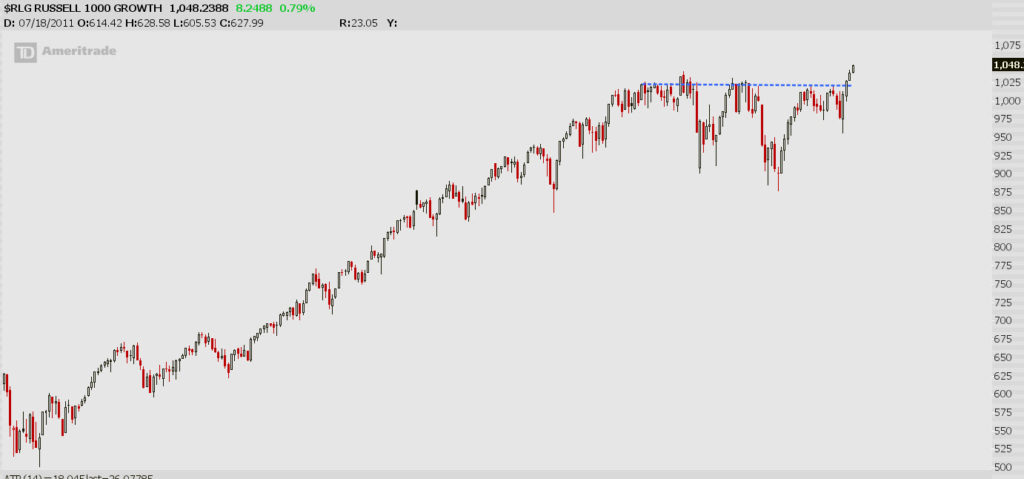

Naturally, so many stocks have had their asses kicked, and are off their highs of last year or year prior. However, the VIX is low here as well, and this market breakout has a steady bid underneath it, where we aren’t seeing fast selling in stocks, nor are most stocks responding to the multiple slow grind down attempts we’ve seen in the last week.

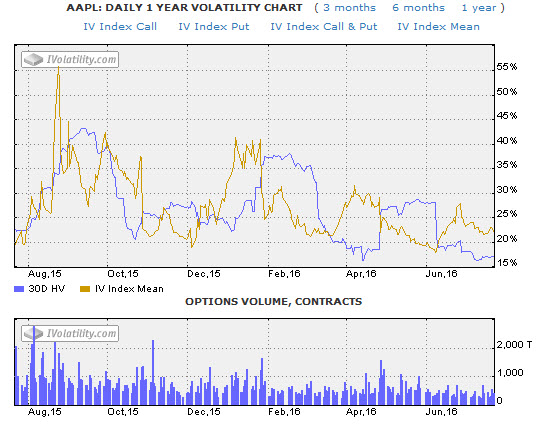

Most notably, I’m seeing the trends of implied volatility collapsing on most stocks into this quarter. Naturally, IV on most stocks was relatively high over the last several quarters, especially in energy/materials. However, look at something like $AAPL.

Focus on the Gold colored line, relative to itself. This is the trend for the “expectations” being priced into the options. And what this is saying is that “expectations” are the lowest price they’ve been in the last year. Aren’t expectations supposed to be high going into earnings?

Focus on the Gold colored line, relative to itself. This is the trend for the “expectations” being priced into the options. And what this is saying is that “expectations” are the lowest price they’ve been in the last year. Aren’t expectations supposed to be high going into earnings?

This is why on average I tell most traders to avoid earnings, is that the options are usually discounting all the movement you’ll catch playing options. That’s why my Chipotle trade was so brilliant. Those options were the highest pricing they’ve been, meaning that “expectations” are super high for the stock. What’s the pain trade in that situation? No price movement, and wipe out all option holders.

This quarter is the most unique I can recall with all these things considered. I look for the following conditions to be present if playing a stock into earnings; I call them the “3P’s”…

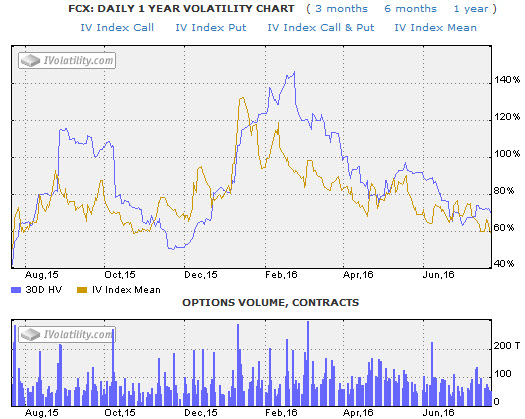

P- Price pattern: I want a good consolidation or recent acceptance of price.

P- Profile: I need a good profile above or below this recent price range.

P- Premium: I need relatively cheap premium.

$FCX is another name I’m stalking here. Take a look at the premium here. Most of you are aware of the pattern and profile…

If you practice this strategy, remember not to bet more than what you can lose.

If you practice this strategy, remember not to bet more than what you can lose.

OA

Comments »