I’ve been dabbling in a few earnings plays last week and am enamored with the conditions that are set-up for this particular quarter.

Naturally, so many stocks have had their asses kicked, and are off their highs of last year or year prior. However, the VIX is low here as well, and this market breakout has a steady bid underneath it, where we aren’t seeing fast selling in stocks, nor are most stocks responding to the multiple slow grind down attempts we’ve seen in the last week.

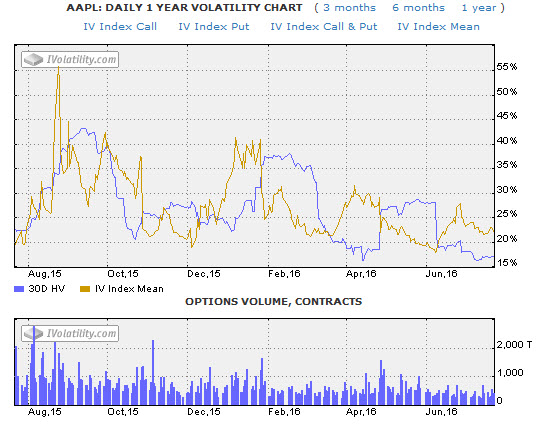

Most notably, I’m seeing the trends of implied volatility collapsing on most stocks into this quarter. Naturally, IV on most stocks was relatively high over the last several quarters, especially in energy/materials. However, look at something like $AAPL.

Focus on the Gold colored line, relative to itself. This is the trend for the “expectations” being priced into the options. And what this is saying is that “expectations” are the lowest price they’ve been in the last year. Aren’t expectations supposed to be high going into earnings?

Focus on the Gold colored line, relative to itself. This is the trend for the “expectations” being priced into the options. And what this is saying is that “expectations” are the lowest price they’ve been in the last year. Aren’t expectations supposed to be high going into earnings?

This is why on average I tell most traders to avoid earnings, is that the options are usually discounting all the movement you’ll catch playing options. That’s why my Chipotle trade was so brilliant. Those options were the highest pricing they’ve been, meaning that “expectations” are super high for the stock. What’s the pain trade in that situation? No price movement, and wipe out all option holders.

This quarter is the most unique I can recall with all these things considered. I look for the following conditions to be present if playing a stock into earnings; I call them the “3P’s”…

P- Price pattern: I want a good consolidation or recent acceptance of price.

P- Profile: I need a good profile above or below this recent price range.

P- Premium: I need relatively cheap premium.

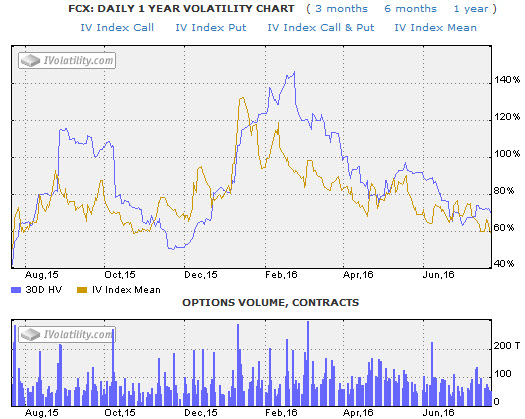

$FCX is another name I’m stalking here. Take a look at the premium here. Most of you are aware of the pattern and profile…

If you practice this strategy, remember not to bet more than what you can lose.

If you practice this strategy, remember not to bet more than what you can lose.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

Great analysis. Only thing I would add would be watching unusual option activity prior to release of earnings.

My biggest wins had no activity worth analyzing. I think it could be a nice coincidence…but I’m doing well without it.

That makes sense as out sized option trades would expand volatility.

The point of cheap premiums and such implies to me that the stock is not on anyone’s radar. Your idea of activity implies the opposite to me. I don’t want to follow those guys, I want them to follow me.

Right and FCX has a nice volatility “smile” about it as well. Good luck with the trade!

If you don’t use Estimize definately take a look. It will work better for more popularly talked about stocks but may be worht a look.

OA, not earnings play.. but id like you thoughts on the chart for stock purchases… IBM, and CALM…i like both but looking for entry points…

CALM seems easier to buy. No clue on IBM.

thank you sir

VLO?

Yeah, I could try to buy here.

May be TSO?

I have it right here, but will not hold much lower

Do you have a targeted move on each for earnings play based on previous move postearnings or do you want to look at price profile and filling volume pockets? I purchased a couple of cheapo weeklies in FCX. I wish I would have done the same in S.

I believe an 8% move is projected.

From Earnings Whispers:

Overall earnings estimates have been revised higher since the company’s last earnings release. On Monday, July 11, 2016 there was some notable buying of 10,766 contracts of the $14.00 call expiring on Friday, August 19, 2016. Option traders are pricing in a 8.0% move on earnings and the stock has averaged a 4.4% move in recent quarters.

Assuming a possible 8% move, I’d buy based on making a profit on 4% spike. If that makes any sense. It’s happy hour here:)

Thanks and cheers!

Thanks Philsy-. So would you play an ATM call/put based on your bias or stretch it out to a strike further out? I called AMD earnings last week, but bought the 6s that expired Friday, so lost. If I would’ve done the 5.5s, I would have had 100% move…

Sorry Decrima, please see answer above.

Nice, were you there for my LT call in that stock a few months ago?

I saw it but wasn’t on board. I’ve joined AHWOA now so I can stop looking in from the sidelines.

AAPL is toast.

SCO to $150

FB rips

OA, based on the new membership setup, will you be posting trades in AHWTOA

No, format stays the same.

If you find a stock whose options premium seems inflated do you ever sell options before earnings to take advantage of a potential pain trade of the stock going nowhere?

OA, first off, great post thanks for the education. In regards to the CMG earnings trade, how come you bought calls (at least that’s what I’m assuming) if the premium was so high? I apologize if I’m missing something here; thanks for the knowledge.

Yeah, you missed the part about waiting til *after* earnings. I bought them at the open Friday. Blogged about it. Waited for the vol crush.

That makes sense. The $AAPL set up you pointed out has a very familiar look to it a couple years ago when IV was low compared to other earnings releases.

UWTI anyone?

I got stopped out of my /CL long last week but am considering it or UWTI again

Indicators hit triple oversold at the close.

I’m still holding onto my XOP… but I’m closing in on being down like 5 percent.

Lots of bears shitting on oil though also – I think it could be due for a raging bounce.

Help me understand why oil will bounce.

I took some $UWTI at $21.04 – short lease on this one

For me 3x is an intra-day trade, in and out using level II book with the ability to <1 sec execution.

I usually hold for a few days but will consider your strategy. Thanks for the idea. Was one penny away from dumping PM then it bounced. Will watch closely today.

I just got pretty wound up for $TWI. Sold off right into support today. IV is very low. Earning coming up next Monday. The premium is good enough that leaps are pretty cheap by my eye. So I may buy a bunch of those if it holds its spot tomorrow.

MSGT Hartman, will you hold all your FB through earning? This time, not like last couple ERs, stock run up and holding, that make me wonder.

WDC popping today. I can’t tell if it’s in the pocket on my phone, but definitely eyeing for earnings.