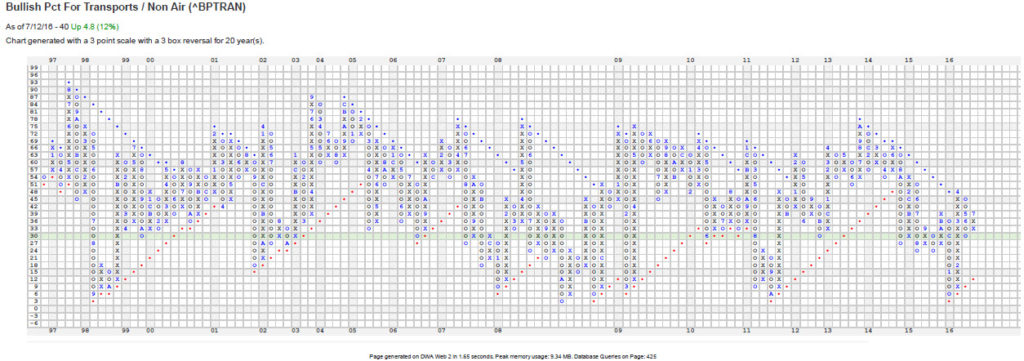

My recent Boot Camp was themed on how to be a Better Stock Picker. I spoke about the recent trends in the market that have been moving away from active investing towards a passive investing approach. ETFs have been the favored instruments to participate in stocks, and while inflows have been mostly away from stocks all year, the inflows we’ve seen have been primarily to SPY.

Here’s another interesting stat: http://www.bloomberg.com/news/articles/2016-07-18/investors-pull-most-money-from-u-s-stock-pickers-since-2008

As the market moves to new highs, people have sworn off stock picking. That’s a great signal IMO.

Comments »