Make no mistake, but if you are involved here whatsoever, its an entirely different market than it has been for the last few years. There’s still so much anxiety out there about being involved or participating, and for that reason we continue to grind. Like I said at the initial point of breakout, no dips for you. Why would it be that easy?

I’ve been in the process of trying to formulate a market pain trade theory here, which involves the massive trend away from active MF’s, hedge funds, and stock pickers and has gone into ETF’s and indexed products. Safe to say the boat is officially loaded in those products…so what if the market really doesn’t go anywhere? In the meantime, the moves I’ve been nailing in stocks has been insane. Huge moves left and right. Predictable, cheap, and a new ease of follow through. All while your SPY goes nowhere.

I’ve said this before, but if you are watching the market to dictate a trade in XYZ, you’re only hurting yourself here. Correlations still remain at multiyear lows.

Come trade some stocks with me.

OA

Comments »

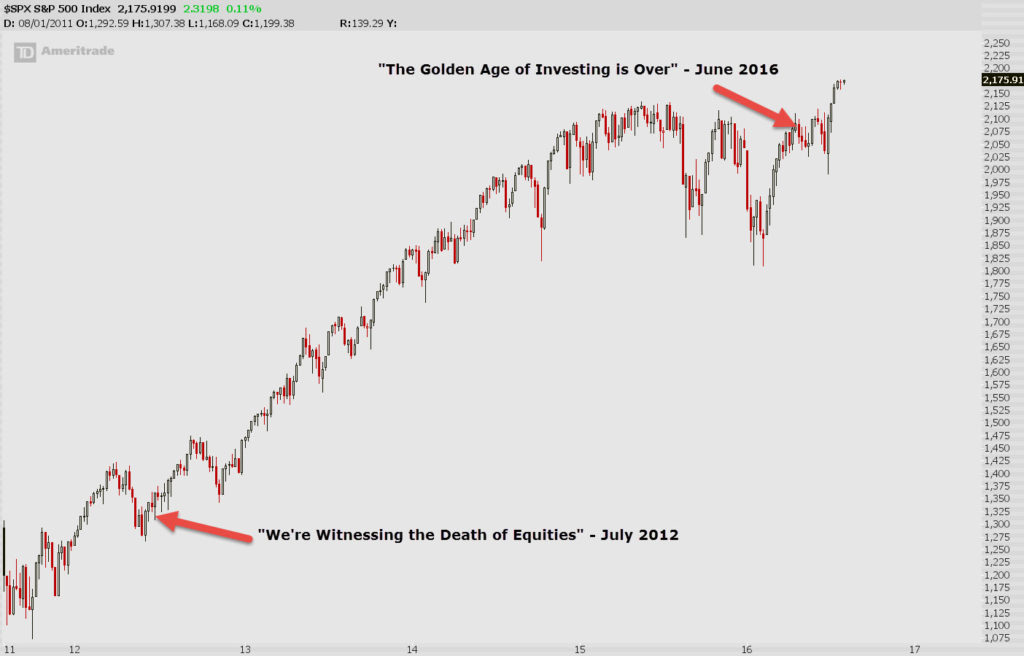

This is why I don’t blog news here, because the stuff I notice is pretty stale stuff. Why didn’t someone tell me Bill had said that the “Golden Age of Investing is Over?” That’s pretty important stuff. I know it was a month ago, but last time he said something like that was 2012, right before we took out 2007 highs.

This is why I don’t blog news here, because the stuff I notice is pretty stale stuff. Why didn’t someone tell me Bill had said that the “Golden Age of Investing is Over?” That’s pretty important stuff. I know it was a month ago, but last time he said something like that was 2012, right before we took out 2007 highs. I always like those certainties. I bookmark them for future reference.

I always like those certainties. I bookmark them for future reference.